Massive Inflows of Bitcoin, Ethereum, and XRP in Crypto Funds

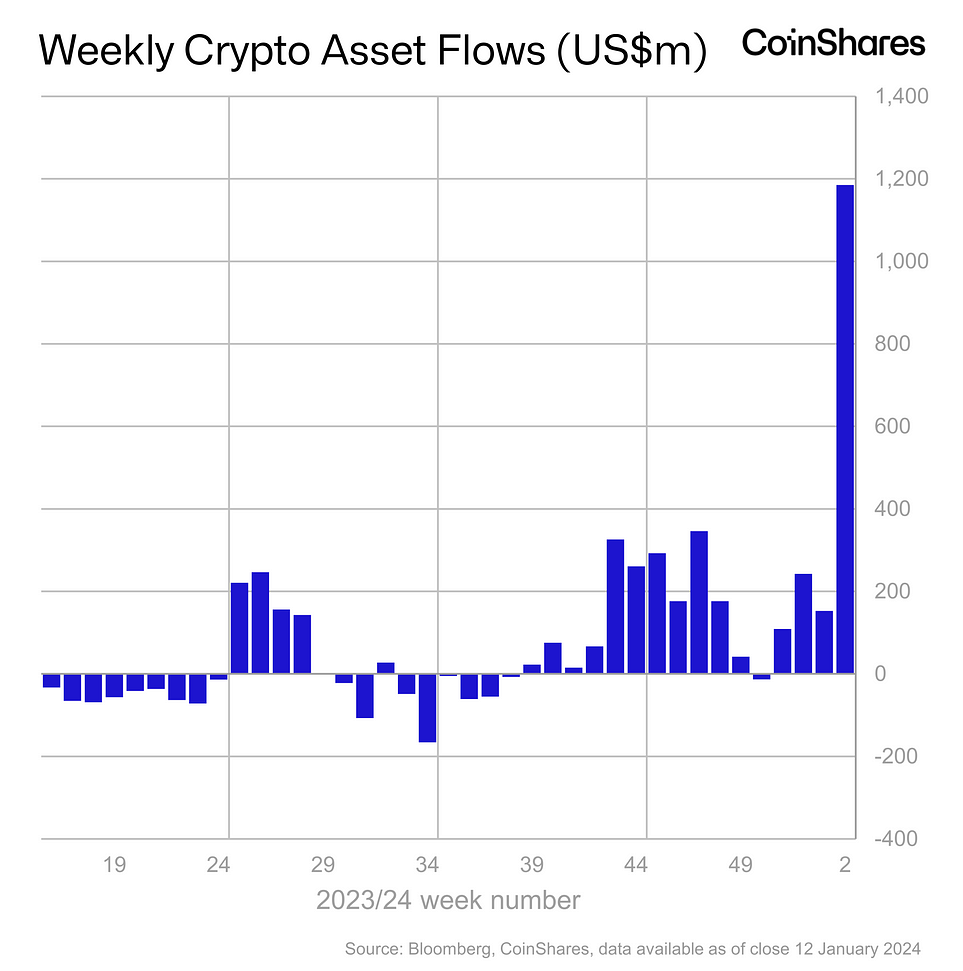

Last week, there were significant inflows of $1.18 billion into crypto asset investment products, led by Bitcoin, Ethereum, and XRP. Despite the excitement surrounding spot Bitcoin ETFs, it failed to surpass the record-breaking $1.5 billion inflows seen in October 2021 from futures-based Bitcoin ETFs. However, trading volumes for crypto funds reached an all-time high of $17.5 billion, averaging $2 billion per week.

Bitcoin witnessed inflows of $1.16 billion, accounting for 3% of total assets under management. Additionally, short-bitcoin products attracted $4.1 million in inflows, with a month-to-date total of $3.2 million. While spot Bitcoin ETFs brought money back into the market, some experts remain skeptical about their long-term profitability.

Ethereum experienced inflows of $26 million, indicating strong investment fundamentals and high demand for its staking yield. XRP also saw substantial inflows of $2.2 million within a week and $3.1 million month-to-date, making it the largest among altcoins.

On the other hand, Cardano and Solana witnessed decreased inflows at just $1.4 million and $0.5 million respectively. Altcoins like Avalanche and Polkadot also had minimal inflows as investors explored other crypto assets.

The United States attracted $1.24 billion in inflows last week, while Switzerland received $21 million. However, Germany, Canada, and Sweden experienced significant outflows of crypto asset funds.

Crypto Performance Today

Bitcoin’s price has dropped 1% in the past 24 hours and is currently trading at $42,592. The trading volume has increased by 40% during this period, indicating growing interest among traders.

In contrast, Ethereum’s price has surpassed $2500, with the current trading price at $2537. In the last 24 hours, the lowest and highest prices recorded were $2,470 and $2,545 respectively.

XRP’s price has increased by 1% in the past 24 hours and is currently trading at $0.57. The lowest and highest prices within this period were $0.574 and $0.592 respectively. Moreover, the trading volume has surged by 90% in the last 24 hours.

Hot Take: Crypto Funds Experience Significant Inflows Despite Spot Bitcoin ETFs’ Failure to Break Records

Last week witnessed substantial inflows of $1.18 billion into crypto funds, with Bitcoin, Ethereum, and XRP leading the way. Despite the hype surrounding spot Bitcoin ETFs’ introduction on Wall Street, these products fell short of breaking previous records set by futures-based Bitcoin ETFs in October 2021.

However, the overall trading volumes for crypto funds reached new heights at $17.5 billion. This indicates a growing interest in cryptocurrencies as investment assets.

By

By

By

By

By

By

By

By