The Render Token (RNDR) Price Breaks Out and Reaches Long-Term Resistance

The price of Render Token (RNDR) has recently broken out from a descending resistance trendline and surpassed the $1.85 horizontal resistance level, reaching its highest price since July.

Technical Analysis Indicates a Bullish Trend for RNDR

When analyzing the weekly timeframe, RNDR is trading just below the $1.90 horizontal resistance area. Although the price initially broke out from this area in April, it failed to sustain the increase and fell below it in July. However, since breaking out from the descending resistance trendline in September, the price has been increasing. While it briefly moved above $1.90 this week, it has yet to close above that level on a weekly basis.

The weekly Relative Strength Index (RSI), which measures market momentum, indicates a bullish reading for RNDR. With an RSI above 50 and showing an upward trend, it suggests that bulls still have an advantage in the market.

Impact of Artificial Intelligence (AI) on the Market

Render Token is a significant project that leverages AI-related technologies. While the AI sector has been thriving in traditional markets, it is still lagging behind in the cryptocurrency sector.

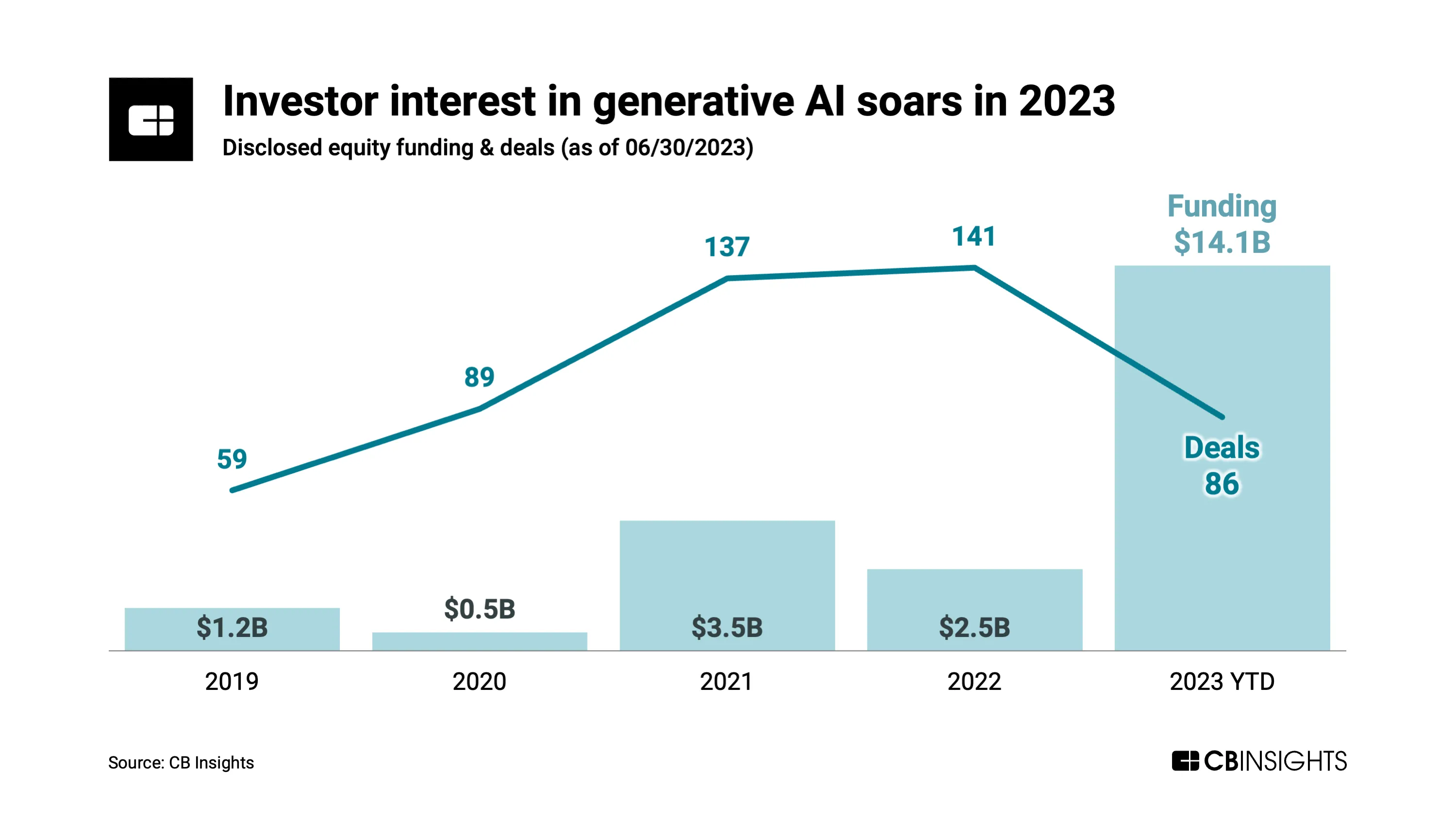

Investments in generative AI tools, such as Chat-GPT, have reached $14.1 billion in 2023, surpassing the $2.5 billion and $3.5 billion invested in 2022 and 2021, respectively.

According to Mr. Hatu Sheikh, Co-Founder and CMO of DAO Maker, the decreased venture capital funding for crypto projects is partly due to the focus on AI in the market. He believes that as crypto gains traction again, investor interest will follow suit.

Mr. Sheikh also notes that Web3 is not a strong ground for Business-to-Business (B2B) products in the AI crypto market. Instead, the main monetization lies in Business-to-Consumer (B2C) models. Currently, AI products in the crypto space simply tokenize traditional business models and lack gamified earn economics.

Cryptocurrencies now follow macro trends and could see a boom in AI tokens following a boom in AI chips and stocks. NVIDIA, the leading provider of AI chips, is trading near its all-time high.

RNDR Price Prediction: Bullish Reversal Possible

On the daily timeframe, RNDR’s technical analysis suggests a bullish outlook. The price has broken out from a descending resistance trendline and closed above the $1.85 horizontal resistance level, which is the final resistance before $2.35.

In addition, RNDR has broken out from an ascending parallel channel, indicating a bullish trend. If the upward movement continues, RNDR could increase by another 25% and reach the $2.35 horizontal resistance area.

However, if RNDR fails to maintain its breakout and closes below the $1.85 horizontal resistance level, a 30% drop to the $1.30 horizontal support level may be expected.

Hot Take: The Intersection of AI and Crypto

The AI sector’s growth in traditional markets has yet to fully translate to the cryptocurrency sector. However, projects like Render Token are leveraging AI-related technologies to bridge this gap.

While B2B models struggle to find traction in the AI crypto market, B2C models that gamify earn economics are gaining popularity. As crypto gains more attention and investment, the AI token narrative could follow suit.

It is important to recognize that cryptocurrencies now follow macro trends, and the success of AI chips and stocks could potentially drive a boom in AI tokens. With NVIDIA’s strong performance in the AI chip market, there is potential for further growth in this sector.

By

By

By

By

By

By

By

By

By

By