FTX Advisers Provided Customer Trading Data to FBI

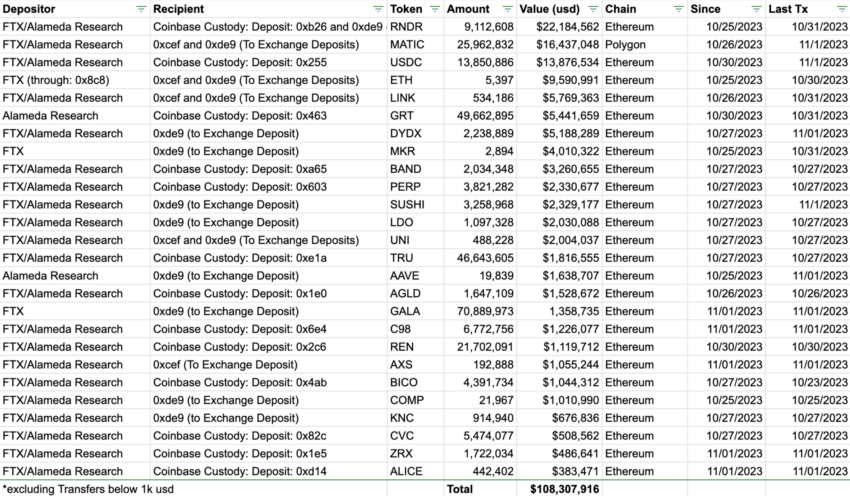

FTX advisers Alvarez & Marsal (A&M) have shared information on FTX customer trades with multiple field offices of the US Federal Bureau of Investigation (FBI) in response to subpoenas. The FBI’s Philadelphia, Oakland, Portland, Cleveland, and Minneapolis offices requested specific customer information and transactions from FTX. A&M billed the FTX bankruptcy estate $21,000 for fulfilling these requests.

FTX Risked Customer Data

The subpoenas highlight the fact that users of centralized exchanges like FTX sacrifice anonymity when they sign up. Crypto wallet addresses can be linked to real-world identities if exchanges comply with anti-money laundering regulations. Storing customer information in a centralized location like a cloud server also poses a risk as it creates a single point of failure that could lead to hacks and the loss of customer assets.

How Crypto Firms Respond to Subpoenas

US crypto companies have processes in place to limit government overreach into customer transaction data when responding to subpoenas. The agency must provide probable legal cause for the exchange to turn over requested information. Coinbase, for example, fought a subpoena from the US Internal Revenue Service (IRS) and successfully narrowed its scope. Coinbase has previously received thousands of law enforcement requests for information.

Read more: The Ultimate US Crypto Tax Guide for 2023

Hot Take: FTX’s Disclosure Raises Concerns About User Privacy

The revelation that FTX advisers provided customer trading data to the FBI raises concerns about user privacy and the potential risks associated with centralized exchanges. When users sign up for these platforms, they often give up their anonymity and expose their real-world identities. Additionally, storing customer information in a centralized location like a cloud server creates vulnerabilities and increases the risk of hacks that could lead to the loss of customer assets. Crypto firms need to find ways to protect user privacy while complying with regulatory requirements.

By

By

By

By

By

By

By

By

By

By