Kraken Strengthens European Presence with Acquisition of Coin Meester B.V.

Cryptocurrency exchange Kraken has announced its plan to acquire Coin Meester B.V. (BCM), a Netherlands-based crypto exchange. This move is aimed at expanding Kraken’s foothold in the European market. BCM has been running for nearly six years, making it one of the longest-running exchanges in the Netherlands.

Kraken CEO Cites Innovation and Crypto Adoption as Reasons for Acquisition

David Ripley, the CEO of Kraken, highlighted the Netherlands’ rapidly growing economy and its culture of innovation as the primary reasons behind their interest in acquiring BCM. He stated that the Netherlands is a key market for Kraken’s European expansion plans due to its advanced economy and high level of crypto adoption.

Kraken also emphasized its recent regulatory approvals for Virtual Asset Service Providers (VASPs) in Ireland, Italy, and Spain. The exchange expressed optimism about obtaining further approvals in other European markets in the near future.

The Netherlands Ranks High in Crypto Investment

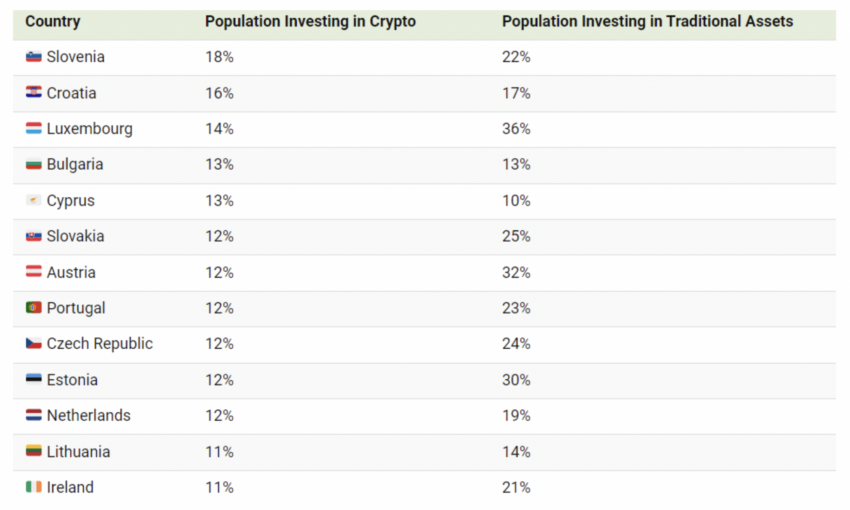

According to data from the World Economic Forum, the Netherlands ranks 6th out of 50 European countries in terms of the percentage of its population investing in cryptocurrencies. This further reinforces Kraken’s interest in expanding its presence in the country.

Growing Focus on the European Market in the Crypto Industry

The acquisition of BCM by Kraken is still pending finalization, as both parties need to agree on specific conditions. The sale price for BCM has not been disclosed.

In other news, Kraken is currently facing legal troubles in Australia over its margin trading product. The Australian Securities and Exchange Commission (ASIC) has sued Bit Trade, the provider of Kraken to Australian customers, alleging that Kraken failed to create a “target market determination” before launching the product.

Meanwhile, European regulators are strengthening crypto regulations, with the Markets in Crypto-Assets (MiCA) legislation set to be implemented in July 2024. This legislation aims to address tax-related loopholes in the crypto industry.

On a positive note, eToro, a crypto and stock trading platform, has received regulatory approval in the European Union. It has registered as a Crypto Assets Service Provider (CASP) with the Cyprus Securities and Exchange Commission (CySEC).

While the United States has faced challenges in launching Bitcoin ETFs, Europe recently introduced its first Bitcoin exchange-traded fund (ETF) on the Euronext Amsterdam stock exchange.

Hot Take: Kraken Expands European Reach with Coin Meester B.V. Acquisition

Kraken’s acquisition of Coin Meester B.V. marks a strategic move to strengthen its position in the European market. With the Netherlands’ advanced economy and high level of crypto adoption, it presents a key opportunity for Kraken’s expansion plans. Additionally, Kraken’s regulatory approvals in multiple European countries further demonstrate its commitment to growing its presence on the continent. However, legal challenges in Australia and increasing regulations in Europe pose potential hurdles for Kraken. Nevertheless, with eToro’s recent regulatory approval and the debut of Europe’s first Bitcoin ETF, the European market continues to show promise for crypto-related ventures.

By

By

By

By

By

By

By

By

By

By