The Coinbase vs. SEC Case: Arguing the Status of Tokens

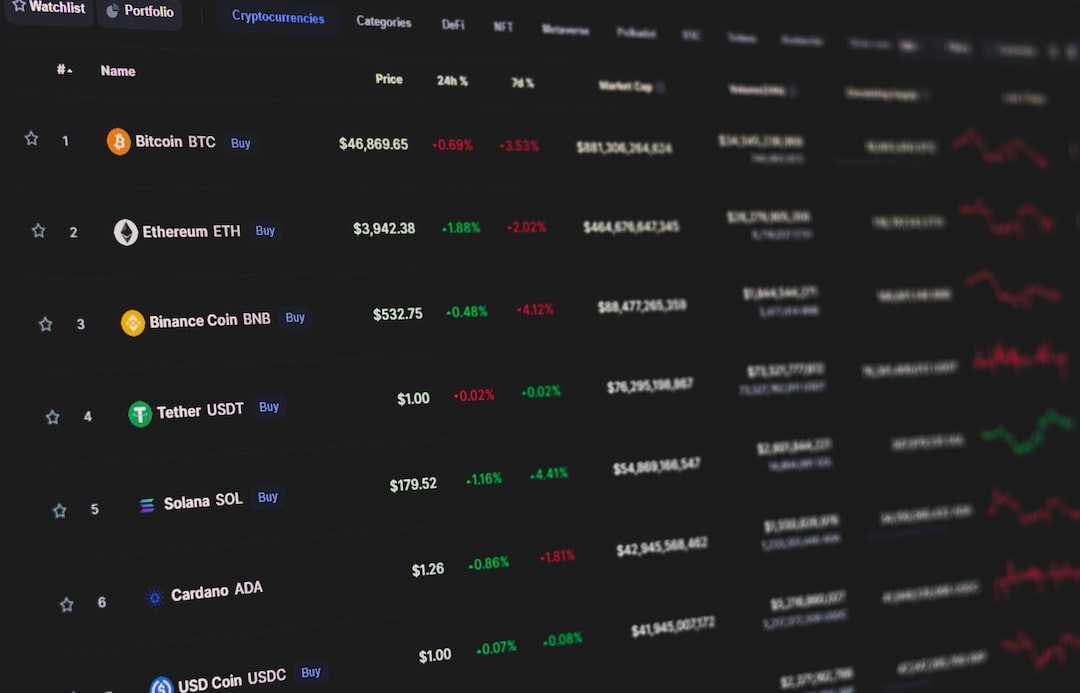

The ongoing legal battle between Coinbase and the SEC is centered around whether the tokens traded on the exchange are unregistered securities. The SEC sued Coinbase in June 2023, accusing them of trading 13 unregistered securities. The case is currently being heard by Judge Katherine Polk Failla in the Southern District of New York.

Outdated Laws and Bitcoin’s Distinctiveness

During the hearing, Judge Failla questioned the relevance of the Securities Act of 1933 in relation to new technologies like Bitcoin. She cited pro-Bitcoin Senator Cynthia Lummis’ statement that the 90-year-old law does not consider these advancements. The judge’s concern lies in whether the SEC’s definition of securities could unintentionally encompass a wider range of digital assets, potentially affecting unknowing investors.

The SEC’s Argument and Coinbase’s Defense

The SEC lawyer argued that a favorable ruling would classify the disputed tokens as investment contracts, allowing purchasers to seek rescission or nullification. However, Coinbase’s legal team countered this by stating that not all tokens on their platform meet the criteria to be considered securities. They also referenced a previous case presided over by Judge Failla involving Uniswap to highlight their non-responsibility for third-party activities.

Hot Take: Implications for Crypto Regulation

The outcome of the Coinbase vs. SEC case has significant implications for crypto regulation. If the court rules in favor of the SEC, it could lead to broader enforcement actions against other platforms and tokens. On the other hand, a victory for Coinbase may establish clearer guidelines for distinguishing between securities and non-securities in the crypto space. This case highlights the need for updated legislation that considers emerging technologies and provides regulatory certainty for the industry.

By

By

By

By

By

By

By

By