The Cardano (ADA) price prediction is gradually turning bullish due to an impressive increase since June 10.

Despite the massive increase, it is not yet certain if the upward movement is part of a relief rally or if it is the beginning of a new bullish trend reversal.

Cardano Price Recovers After Yearly Low

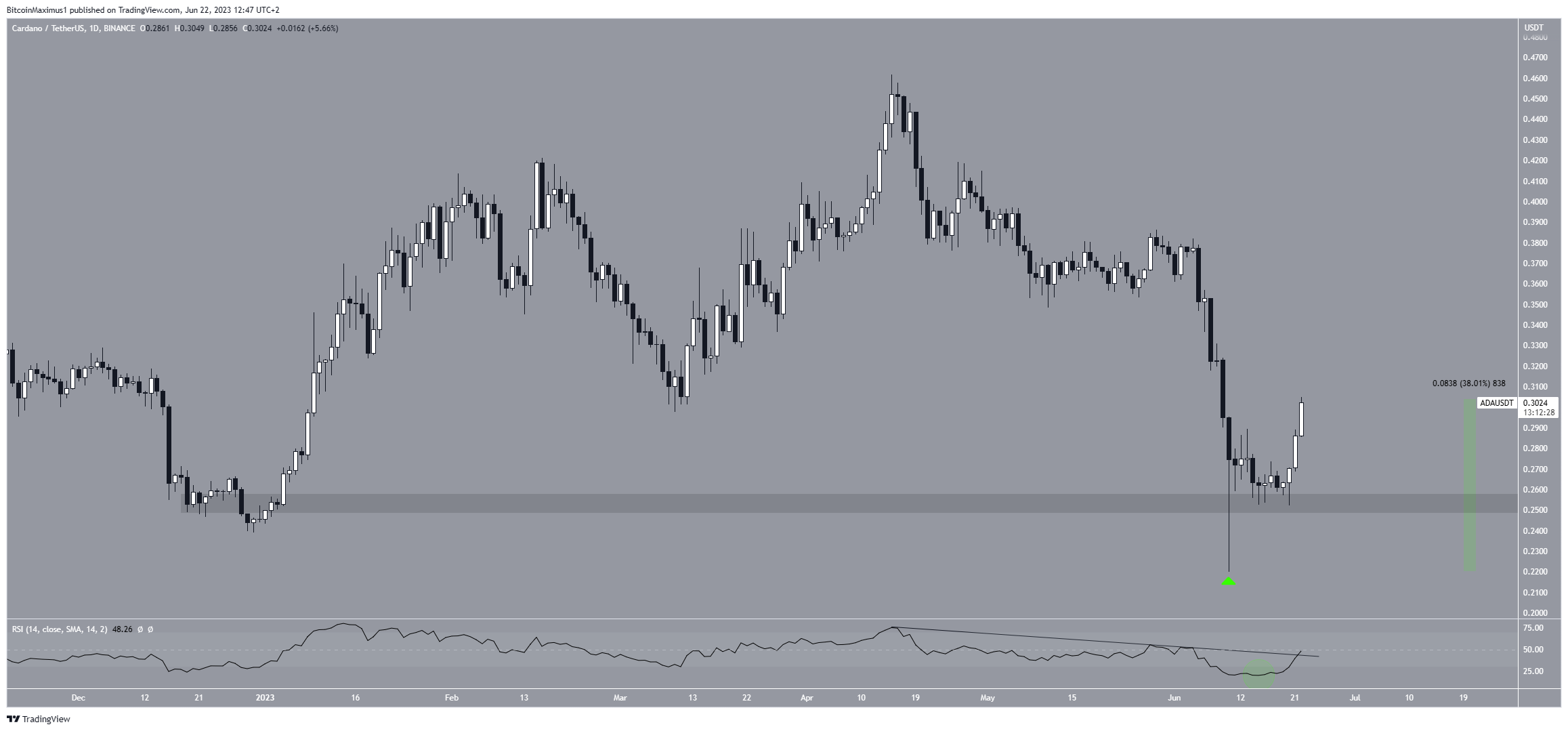

The daily time frame technical analysis for ADA shows that the ADA price has recovered by 38% since falling to a new yearly low of $0.22 on June 10. The increase has been swift, creating a very long lower wick.

This is considered a sign of buying pressure since sellers could not push the price down. Rather, buyers took over and caused the close period to be considerably higher than the low.

Additionally, this increase caused a reclaim of the $0.25 horizontal area, which is now expected to provide support once again.

Additionally, the weekly Relative Strength Index (RSI) gives a bullish reading. Traders utilize the RSI as a momentum indicator to assess whether a market is overbought or oversold and to determine whether to accumulate or sell an asset.

If the RSI reading is above 50 and the trend is upward, bulls still have an advantage, but if the reading is below 50, the opposite is true. The indicator is increasing and has nearly moved above 50.

Moreover, the RSI moved outside of its oversold territory (green circle) and is breaking out from its bearish trendline.

ADA Price Prediction: Relief Rally or Trend Reversal?

A closer look at the wave count does not confirm the direction of the trend. However, it offers queues for what can be based on future movement. Elliott Wave theory involves the analysis of recurring long-term price patterns and investor psychology to determine the direction of a trend.

The first possibility is that the ADA price completed an A-B-C correction (black). If so, a new increase has begun to take it to $0.50.

The second possibility suggests that the ADA price is still mired in a five-wave decrease (white). In this case, the price will complete wave four soon and then fall toward $0.20.

The key level to watch in these possibilities is $0.35, at the wave one/A low (red line). If the ADA price moves above it, it will confirm that the trend is bullish. In that case, an increase to $0.50 will be the most likely scenario.

On the other hand, failure to reach the level will mean that a bearish scenario is transpiring.

To conclude, the ADA price prediction is still undetermined. Whether the price moves above $0.35 will be key in determining the future movement.

An increase above the level can trigger a pump to $0.50, while failure to do so could cause a drop to $0.20.

By

By

By

By

By

By

By

By

By

By

By

By