Centralized Crypto Exchanges Experience Decrease in Trading Volumes

The bear market in the crypto industry is causing trading volumes on centralized exchanges to plummet. In fact, some of the largest exchanges have seen a decline of over 20% in trading activity in just one month.

Crypto Exchange Trading Falls

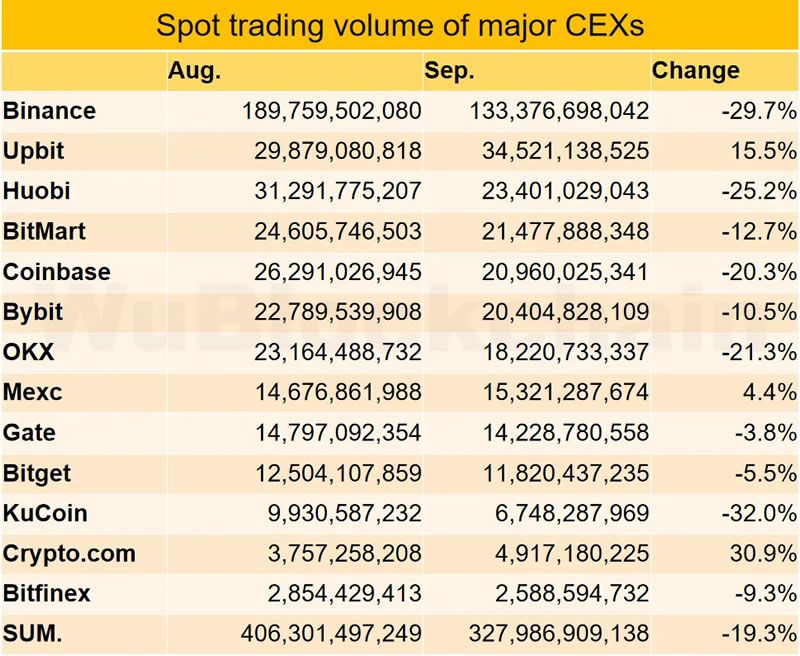

A report from industry outlet Wu Blockchain reveals that spot trading volumes on major exchanges dropped by 19.3% in September compared to the previous month. This is the lowest level recorded since October 2020, indicating a significant decline.

Almost half of the analyzed exchanges experienced a decrease of more than 20% in trading volume between August and September. The biggest losses were observed on KuCoin and Crypto.com, which saw drops of 32% and 31%, respectively.

Binance, one of the leading exchanges, witnessed a decline of almost 30% in September, with its trading volume falling from $189 billion to $133 billion.

Huobi’s trading volume also suffered a 25% loss, dropping from $31 billion in August to $23 billion in September. Additionally, OKx and Coinbase experienced decreases of 21% and 20%, respectively.

Overall, the total decline across the measured exchanges was 19.3%, from $406 billion in August to $328 billion in September.

Furthermore, crypto derivatives volumes also experienced a decline. Futures trading volumes decreased by approximately 15%, from $1.9 billion to $1.6 billion in September.

When it comes to web traffic, major crypto exchanges saw an average decline of 17.4% in September.

Bear Market Blues

Decentralized exchange (DEX) volumes have remained relatively stable over the past few months, according to DeFiLlama. The weekly volume for DEXes is currently around $11.7 billion.

The total value locked in decentralized finance (DeFi) has been steadily decreasing and currently stands at $41 billion.

As for the global cryptocurrency market cap, CoinGecko reports it to be $1.12 trillion, with a minimal change of 2.24% in the last 24 hours. However, there has been little movement over the past two months, with assets trading within a narrow range.

Bitcoin briefly surged to $28,000 following a fake news-driven pump but is now showing signs of returning to previous levels.

Hot Take: Decreasing Trading Volumes Indicate Crypto Market Struggles

The recent decrease in trading volumes on centralized crypto exchanges highlights the challenges faced by the market during this bearish period. With significant drops in spot trading and derivatives volumes, as well as a decline in web traffic, it’s evident that investor interest has waned.

On the other hand, decentralized exchanges have managed to maintain relatively stable volumes. However, the overall cryptocurrency market seems to be stagnant, with limited movement in market cap and asset prices.

As the bear market continues to affect trading activity, it remains to be seen how exchanges and investors will adapt to these challenging conditions.

By

By

By

By

By

By

By

By

By

By

By

By