The European Banking Authority’s Proposal for Stablecoin Issuers

The European Banking Authority (EBA) has published a consultation paper outlining the liquidity requirements for stablecoin issuers under the Markets in Crypto-Assets (MiCA) regulation. The EBA stipulates reserve requirements for stablecoins and suggests liquidity stress tests to assess an issuer’s risk tolerance.

According to the EBA, issuers of asset-referenced or e-money (stablecoin) tokens should be capable of meeting redemption requests at any time. An issuer must adjust its risk management policies if the weighted composition of its reserves is lower than the weighted amounts of the assets referenced by the tokens.

How EU Stablecoin Issuers Can Manage Risk

The EBA advises that issuers utilize historical data to assign stress factor weights to each asset and its reserves. Issuers can subject these assets to different withdrawal scenarios and then make necessary adjustments.

The reserve asset stress factor for a credit-based asset should be based on the risk tolerance of the credit issuer. For commodity reserve assets, the risk factor should be determined by how closely the reserve mirrors the assets referenced by the tokens.

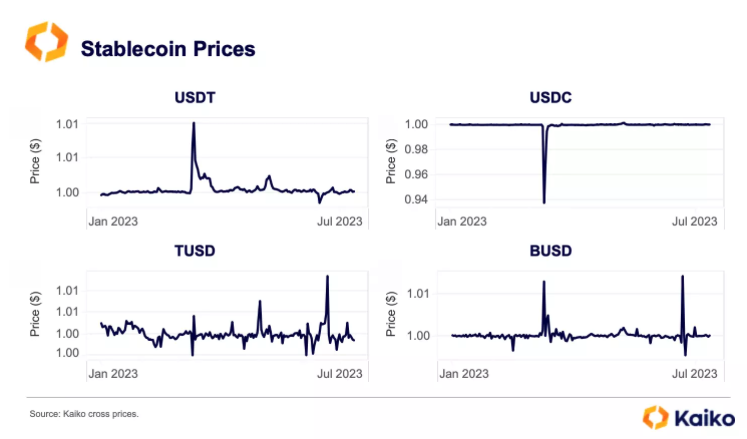

The stress factor for the stablecoin itself should consider volatility risks associated with how the asset is distributed. The issuer must also account for discrepancies between the token price and its market value during periods of market-wide stress.

The proposal suggests two approaches to a policy framework for issuers, either harmonizing policies in the European Union or allowing companies to have a high degree of freedom in developing a risk profile.

Once finalized, these rules will be implemented in the upcoming MiCA legislation, with crypto exchanges having until June 2024 to comply with these new regulations.

UK Stablecoin Rules Also in Progress

In addition to EBA’s proposal, both Bank of England (BoE) and UK Financial Conduct Authority (FCA) have released papers on stablecoins for public comment. The BoE emphasizes operational resilience and guarding against liquidity and terrorism financing risks, while FCA focuses on ensuring stablecoin issuers act in their customers’ best interests.

In other parts of Asia, Hong Kong is advancing discussions on stablecoin regulation, while Singapore has already finalized laws for privately issued stablecoins. In contrast, US regulation efforts have been delayed due to political hurdles in Congress.

Hot Take: Implications of EBA’s Proposal

The EBA’s proposal aims to bring greater stability and security to stablecoin issuance within the EU. By establishing clear liquidity requirements and proposing stress tests, it seeks to mitigate potential risks for both issuers and users of stablecoins. This move aligns with global efforts to regulate digital assets effectively while fostering innovation in the crypto industry.

By

By

By

By

By

By

By

By

By

By