A Liquidity Pool for PayPal’s PYUSD Stablecoin on Curve Locks $135 Million in Value

A new liquidity pool called the FRAXPYUSD pool, which includes PayPal’s dollar-backed stablecoin PYUSD, has locked $135 million in total value. The pool went live on December 27 and is currently the third largest on Curve, a platform designed for stablecoin swaps. It consists of PYUSD and Frax Finance’s stablecoin FRAX. Traders can use the FRAXPYUSD pool to exchange FRAX for PYUSD, which can then be used on the PayPal app for purchases and remittances. However, the liquidity in the pool is imbalanced, with FRAX accounting for over 80% of the total liquidity.

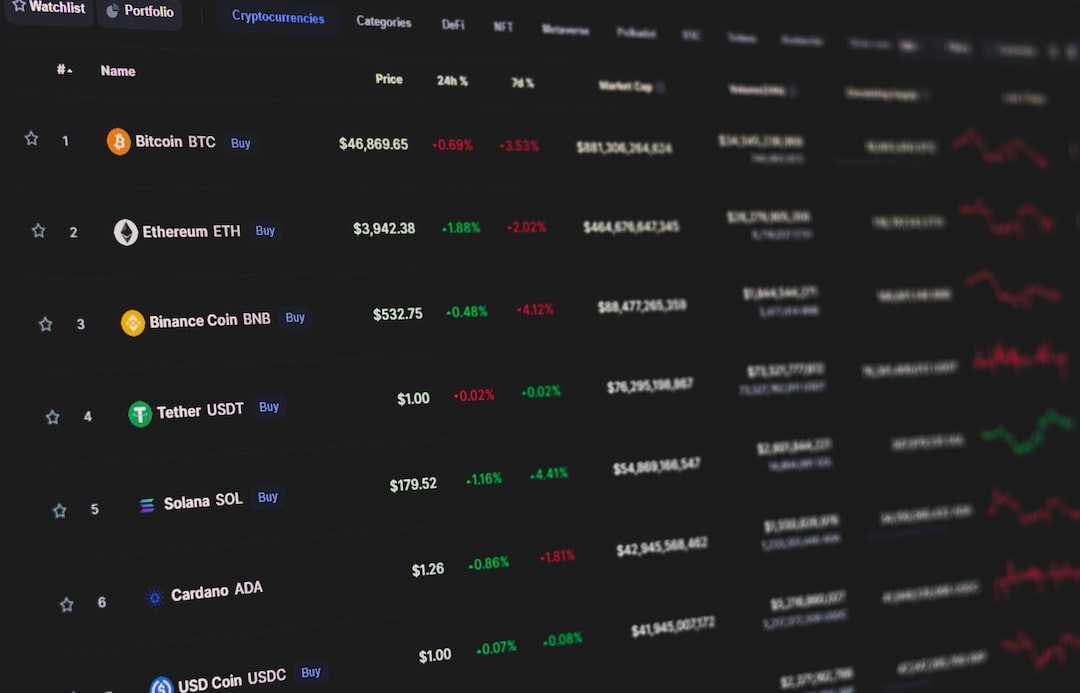

PYUSD Gaining Traction in DeFi

While PayPal’s PYUSD is still behind industry leaders Tether and Circle in terms of adoption, it is gradually making its way into decentralized finance (DeFi). Its daily trading volume reached a peak of $9 million in December and has stabilized at around $4 million. This growing liquidity in DeFi indicates that PayPal is expanding the stablecoin’s usage beyond payments and within its app for crypto trading activities. However, competition from USDT and USDC remains a challenge for PYUSD.

Stablecoin Market to Get Crowded With PayPal’s PYUSD

In August, PayPal announced that it would be launching its PYUSD stablecoin soon. The dollar-pegged asset is issued by Paxos, a blockchain infrastructure firm. While Tether currently dominates the stablecoin market, some believe that PayPal has the potential to shake up the leaderboard due to its large user base and global reach. With 420 million users, if a significant portion of them embrace PYUSD for transactions, merchants will likely follow suit, pushing the stablecoin into mainstream adoption. However, others, like William Quigley, co-founder of Tether, are skeptical of PayPal’s ability to achieve notable adoption outside of the United States.

Hot Take: PayPal’s PYUSD Stablecoin Gains Momentum in DeFi

A liquidity pool on Curve, featuring PayPal’s PYUSD stablecoin, has locked $135 million in value, indicating growing interest in decentralized finance. This liquidity pool allows traders to exchange FRAX for PYUSD, expanding the usage of PYUSD beyond payments. While PYUSD still trails behind industry leaders Tether and Circle in terms of adoption, its daily trading volume has shown stability. As PayPal invests resources in expanding the stablecoin’s usage, competition from USDT and USDC remains a challenge. Nonetheless, the potential integration of PYUSD and Frax Finance within the PayPal app could further drive its growth in DeFi.

By

By

By

By

By

By

By

By

By

By