PEPE has observed a sharp increase of around 64% during the past few days, but is this rise here to stay? Here’s what on-chain data suggests.

PEPE Whale Transfers And Volume Have Been High Recently

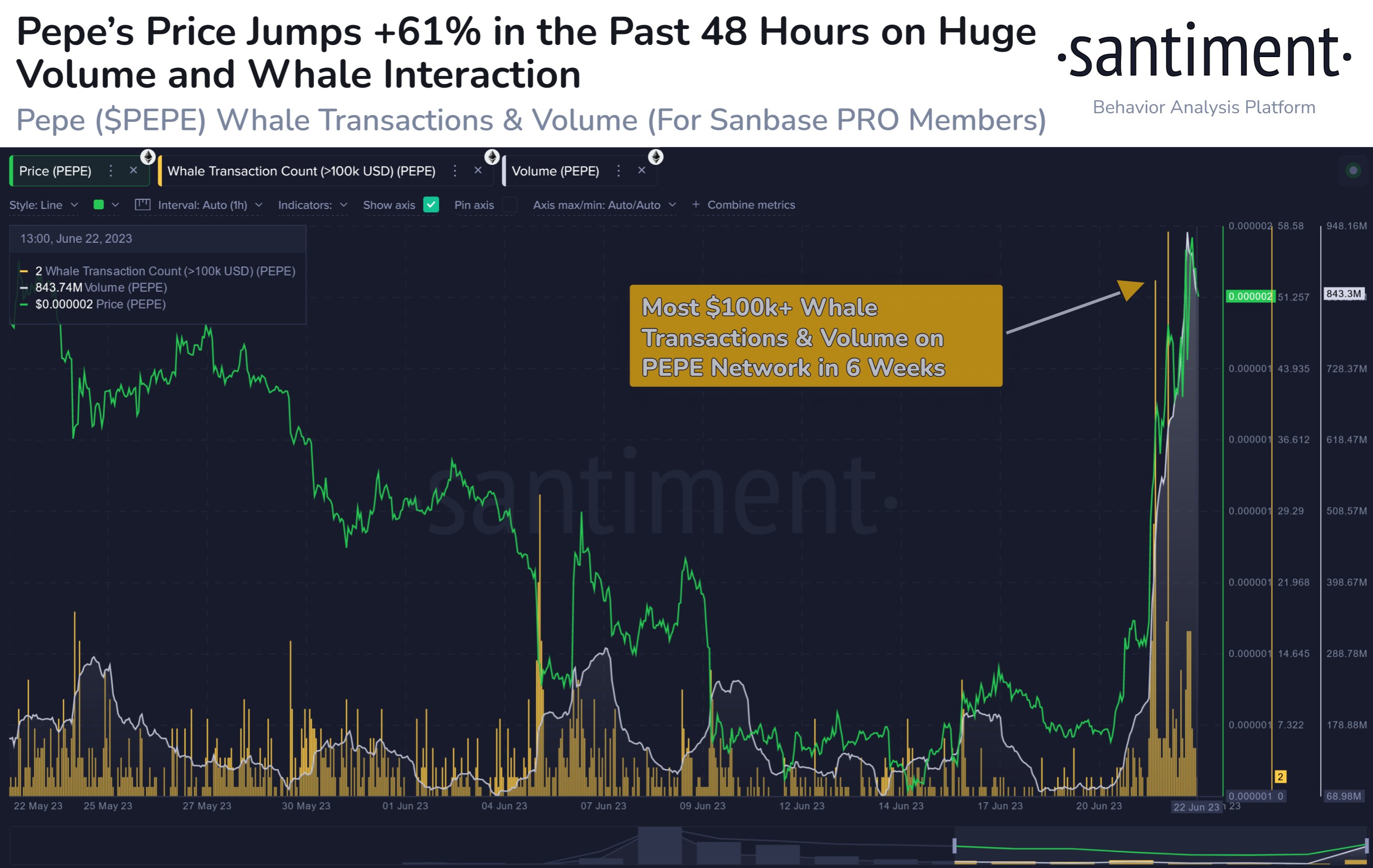

According to data from the on-chain analytics firm Santiment, whales have actively engaged with the asset as it has gone up during the last few days. The relevant indicator here is the “whale transaction count,” which measures all PEPE transfers taking place on the blockchain that are worth at least $100,000 in value.

This indicator can provide us with hints about how active the whales are in the market currently, as generally, they are the only investors capable of moving such a large amount of the asset with a single transfer.

For top cryptocurrencies like Bitcoin, the cutoff for whale transactions that the metric uses is $1 million, but as the memecoin is still relatively small currently, it makes sense that the whales and the transfers that they would make would be smaller as well.

When the value of the whale transaction count is high, it means that the whales are actively trading the cryptocurrency right now. As the amounts involved in their transfers are so large, a high number of them taking place at once can cause noticeable shifts in the market. Thus, whenever the indicator displays this trend, the price becomes more likely to show volatility.

Now, here is a chart that shows the trend in the PEPE whale transaction count over the last month or so:

The value of the metric seems to have been quite large in recent days | Source: Santiment on Twitter

As displayed in the above graph, the PEPE whale transaction count has registered some very large spikes during the last couple of days. This is the first time in around six weeks that the indicator has jumped to such high levels.

The rise in the metric has come as the memecoin has handily outperformed all the top digital assets by market cap, with the price registering a steep growth of 64% within only the past few days.

While the whale transaction count metric doesn’t actually differentiate between buying or selling transactions, the surrounding context of the price trend could help provide some hints related to it.

Since the recent high number of whale transactions came soon after the price rise started, it’s possible that these humongous holders were making these transfers for buying. If the largest of the spikes were signs of mass dumping, the rally likely wouldn’t have been able to continue for as long as it has.

It also looks like the interest in the cryptocurrency hasn’t just come from the whales; the trading volume, which is a measure of the total amount of PEPE being moved around on the network, has also risen to very high values recently, implying that the general investor activity around the coin is elevated currently.

The whale transactions have slumped a bit since the large spikes, but they are still at a notable value. The trading volume, though, hasn’t let up yet. Santiment thinks that this indicator is the one to watch right now, as it staying high could mean fuel for PEPE to maintain around the current levels, or even to continue the bullish momentum.

PEPE Price

At the time of writing, PEPE is trading around $0.00000154, up 73% in the last week.

Looks like the memecoin has surged recently | Source: PEPEUSD on TradingView

Featured image from iStock.com, charts from TradingView.com, Santiment.net

By

By

By

By

By

By

By

By

By

By