Legal Implications of Cryptocurrency Taxation: What You Need to Know

Welcome to the exciting world of cryptocurrency! As a cryptocurrency enthusiast, it’s important to understand the legal implications of taxation in this evolving landscape. The decentralized nature of cryptocurrencies presents unique challenges for tax authorities worldwide. In this article, we will explore the key aspects of cryptocurrency taxation, the potential legal implications, and what you need to know to stay compliant.

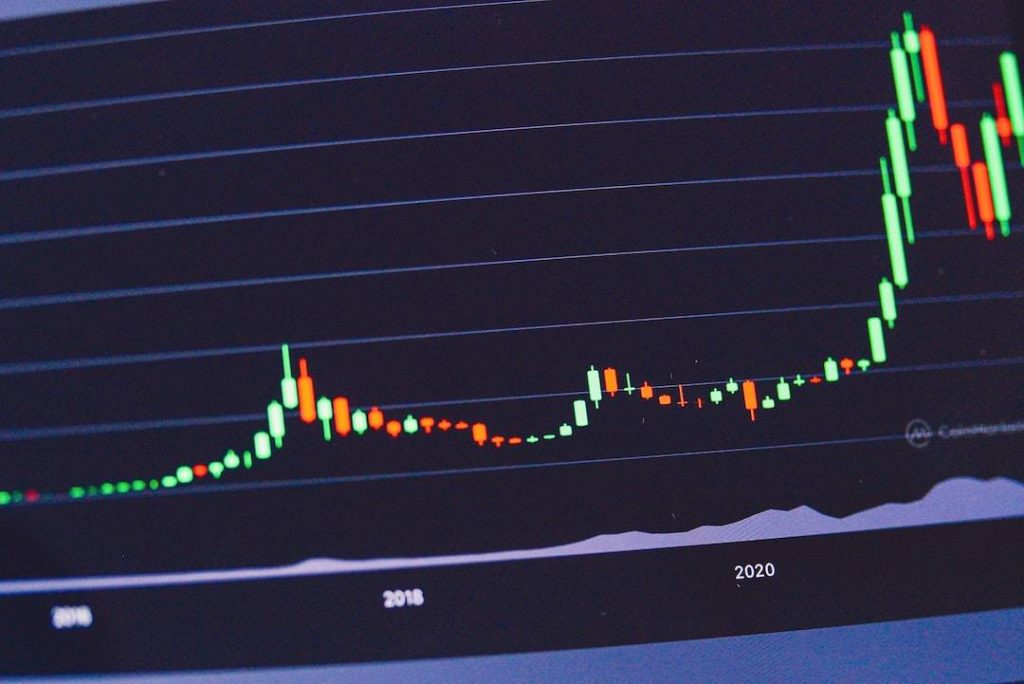

Understanding Cryptocurrency Taxation

When it comes to taxation, cryptocurrencies are generally treated as property by most tax authorities. This means that every transaction you make using cryptocurrencies, whether it’s buying goods, services, or trading, may have tax implications. Just like any other investment, you may be liable for capital gains or losses upon selling or trading your cryptocurrencies.

One key tax event to be aware of is when you convert your cryptocurrency into fiat currency. Keep in mind that this conversion is considered a taxable event in most jurisdictions. It’s crucial to keep detailed records of your transactions, as accurate reporting will be essential when filing your taxes.

The Importance of Reporting

As a cryptocurrency trader or investor, reporting your transactions is crucial to ensure compliance with tax laws. Although the decentralized nature of cryptocurrencies might provide a certain level of anonymity, tax authorities are increasingly targeting those who fail to report cryptocurrency gains.

Failing to report your cryptocurrency gains can lead to penalties, fines, or even criminal charges. It’s essential to understand the reporting requirements in your jurisdiction and keep thorough records of your cryptocurrency activities. Remember, when it comes to taxation, it’s always better to be safe than sorry.

The Concept of Cryptocurrency Losses

Just as you can realize capital gains, you can also encounter losses when trading or investing in cryptocurrencies. It’s important to understand that these losses can be deducted from your taxable income, which can offset your gains and potentially lower your overall tax liability.

If you experience losses in your cryptocurrency investments, make sure to consult with a tax professional to understand the specific regulations in your jurisdiction regarding the deductibility of these losses.

Global Perspectives on Cryptocurrency Taxation

While cryptocurrency taxation laws vary from country to country, most tax authorities around the globe are starting to address the issue. In the United States, for example, the Internal Revenue Service (IRS) has issued guidelines stating that cryptocurrency is treated as property for tax purposes.

Other countries, such as Japan and Australia, have also established clear guidelines for cryptocurrency taxation. It’s crucial to stay informed about the regulations in your jurisdiction to ensure compliance.

Tax Compliance Tools and Services

Managing your cryptocurrency taxes can be challenging, considering the complexities of the evolving regulations and the number of transactions you may have. Fortunately, there are various tools and services available that can help ensure accurate reporting and tax compliance.

Several software platforms specialize in cryptocurrency tax reporting, enabling you to import your transaction data and generate comprehensive reports for tax purposes. Additionally, seeking advice from certified tax professionals who specialize in cryptocurrency taxation can provide valuable guidance.

FAQs

Q: Do I need to pay taxes on every cryptocurrency transaction?

A: In most jurisdictions, every transaction involving cryptocurrencies, including buying, selling, and trading, may have tax implications. It’s important to report and potentially pay taxes on these transactions.

Q: Can I deduct cryptocurrency losses from my taxable income?

A: Yes, just like capital gains, cryptocurrency losses can often be deducted from your taxable income, lowering your overall tax liability. Consult with a tax professional to understand the specific regulations in your jurisdiction.

Q: Are cryptocurrency taxes enforced globally?

A: While cryptocurrency taxation laws vary from country to country, tax authorities worldwide are increasingly addressing this issue. It’s essential to stay informed about the regulations in your jurisdiction to ensure compliance.

Conclusion

Understanding the legal implications of cryptocurrency taxation is crucial for every enthusiast. By treating cryptocurrencies as property and reporting your transactions accurately, you can ensure compliance with tax laws and avoid penalties or criminal charges. Remember to keep detailed records, seek guidance from professionals, and leverage available tax compliance tools to manage your cryptocurrency taxes effectively.

By

By

By

By

By

By