GALA Price Breaks Out from Short-Term Trendline

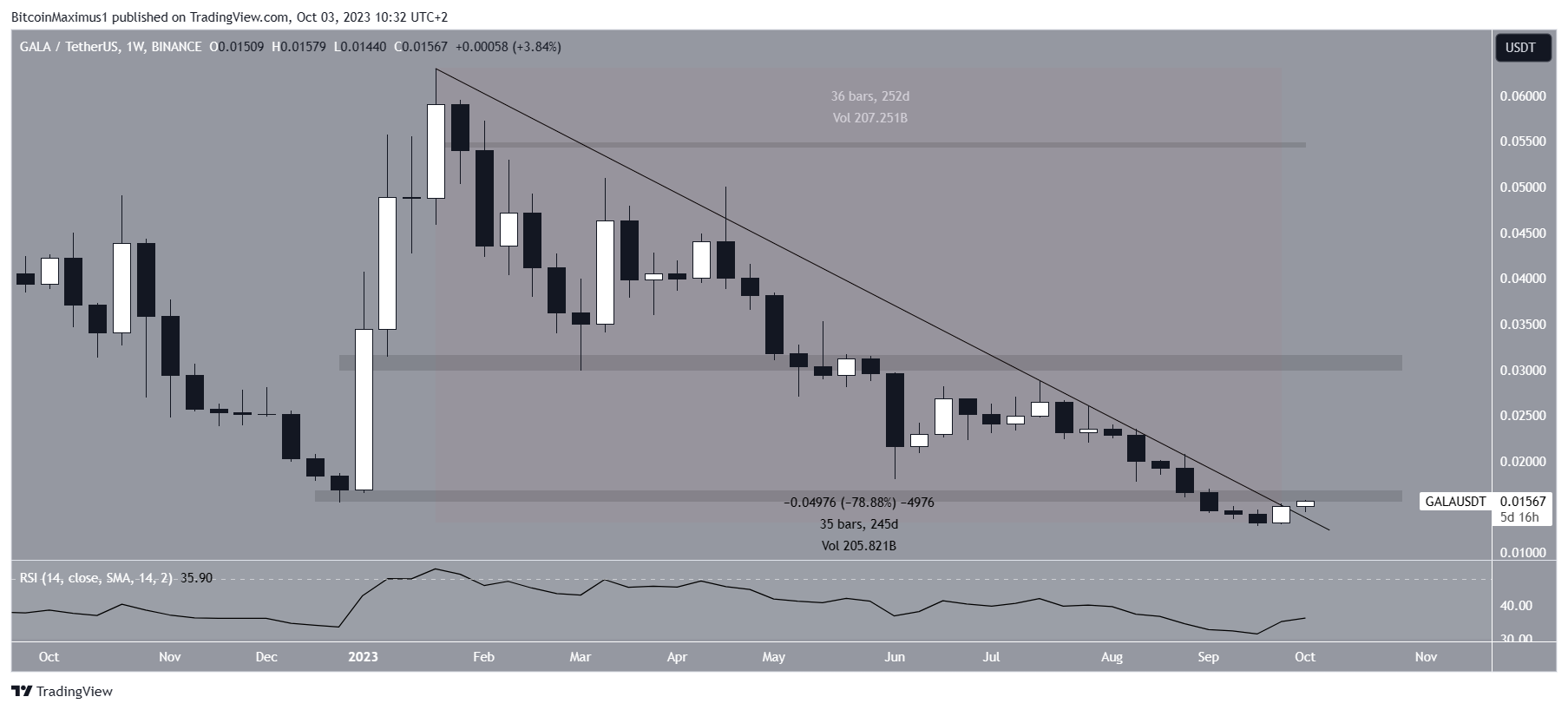

The GALA price has been trading under a descending resistance trendline since the beginning of the year. This trendline aligns with the yearly high of $0.062. Over the past 252 days, GALA has experienced an 80% decline, reaching a low of $0.013 last week. However, the price has recently bounced and is in the process of breaking out from the trendline. Confirmation of the breakout requires a weekly close above the trendline.

GALA Falls Under Descending Resistance Trendline

The descending resistance trendline that GALA has been following has significant importance as it coincides with the $0.016 horizontal resistance area. The next resistance level is at $0.032.

Daily and Weekly Readings Misaligned

While the daily timeframe shows more bullish signs, there is still uncertainty in the weekly outlook. The RSI reading, which indicates momentum, is currently below 50 and increasing but does not provide a clear direction for the future trend.

GALA Price Prediction: Bullish Divergence

The daily timeframe provides a more bullish outlook for GALA. The price has broken out from a shorter-term descending resistance trendline and closed above it, confirming the breakout. Additionally, the RSI has generated a bullish divergence, indicating a potential trend reversal. If the upward momentum continues, the next resistance level is at $0.021.

Hot Take: GALA Price Indecision Could Be Determined With This Indicator – Will It Bounce or Drop?

The GALA price is currently in a state of indecision, with conflicting signals from different timeframes. While the daily chart suggests a potential bullish reversal with a breakout from a short-term trendline and a bullish divergence in the RSI, the weekly chart still shows uncertainty. Traders should closely monitor whether GALA can sustain its breakout and close above the long-term trendline to confirm a bullish trend. However, if momentum weakens, there is a possibility of a retest of the descending resistance line as support.

By

By

By

By

By

By

By

By

By

By