Mastercard’s View on CBDC Adoption

In the world of digital finance, Central Bank Digital Currencies (CBDCs) have become a hot topic. Ashok Venkateswaran, Mastercard’s blockchain and digital assets lead for Asia-Pacific, recently expressed skepticism about the widespread adoption of CBDCs, especially in regions with strong payment systems, at the Singapore FinTech Festival. His comments reflect a cautious approach to the adoption of these digital assets.

Retail and Wholesale CBDCs

Retail CBDCs are the digital equivalents of traditional fiat currencies, catering to the daily transactional needs of individuals and businesses. On the other hand, financial institutions design wholesale CBDCs for high-value transactions. Despite the International Monetary Fund’s (IMF) endorsement of CBDCs as a safe, low-cost alternative to cash, widespread adoption remains a complex issue.

Venkateswaran explained that the main challenge lies in adoption. If you have CBDCs in your wallet, you should have the ability to spend it anywhere you want—similar to cash today.

The Complex Issue of Widespread Adoption

The IMF reports that about 60% of countries globally are exploring CBDCs, but only 11 have fully adopted them. Venkateswaran highlights the significant time and effort required to build the necessary infrastructure for CBDCs despite many central banks becoming increasingly innovative and collaborating with private companies like Mastercard.

Venkateswaran also noted consumer preference for traditional forms of money like paper and coins. He also suggested that there isn’t enough justification for CBDCs in places where existing payment systems are efficient.

A Balancing Act Between Privacy and Convenience

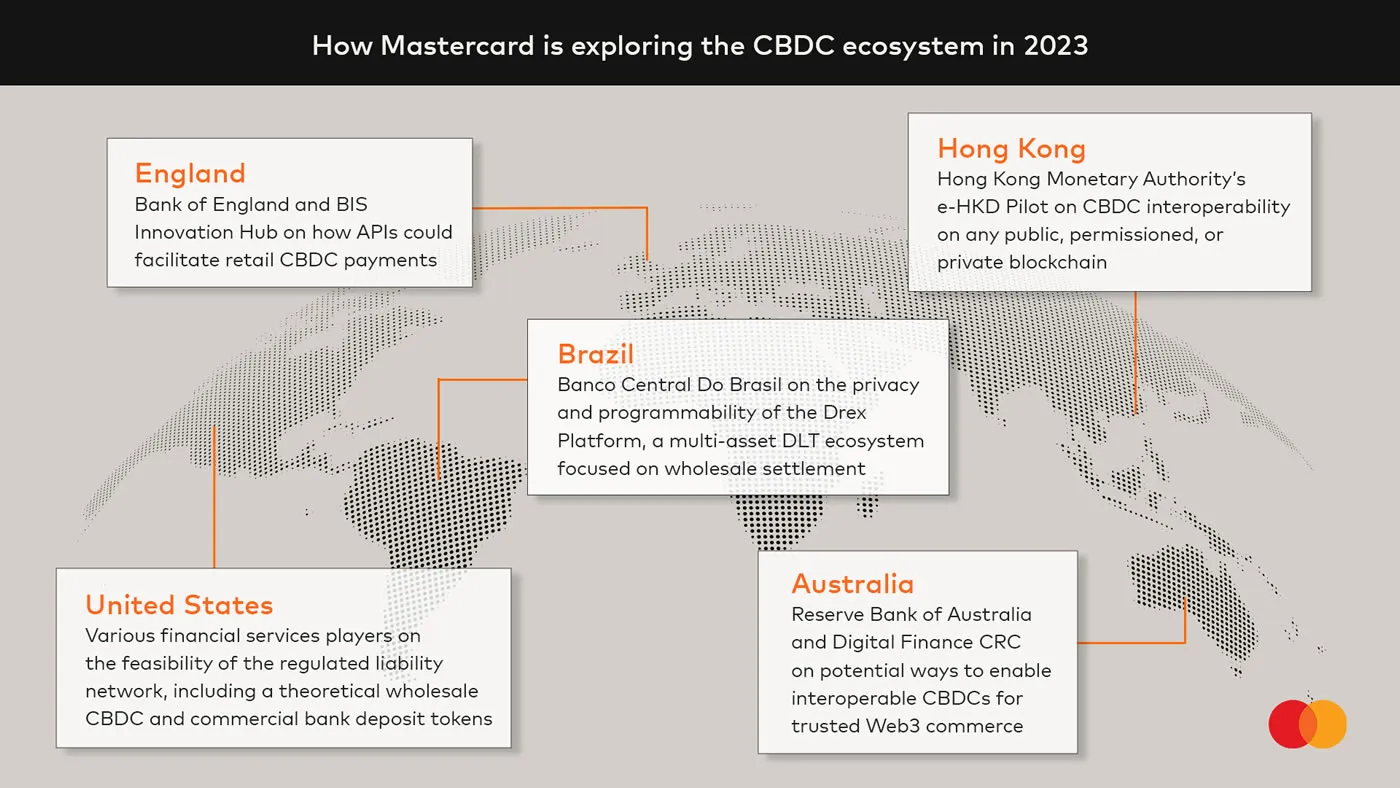

Mastercard is actively involved in the CBDC space and has completed testing its solution in the Hong Kong Monetary Authority’s e-HKD pilot program. The company is working to foster collaborations through its CBDC Partner Program, aiming to bring together blockchain technology and payment service providers to develop blockchain-based money.

The Future of CBDCs

The CBDC industry continues to evolve, with various countries at different stages of exploration and adoption. Some view CBDCs as a step forward in the digital evolution of money. However, others raise concerns over privacy and the extent of state control over financial transactions. A delicate balance between innovation, consumer preference, regulatory considerations, and each country’s specific financial needs will likely shape the future of CBDCs.

Hot Take: The Challenges Ahead for Widespread Adoption

As more countries explore the potential of Central Bank Digital Currencies (CBDCs), challenges related to infrastructure development, consumer preference for traditional forms of money, and regulatory considerations continue to hinder widespread adoption. While some see CBDCs as a positive step toward digital evolution, others express concerns about privacy and state control over financial transactions. The future of CBDCs will depend on finding a balance between these factors while addressing each country’s unique financial needs.

Bernard Nicolai emerges as a beacon of wisdom, seamlessly harmonizing the roles of crypto analyst, dedicated researcher, and editorial virtuoso. Within the labyrinth of digital assets, Bernard’s insights echo like a resonant chord, touching the minds of seekers with diverse curiosities. His talent for deciphering the most intricate strands of crypto intricacies seamlessly aligns with his editorial finesse, transforming complexity into a captivating narrative of comprehension. Guiding both seasoned adventurers and inquisitive newcomers, Bernard’s insights forge a compass for informed decision-making within the ever-evolving tapestry of cryptocurrencies. With the artistry of a wordsmith, they craft a narrative that enriches the evolving chronicle of the crypto cosmos.