JPMorgan Predicts 20% Decline in Bitcoin Hash Rate After Halving

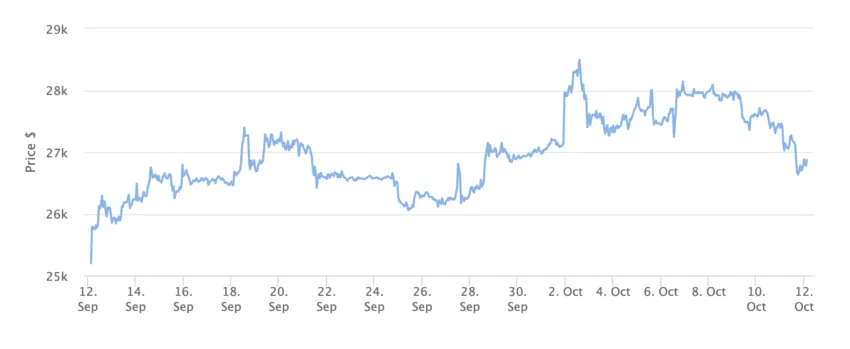

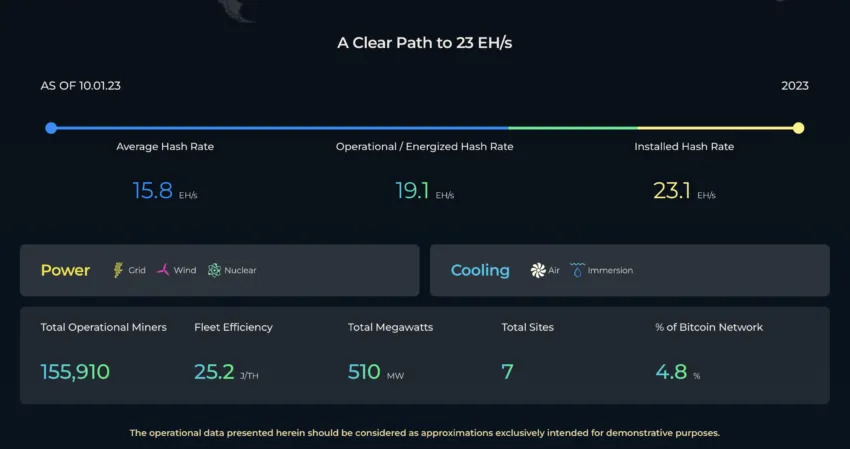

JPMorgan has released a report suggesting that the Bitcoin Network Hash Rate could potentially decrease by 20% following the Bitcoin halving in April 2024. The report explains that this decline may occur as less-efficient mining hardware is decommissioned, resulting in the removal of approximately 80 EH/s from the network.

Bitcoin Mining Industry Faces Crucible Moment

The research report highlights that the Bitcoin mining industry is currently at a critical juncture as it approaches the upcoming Bitcoin halving in April 2024. The halving, which occurs every four years, involves reducing miners’ rewards by half to control inflation. The report mentions that the total block reward opportunity over the four-year period leading up to the halving is estimated to be around $20 billion, representing a significant decrease of 72% compared to two years ago.

JPMorgan’s Preferred Bitcoin Mining Firm

JPMorgan lists several Bitcoin mining firms but identifies CleanSpark as its preferred option due to its scale, growth potential, power costs, and relative value. However, the investment firm notes that Marathon Digital, despite being the largest operator, has high energy costs and low margins.

Riot Platforms, on the other hand, is believed to have lower power costs and better liquidity. However, recent online commentary has questioned the correlation between Bitcoin’s four-year cycles and the halvings, suggesting that these cycles may be mere coincidences.

Hot Take: The Future of Bitcoin Mining

The upcoming Bitcoin halving in April 2024 poses significant challenges for the mining industry, with a potential 20% decline in the network’s hash rate predicted by JPMorgan. This decline may result from decommissioning less-efficient mining hardware. As the industry faces this crucial moment, mining firms like CleanSpark are seen as favorable options due to their scale and growth potential. However, debates continue regarding the relationship between Bitcoin’s four-year cycles and halvings, raising questions about whether these cycles are truly significant.

By

By

By

By

By

By

By

By

By

By