Bitcoin Holders In Profit Have Crossed The 90% Mark Now

Recent on-chain data reveals that more than 90% of Bitcoin investors are currently holding some profits after the cryptocurrency broke the $46,000 barrier. This information comes from market intelligence platform IntoTheBlock, which tracks the percentage of investors with unrealized gains throughout Bitcoin’s history.

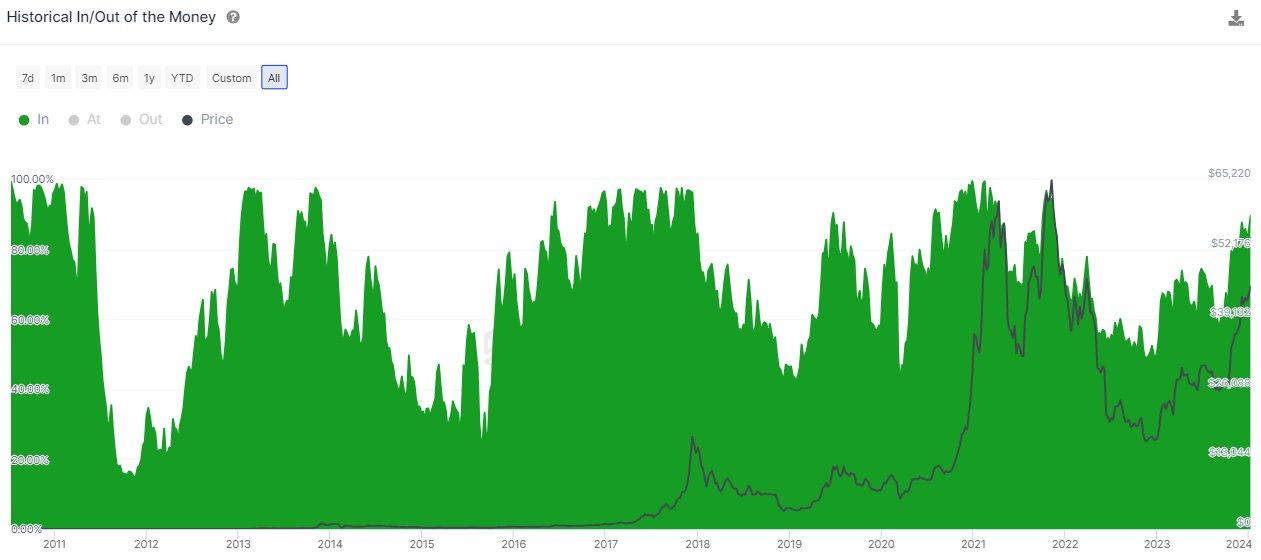

The metric used to determine this is called “Historical In/Out of the Money,” which analyzes each address’s transaction history. If an address’s average cost basis is lower than the spot price at a specific point in time, it is considered to be in profit for that period.

This data is crucial because investors in profit are more likely to sell their holdings. When there are many addresses with gains, it increases the chances of a widespread selloff. Conversely, bottoms may occur when only a few hands are in profit, indicating a possible exhaustion of selling pressure.

The chart below illustrates the trend in the percentage of Bitcoin holders in profit:

Potential Implications and Historical Patterns

The recent surge in the percentage of Bitcoin holders in profit suggests that most of the market is currently gaining. This could potentially lead to a mass profit-taking event and impact the rally’s longevity.

Previous cycles have shown that Bitcoin holders reached similar levels of profit multiple times during bull markets. However, historical data indicates that local tops usually precede a cycle top where profit levels approach 100%. Determining the current stage of the cycle is challenging.

IntoTheBlock has also highlighted what happened during previous cycles when Bitcoin surpassed this profit level. The chart below demonstrates these occurrences:

According to the analytics platform, smaller tops have typically emerged before the cycle top when profit levels were pushing towards 100%. Therefore, it’s essential to consider past patterns while assessing the current state of the cryptocurrency cycle.

BTC Price

Bitcoin recently surged above $47,000 but has experienced a pullback. It is currently trading around $46,900. The chart below illustrates Bitcoin’s performance over the past few days:

Hot Take: Bitcoin Holders in Profit Surge, Signaling Potential Market Dynamics

The percentage of Bitcoin investors in profit has surpassed 90% following its recent climb above $46,000. This data implies that most market participants are currently enjoying gains. However, historically, such high profit levels have often preceded smaller tops before reaching a cycle top where profit levels approach 100%. It remains uncertain at which stage of the cycle Bitcoin currently stands. Additionally, the recent surge in profit levels raises the possibility of a mass profit-taking event that could impact the ongoing rally’s longevity. Monitoring historical patterns and market dynamics will be crucial to understanding Bitcoin’s future trajectory.

By

By

By

By

By

By

By

By

By

By

By

By