Ethereum Price Surpasses $1900 for the First Time Since August

The price of Ethereum (ETH) has risen over 16% in the past month, reaching a milestone of over $1900. This surge comes as Bitcoin takes a breather around the $35K mark and altcoins gain momentum. However, despite the positive market sentiment, ETH price is facing pressure due to the wiping out of millions of dollars in open interest (OI) after a significant increase last week.

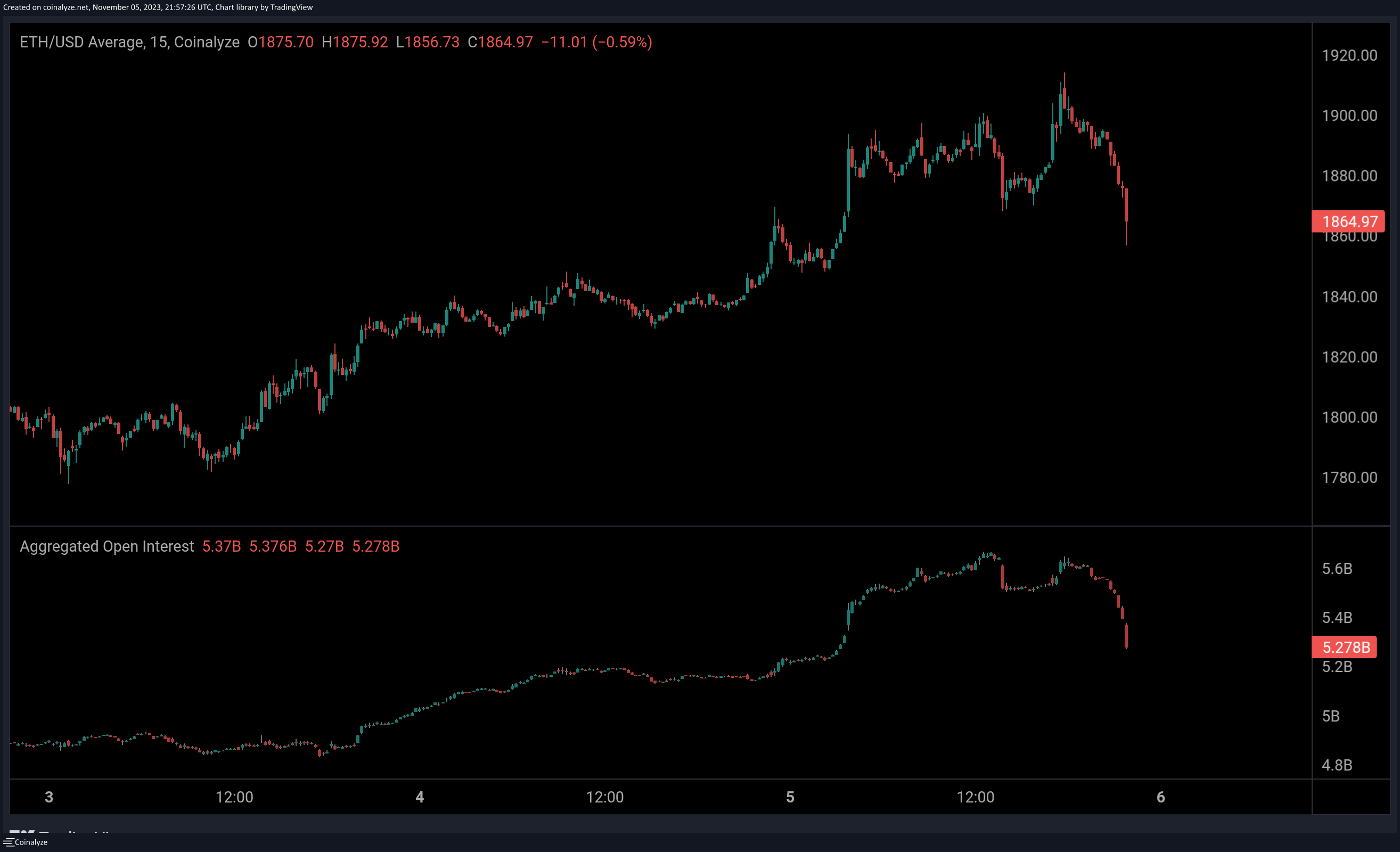

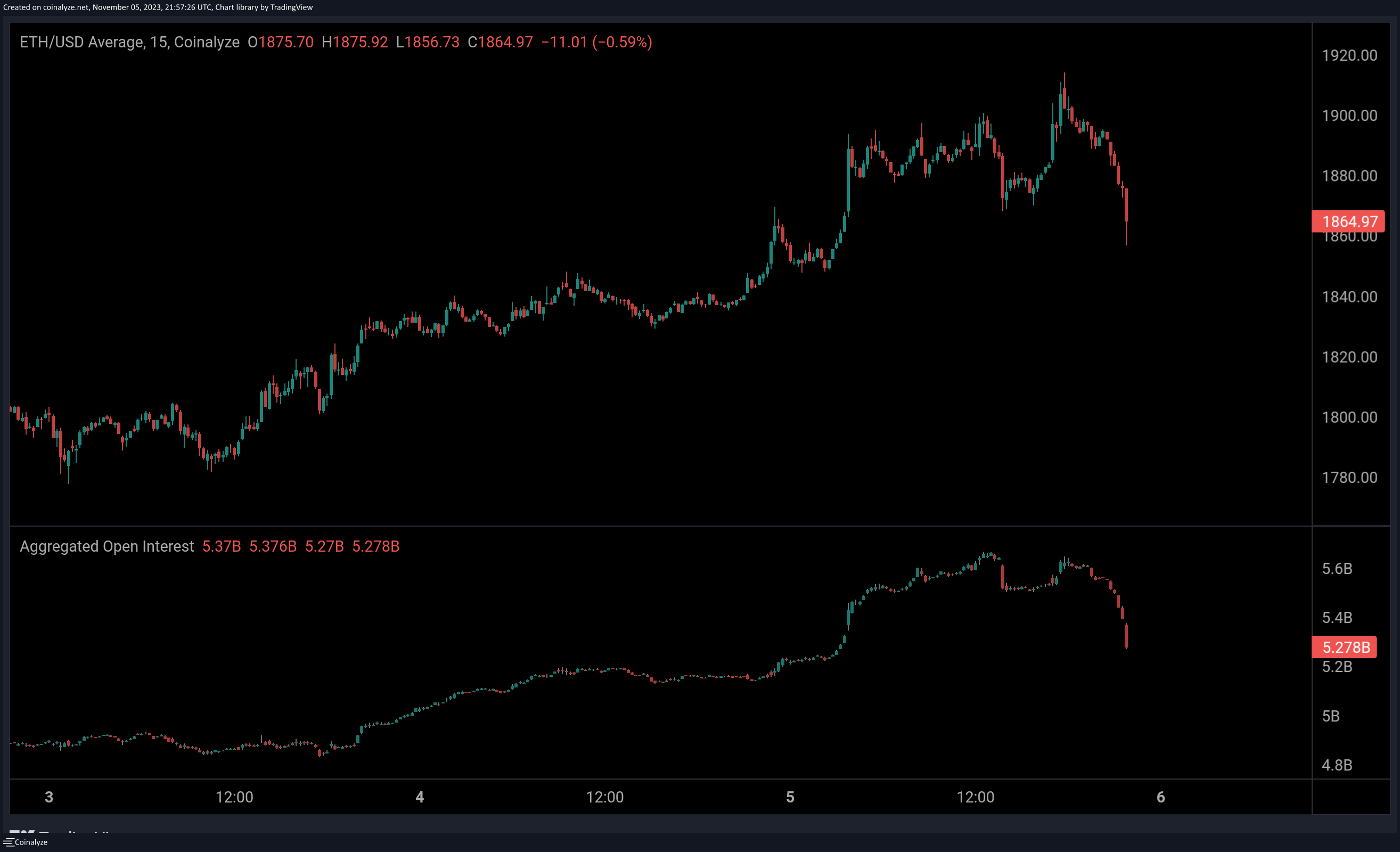

Ethereum Sees $400 Million of Open Interest Wiped Out

An on-chain crypto analyst named Maartunn noted that Ethereum’s open interest (OI) increased by over $600 million in recent days, indicating potential volatility ahead. However, on November 6, $400 million of OI was wiped out in just one day, erasing most of the gains. This has put pressure on the ETH price, potentially leading to a pullback or correction. While a correction is unlikely given the positive market sentiment, a retracement is more probable.

In addition to the open interest situation, there has been a significant movement of ETH to crypto exchanges by whales during the recovery of altcoins. While a selloff by whales is typically seen as a bullish move, it’s important to keep an eye on trading volume for any signs of a correction invalidation.

CoinGape Markets reported that a bearish breakdown channel pattern could result in a 16% drop in the price of Ethereum. The $1830 level has proven to be a strong resistance point with heightened volatility. However, popular crypto analyst Credible Crypto believes that the chart looks clean at the moment and sees the $1400-$1500 zone as a buy zone and the bottom. He predicts that ETH will first hit $1700 before reaching $2000.

As of now, ETH price has fallen 1% in the last 24 hours and is currently trading at $1,877. The 24-hour low and high are $1,863 and $1,911 respectively. Trading volume has also increased by 42% in the past day.

Hot Take: Ethereum Faces Pressure Amidst Open Interest Wipeout

Ethereum’s recent surge in price to over $1900 has been met with challenges as millions of dollars in open interest (OI) were wiped out. While market sentiment remains positive, the pressure on ETH price and potential retracement or correction cannot be ignored. Traders are anticipating further upward movement towards $2000, but it is crucial to monitor trading volume for any signs of invalidation. Overall, Ethereum’s performance in the coming days will be closely watched by investors and traders alike.

By

By

By

By

By

By

By

By