Regulated Crypto Futures Trading: Coinbase Makes History

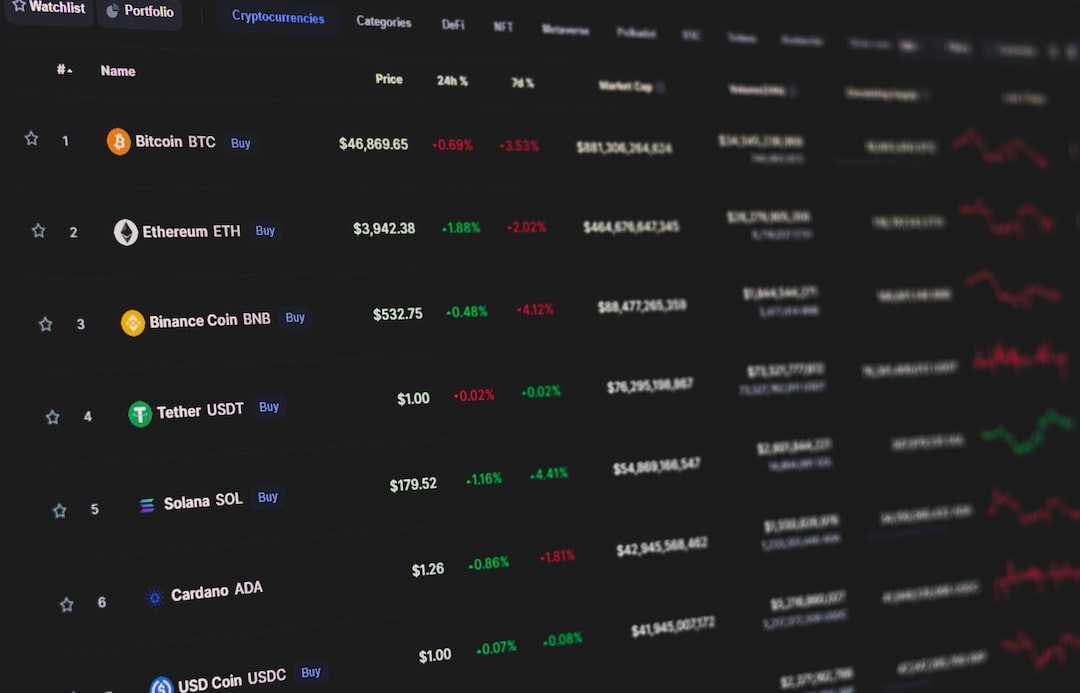

Coinbase Financial Markets has obtained regulatory approval to offer crypto futures trading in the United States, setting a precedent in the world of cryptocurrency. Here are the key points:

1. Coinbase’s Milestone: Coinbase Financial Markets has been approved by the National Futures Association to function as a Futures Commission Merchant (FCM), highlighting its commitment to a regulated and transparent crypto economy.

2. Approval from NFA: The National Futures Association, a CFTC designated SRO, has given its approval for Coinbase Financial Markets to operate as a registered Futures Commission Merchant.

3. Expansion into Futures Trading: With this approval, Coinbase can now offer futures contracts in BTC and ETH to eligible customers in the US.

4. Focus on Accessibility: Coinbase aims to increase accessibility to the crypto economy and boost the US’s position in the global digital innovation landscape by being the first exchange to offer both traditional spot crypto trading and regulated leveraged crypto futures.

5. Legal Battle with SEC: Coinbase is currently involved in a legal battle with the US SEC, filing a motion to dismiss the lawsuit and arguing that crypto falls outside the SEC’s jurisdiction.

Global Expansion: Canada Partnership

Coinbase has expanded its presence in Canada through a collaboration with Peoples Trust Company, aiming to provide easier access to Interac e-Transfers for Canadian users. Key details include:

– Partnership with Peoples Trust: Coinbase has formed a partnership with Peoples Trust Company to facilitate seamless access to Interac e-Transfers for Canadian users.

– Targeting the Canadian Market: Coinbase sees Canada as a significant market, especially considering it is the second-most crypto-aware country among its international markets.

Legal Battle with SEC

Coinbase is currently engaged in a legal dispute with the US SEC, arguing that cryptocurrency does not fall under the SEC’s purview. Key details include:

– Lawsuit Dismissal: Coinbase has filed a motion to dismiss the lawsuit brought by the SEC.

– Support from Senator Cynthia Lummis: Senator Cynthia Lummis has submitted an amicus brief in favor of dismissing the lawsuit.

Stock Market Reaction

Following recent downtrends, Coinbase’s stock price (COIN) experienced a bullish move, rising 6.39% to $84.24 in pre-market hours.

Hot Take

Coinbase’s approval to offer regulated crypto futures trading is a groundbreaking achievement that showcases their commitment to a transparent and compliant crypto economy. Their focus on accessibility and expansion into new markets, such as Canada, further solidify their position as a leader in the crypto industry. Despite the ongoing legal battle with the SEC, Coinbase continues to innovate and push the boundaries of what is possible in the world of cryptocurrency.

By

By

By

By

By

By

By

By