The Bitcoin Market Sees a Surge in Millionaires

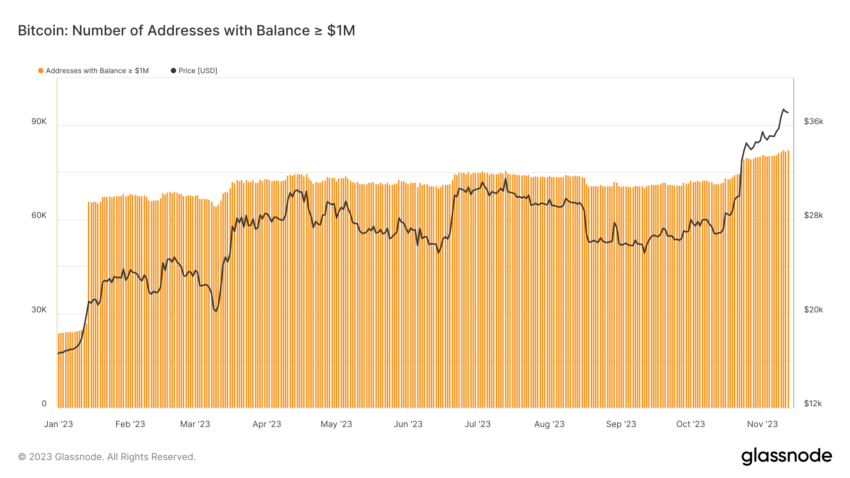

The cryptocurrency market is currently experiencing a significant shift, with the number of addresses holding over $1 million in Bitcoin more than tripling in 2023, reaching over 81,000.

This surge represents a 237% growth since January and coincides with Bitcoin’s price rally, surpassing the $37,000 threshold.

Bitcoin Millionaires Multiply

Bitcoin has been on a remarkable ascent, nearing $38,000 last week and hovering around $37,000 in the early hours of Monday. Short-term Bitcoin holders have reaped significant profits from this upsurge by selling and raking over $1.8 billion.

On the other hand, long-term holders have been accumulating before the upcoming Bitcoin halving. This accumulation phase contrasts with short-term holders who are potentially influencing market dynamics by taking profits.

The bullish trend in Bitcoin’s price and increasing millionaires is underpinned by strong liquidity trends. Data from Glassnode suggests that Bitcoin’s available supply has hit a historical low, indicating a tightening supply and reluctance among existing holders to sell.

Institutional Interest Spikes

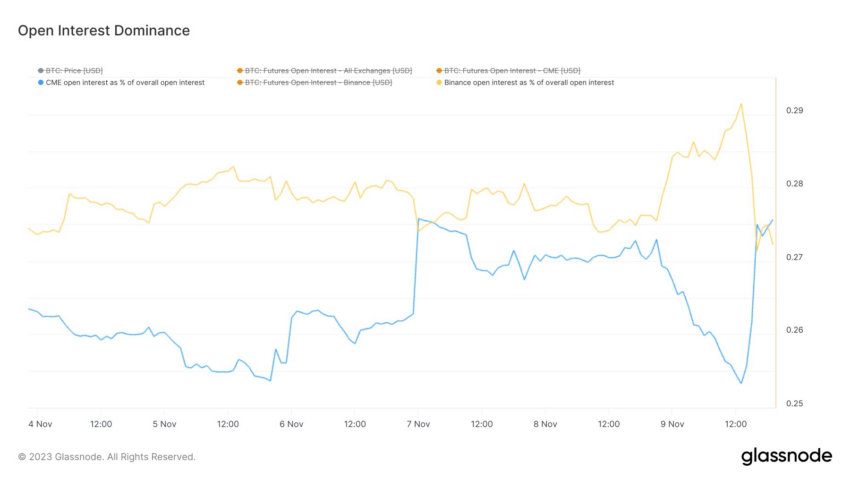

Open interest in Bitcoin and Ethereum crossed the $20 billion mark for the first time since the FTX collapse, indicating heightened market activity and interest levels. The increasing market share of the Chicago Mercantile Exchange (CME) suggests it is a preferred venue for large traditional finance companies to get exposure to crypto.

The order book depth for Bitcoin and Ethereum has tightened despite strong price increases, suggesting a relative lack of sellers compared to buyers. The annualized realized volatility for Bitcoin and Ethereum also remains relatively low, reinforcing the stability of the current market rally.

Hot Take: The Ongoing Crypto Rally

The ongoing crypto rally indicates a significant shift in market dynamics and might signal the beginning of the next bull market. This surge is driven by institutional investors and a market with relatively few sellers.

By

By

By

By

By

By

By

By

By

By