The Dogecoin network has experienced a gradual decline in DOGE user participation, accompanied by a consistent decrease in the number of Telegram members.

This raises concerns about the sustainability of Dogecoin’s current bearish trend and prompts questions about its future trajectory.

Active Addresses Plunged by 22.1% in One Week

In the last seven days, new addresses have fallen by around 46.3%. Active addresses also fell by around 22.1%, and DOGE addresses that do not hold coins are also down by 23.47%.

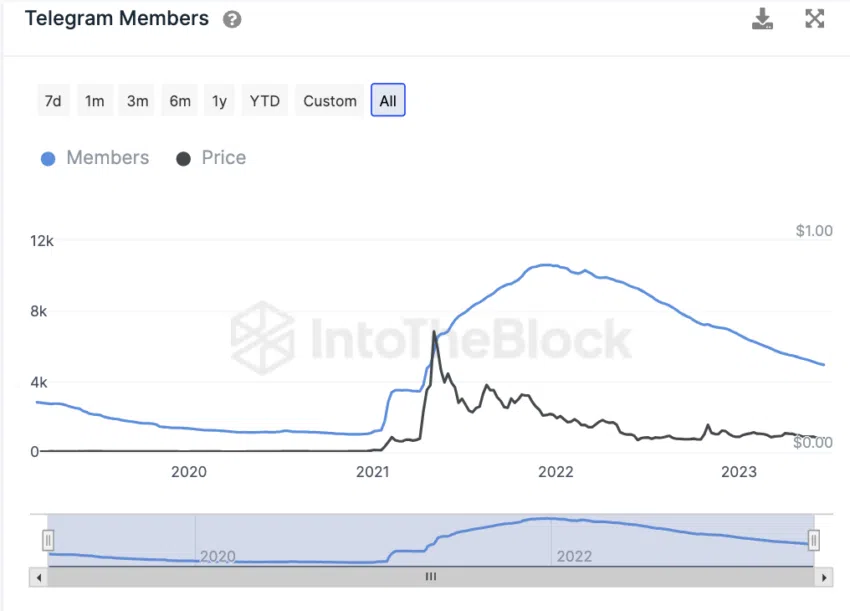

Dogecoin Telegram Group Sees Steep Decline in Members

The DOGE Group on Telegram has witnessed a discernible downward trend in the number of users since 2022.

This ongoing bearish trend suggests a continuation of the decline in user participation.

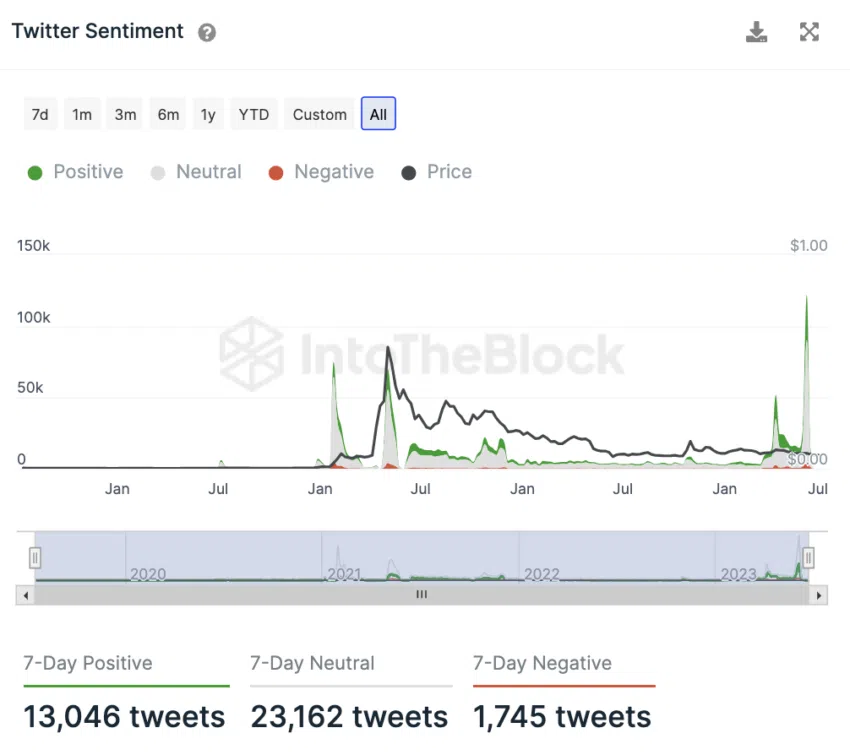

Positive Sentiment Prevails on Twitter

Over the past week, there have been approximately 13,000 positive tweets, compared to around 1,750 negative tweets, indicating a predominantly positive sentiment on Twitter.

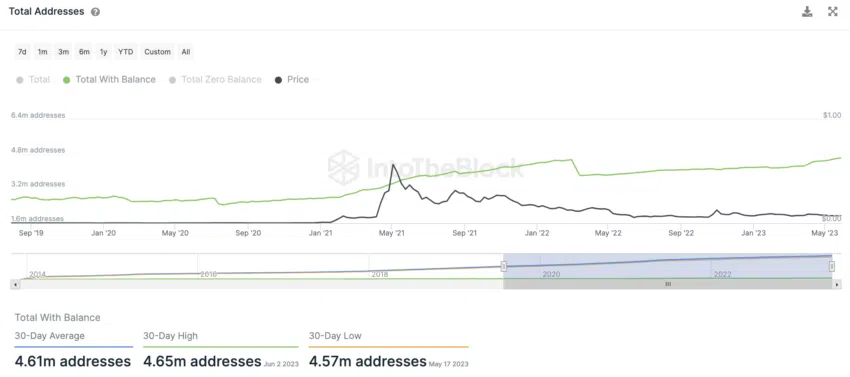

Rising DOGE Address Count

Furthermore, the number of Dogecoin addresses continues to rise, indicating a sustained upward trend in user adoption and interest.

Majority of Buyers in the Profit

While over 40% of Dogecoin addresses are currently in losing positions, a notable subset of addresses made purchases at the beginning of the year and have seen gains of approximately 56%.

Roughly 40.78% of addresses are still in the red, while 3.35% have reached the breakeven point.

DOGE Price Forecast: Analyzing the Future Trajectory

The Dogecoin price experienced an initial decline of over 27% two weeks ago. However, it has since rebounded by approximately 31%.

This week, the MACD indicator has shown a bullish upward tick after a period of bearish decline. Nevertheless, the medium-term trend remains bearish, as indicated by the death cross of the Exponential Moving Averages (EMAs) on the weekly chart.

Furthermore, Dogecoin is currently encountering notable Fibonacci resistance at approximately $0.069. If the price is rejected at this level, Dogecoin could potentially move towards the next support at around $0.04914.

However, in the event of a bullish breakout, the next significant Fibonacci resistance is anticipated at around $0.08.

A successful breach of the golden ratio at $0.08 would increase the likelihood of Dogecoin sustaining its upward momentum, as it would signify the completion of the corrective phase.

By

By

By

By

By

By

By

By

By

By