Coinbase Experiences Declining Trading Volumes

During crypto bear markets, major centralized exchanges like Coinbase often see a significant drop in trading volumes. This decrease in volume can have a negative impact on profits, especially for platforms that charge high transaction fees.

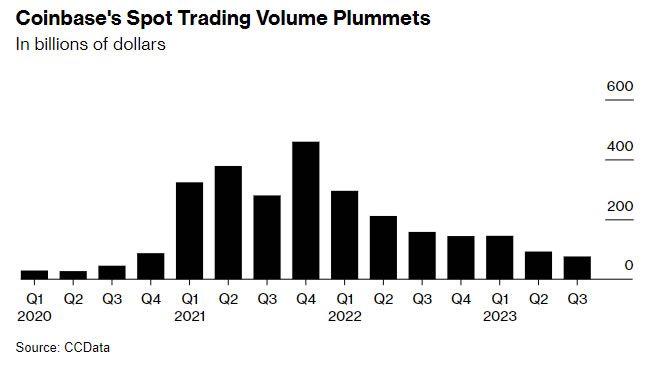

Bloomberg recently reported that Coinbase’s quarterly crypto trading volume is projected to be the lowest it has been since before the company went public.

Coinbase’s Declining Spot Trading Volume

According to data compiled by CCData, Coinbase’s spot trading volume in the third quarter is estimated to have dropped by over half.

The data shows that Coinbase’s Q3 trading volume was approximately $76 billion, which is less than half of the $158 billion reported during the same period last year.

This figure represents the lowest trading volume since Q3 2020, prior to Coinbase’s listing on the Nasdaq Stock Market in April 2021.

Impact on Coinbase’s Revenue

Coinbase generates a significant portion of its revenue from transaction fees that are higher than the industry average.

In the second quarter, transaction revenue accounted for 54% of Coinbase’s total revenue, compared to previous years and quarters where it reached as high as 88%.

Analysts, such as Owen Lau from Oppenheimer & Co., believe that Coinbase is facing a challenging quarter.

Regulatory Pressure and Bear Market Challenges

Coinbase is currently dealing with increasing regulatory scrutiny in the United States. This, combined with the prolonged crypto bear market, has contributed to the decline in its trading volumes.

As a result, Coinbase’s stock (COIN) has decreased by 2.85% and is currently trading at $77.43 after hours. A weak Q3 report is expected to further impact share prices, which have already seen a 130% increase this year.

Other Exchanges Also Affected

Binance, another leading centralized exchange, is also feeling the effects of the bear market in the US. It has faced significant restrictions on its services in the country.

According to CoinGecko, Binance’s daily spot trading volume is now around $5 billion, which is less than half of what it was in November last year after its main competitor, FTX, faced setbacks.

The bear market has caused a decline in volumes, liquidity, and volatility across the board. The current crypto market capitalization stands at $1.09 trillion but has been trading sideways for the past seven months.

Hot Take: Challenging Times for Coinbase and Other Exchanges

Coinbase’s dwindling trading volumes and declining revenue highlight the challenges faced by major centralized exchanges during bear markets. The impact of regulatory pressure and a prolonged market downturn has resulted in significant decreases in trading activity.

As Coinbase prepares to release its Q3 results, it is expected to report a seventh consecutive quarterly loss, further affecting its share prices. Binance is also experiencing similar challenges in the US, leading to reduced trading volumes.

While the crypto market remains relatively stagnant, these exchanges will need to navigate through tough times and adapt their strategies to overcome the current market conditions.

By

By

By

By

By

By

By

By