The FTX Estate Stakes 5.5 Million Solana Tokens Worth $121 Million

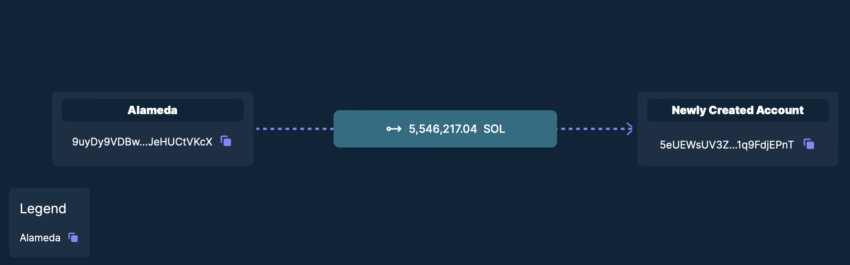

The estate of the now-defunct crypto exchange FTX has staked 5.5 million Solana (SOL) tokens, which are currently valued at $121 million USD. This information was discovered by a user on X (formerly Twitter) and can be seen on Solana.fm under the wallet name ‘Alameda’.

FTX Stakes Solana Following Approval of Liquidation Process

The staked amount consists of 5.55 million SOL tokens, which have an approximate value of $121.17 million.

Staking involves locking up tokens for a specific period to earn passive income and contribute to the blockchain’s operation.

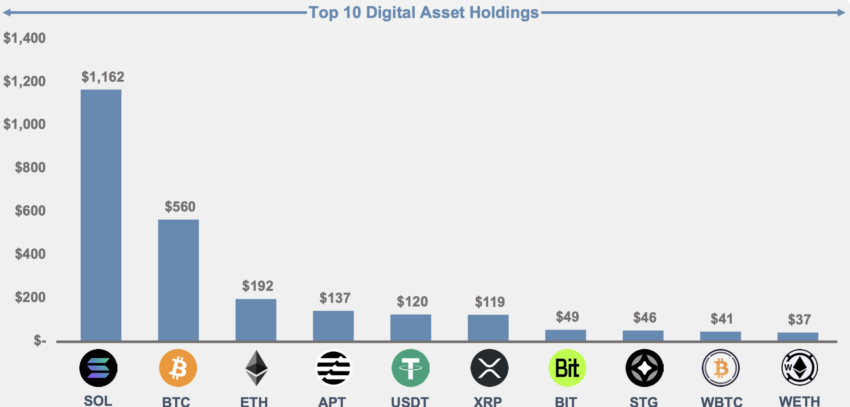

However, a recent court filing revealed that the FTX estate holds a significant amount of SOL as its largest portion of digital assets, totaling around $1.16 billion.

FTX’s liquidation plan, approved by the bankruptcy court, includes the $1.16 billion in SOL and approximately $2.5 billion in other crypto assets.

Gradual Liquidation Process to Prevent Market Impact

The liquidation process will be implemented gradually to avoid negative effects on the crypto market. It will occur in increments of $50 million per week, eventually ramping up to $100 million.

Solana’s Record-Breaking Total Value Locked (TVL)

SOL has recently achieved record-breaking total value locked (TVL) figures. On October 2, it reached its highest TVL levels in 2023, amounting to $338.2 million. This is a significant milestone for the SOL community, considering the previous decline in TVL just a year ago.

Hot Take: FTX Estate’s Stake in Solana Highlights Crypto Asset Management in Bankruptcy

The staking of 5.5 million Solana tokens by the FTX estate showcases the complex nature of managing crypto assets during bankruptcy proceedings. With a significant holding of SOL and other crypto assets, the estate’s liquidation plan requires careful execution to prevent market disruptions. Gradually selling off the assets in controlled increments is a prudent approach to maintain stability. Additionally, Solana’s impressive TVL growth demonstrates the resilience and potential of the blockchain network. As the crypto industry continues to evolve, proper asset management and regulatory compliance will play crucial roles in ensuring the stability and growth of digital assets.

By

By

By

By

By

By

By

By

By

By