Ark Invest Sells COIN and GBTC Shares

Following Bitcoin’s surge past $35,000, Ark Invest, led by Cathie Wood, made a surprising move in the market. The firm offloaded a portion of its crypto stock holdings, including stakes in Coinbase and Grayscale Bitcoin Trust (GBTC).

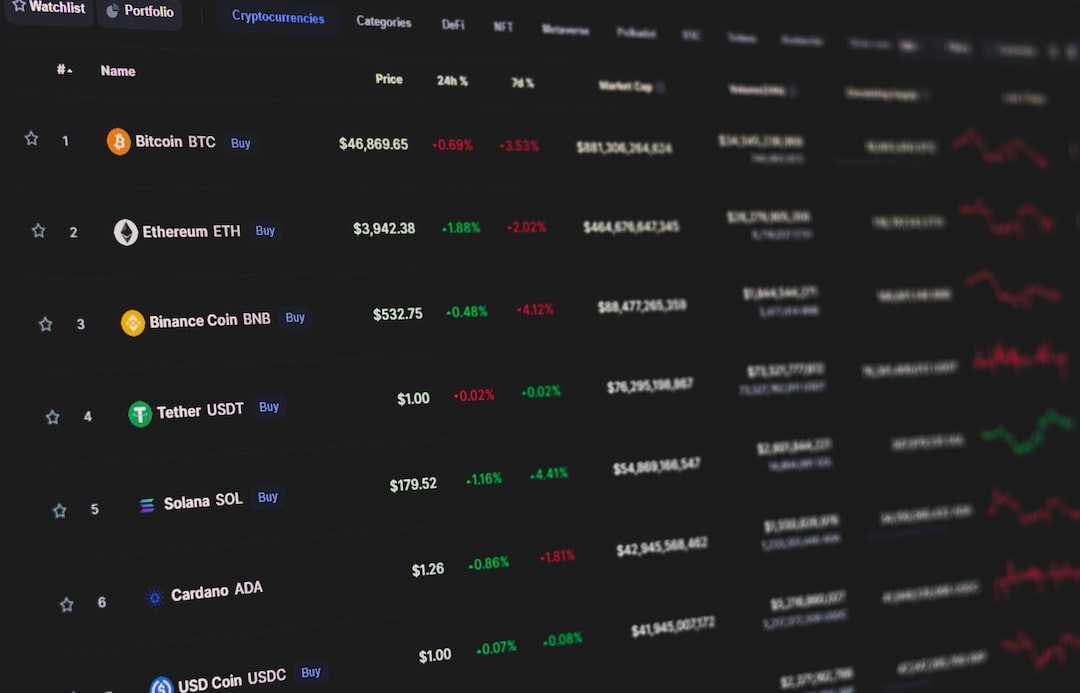

The Bullish Trend and Rising Prices

Last week, Bitcoin experienced a bullish trend, reaching a new yearly high of $35,160. This positive momentum affected the prices of crypto-centric stocks as well. Coinbase saw a 16% increase in its shares, reaching around $89, while GBTC saw a 10% uptick, reaching $27.

Ark Invest’s Divestment

In contrast to the market trend, Ark Invest sold nearly $5.8 million worth of its Coinbase and GBTC shares. The firm sold 42,613 COIN shares and 100,739 GBTC shares through ARK Next Generation Internet ETF (ARKW) and ARK Fintech Innovation ETF.

Shift in Investment Strategy

Interestingly, Ark Invest purchased 259,628 shares of Robinhood while divesting from Coinbase and GBTC. This change comes at a time when the firm is one of GBTC’s largest shareholders with a significant investment.

Possible Reasons for Selling Crypto Stocks

The unexpected portfolio reshuffling by Ark Invest may have several reasons. One possibility is their engagement with regulators for a Bitcoin ETF. Cathie Wood believes there has been a shift in the SEC’s behavior regarding Bitcoin ETF applications.

A Paradigm Shift in the Crypto Market

The involvement of traditional finance entities like BlackRock and Fidelity in the Bitcoin ETF space indicates a changing landscape. Ark Invest’s decision to diversify its investments reflects a cautious optimism amidst the market’s inherent volatility.

Hot Take: Ark Invest’s Bold Move in the Crypto Market

In a surprising move, Ark Invest, known for its bullish stance on Bitcoin, decided to sell off a significant portion of its crypto stock holdings. This comes at a time when Bitcoin is experiencing a bullish trend and the prices of crypto-centric stocks are rising. The divestment from Coinbase and GBTC suggests that Ark Invest is taking a cautious approach and diversifying its portfolio. This move also aligns with the larger narrative in the crypto market, as traditional finance entities like BlackRock and Fidelity show interest in Bitcoin ETFs. Overall, Ark Invest’s decision reflects their strategic outlook and adaptability in response to market dynamics.

By

By

By

By

By

By

By

By

By

By