ARK Invest and 21Shares File Amended Bitcoin ETF Proposal

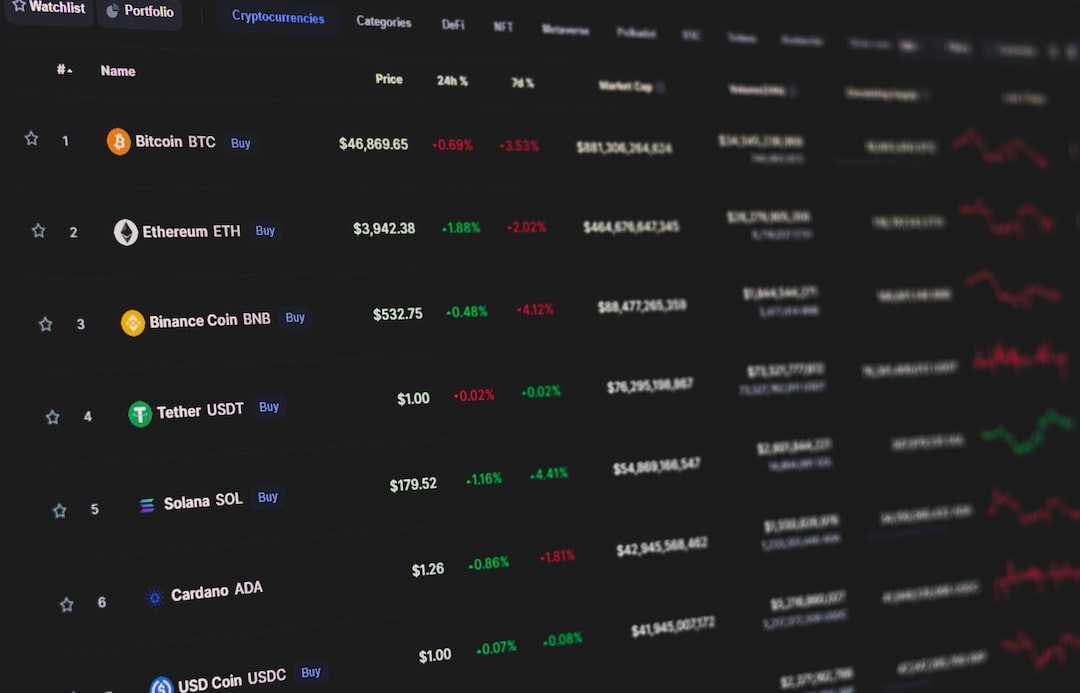

ARK Invest and 21Shares have filed an amended proposal for a bitcoin exchange-traded fund (ETF), indicating progress in working with the U.S. Securities and Exchange Commission (SEC). The amendment, submitted on October 11, provides additional details about the proposed ETF, including its name, ticker symbol, fee structure, and custodian. Analysts see this as a positive development in the approval process. The ETF, called ARK 21Shares Bitcoin ETF, will trade under the symbol ARKB on NYSE Arca. It will charge a management fee of 0.95% per year and use Coinbase Custody Trust Company as its custodian. The ETF aims to provide exposure to bitcoin’s price by tracking the S&P Bitcoin Index, utilizing bitcoin futures contracts and derivatives.

Prospects for Approval

The SEC has not yet approved any bitcoin ETFs in the U.S., but industry experts believe that approval may be forthcoming as the crypto market matures and institutional investors enter the space. The SEC has set December 8, 2023, as the deadline for approving or disapproving the ARK 21Shares Bitcoin ETF. If approved, it will be the first regulated bitcoin ETF in the U.S., attracting significant demand from investors seeking convenient exposure to bitcoin.

About ARK Invest and 21Shares

ARK Invest is an investment management firm founded by Cathie Wood in 2014, focusing on disruptive innovation and cutting-edge technologies. 21Shares is a Swiss-based investment firm specializing in cryptocurrency exchange-traded products (ETPs) that track various cryptocurrencies’ performance.

Hot Take: Bitcoin ETF Progress Shows Positive Signs

The amended filing for the ARK 21Shares Bitcoin ETF indicates progress in collaboration with the SEC. With additional details provided on the proposed ETF, including its name, ticker symbol, and custodian, experts consider this a positive step towards approval. The ETF aims to offer investors a regulated and transparent market for bitcoin exposure, portfolio risk diversification, and lower operational costs compared to holding bitcoin directly. Although the SEC has yet to approve any U.S. bitcoin ETFs due to concerns such as market manipulation and investor protection, analysts are optimistic about approval in the near future as institutional interest in cryptocurrencies grows. The ARK 21Shares Bitcoin ETF is highly anticipated and may pave the way for increased adoption of regulated cryptocurrency investment vehicles.

By

By

By

By

By

By