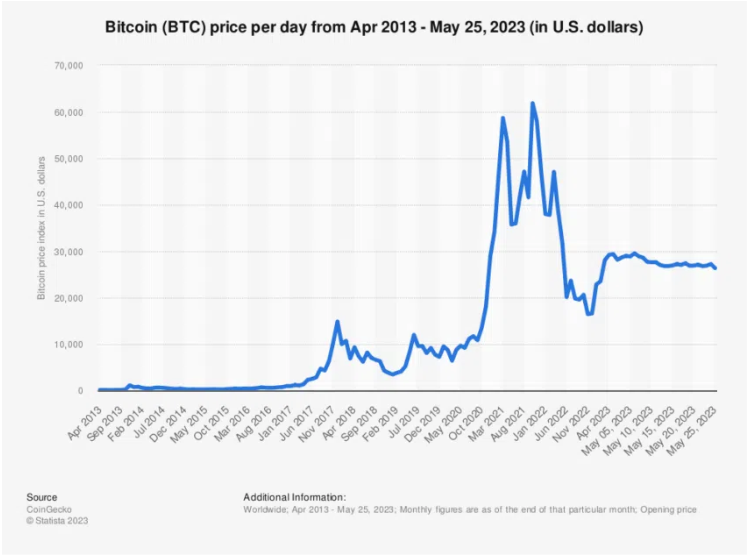

Crypto news: Another day, another dollar. And as the Bitcoin (BTC) price went on a 15% romp, the US-led war on crypto took a sinister twist.

Former Coinbase CTO Balaji Srinivasan warned that if G7 nations allow crypto seizures, big tech companies could assist law enforcement organizations.

Big Brother is Watching You

Srinivasan’s cautionary statement comes while discussing the possible effects of the G7 countries and China acquiring the authority to seize digital assets.

According to Srinivasan said there is a potential risk that companies such as Apple, Google, and Microsoft could scan digital devices on the orders of a government and hand over private keys.

He said:

“The fact that Apple has software updates and Google can get into your Google Drive and Microsoft has Windows; and if ordered by the state, in theory, they could scan your hard drive for private keys and then pull your digital assets.”

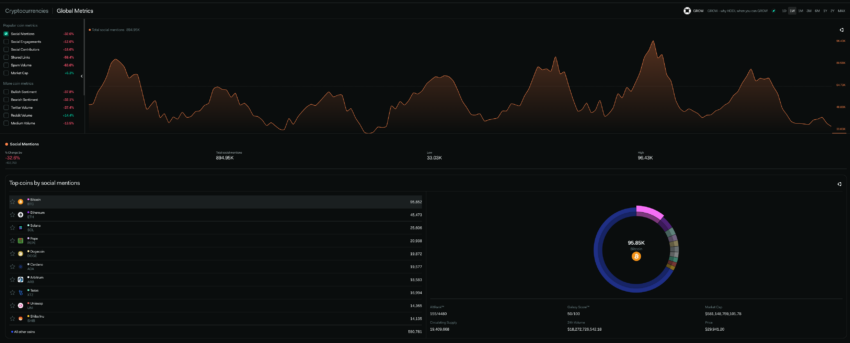

Crypto – Socially Speaking

TradFi Plays Catch Up

If the end is nigh for crypto (as some would like to believe), then traditional finance didn’t get the memo.

In a curious change of events, it would appear that cryptocurrencies are gradually being adopted and shaped by the very firms they sought to challenge.

The biggest event of the week came when the world’s biggest asset manager, BlackRock, announced it was filing for a Bitcoin spot exchange-traded fund (ETF), opening the gate for a flood of applications from other contenders.

Of course, we have been here before. Many have tried, and failed, to get approval from crypto bogeyman the Securities and Exchange Commission (SEC). So what’s different this time?

Well, BlackRock boasts an impressive track record of securing SEC approval for its ETFs. Of the 576 ETFs that BlackRock has filed with the SEC, only one has been rejected.

And to boost its chances of success, it has inked a surveillance-sharing agreement with Nasdaq. The goal is to share information about trading, clearing, and customer identification.

This illustrates a thoughtful approach to tackle regulatory hurdles and secure the approval of the application. And it marks a significant stride in bridging the gap between Wall Street and blockchain.

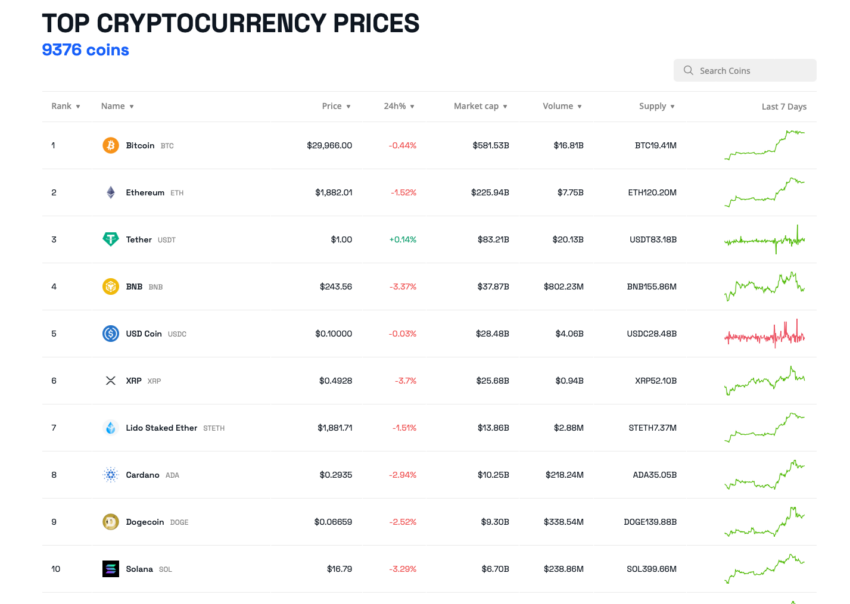

Crypto Coin News

It was a bumper week for Pepe the Frog as the PEPE meme coin made headlines again, rising 71% over the week. Stacks (STX) and Conflux (CFX) put in impressive 46% and 40% gains respectively.

What Exactly is Ethereum?

Meanwhile, an analyst at JPMorgan suggested that Ethereum is neither a security nor a commodity. He says it should be regulated as an alternative asset to strike a middle ground between commodity and security regulatory regimes.

Nikolaos Panigirtzgolou argues that the uncertainty around ETH has prevented the Securities and Exchange Commission (SEC) from including it in a list of crypto assets it deems securities.

But opinions are divided. Senators Cynthia Lummis and Kirsten Gillibrand suggest ETH is a commodity and should be registered with the US Commodity Futures Trading Commission rather than the SEC.

Bitcoin bull Michael Saylor argues that Ethereum’s initial coin offering, management team, and hard forks prove its changeability. And naturally these disqualify it from being a commodity.

No Accounting for Taste

This week’s bad taste award goes to the crypto degens taking bets on the fate of the crew that went missing on a dive to the wreck of the Titanic.

But, while we now know all souls on board were lost, Polymarket was hosting a betting pool, with users wagering whether the OceanGate vessel would be found by June 23.

But, serious moral questions are raised by the growing popularity of crypto betting on actual events. Particularly those involving real people.

While gambling has historically been a part of many different businesses, including sports, it is impossible to overlook the moral ramifications of placing bets on outcomes that could be tragic.

By

By

By

By

By

By

By

By

By

By

By

By