Cryptocurrency: Female Investors Prioritize Education Expenses

A recent survey conducted by cryptocurrency exchange Bitget has revealed that 27% of female investors in the United States invest in crypto to cover their children’s education expenses. The findings also showed that approximately 19% of Chinese investors have dedicated a minimum of $100,000 to cryptocurrency investments.

Female Crypto Investors Outpace Males in Strategic Planning

The report highlighted that education continues to be a primary objective for female investors in the US. However, female investors in South Korea and Japan are using crypto to enhance their personal financial situations. Notably, 49% of female users in South Korea and 41% in Japan invest with this goal in mind, whereas the percentages drop to 45% and 30% for males respectively.

In addition, a rising number of female investors in South Korea and Japan hope that crypto investments will lead to better living situations. On the other hand, 17% of South Korean male investors are dabbling in crypto to improve family finances.

The report also revealed that almost 40% of Chinese investors hold a significant minimum amount in crypto. Among Chinese investors, 19% have invested a minimum of $100,000, while another 18% have invested at least $50,000.

Meanwhile, users in Malaysia and Taiwan view crypto investments as a vital means of supporting their family’s income. The report noted that 36% of respondents from these regions prioritize their family’s quality of life above other financial objectives.

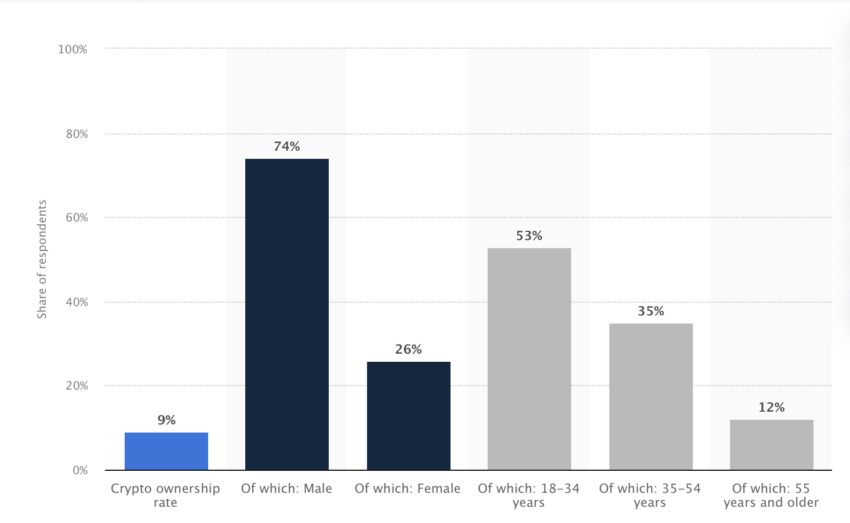

Exploring the Gender Divide in Crypto

The relationship between gender and crypto has been a subject of ongoing exploration and discussion. A report from BeInCrypto in April 2022 indicated that female cryptocurrency adoption was surpassing that of their male counterparts. Over a 12-month period, female involvement in crypto surged by 172%, compared to an 80% increase for men.

Hot Take: Female Investors Use Crypto to Support Education and Personal Finances

A recent survey conducted by Bitget reveals that female investors in the US prioritize using cryptocurrency to cover their children’s education expenses. In South Korea and Japan, female investors focus on enhancing their personal financial situations through crypto investments. On the other hand, male investors in South Korea aim to improve family finances with crypto. Additionally, the study shows that a significant number of Chinese investors hold substantial amounts in crypto, with some investing at least $100,000. Meanwhile, users in Malaysia and Taiwan view crypto investments as crucial for supporting their family’s income. The gender divide in crypto continues to be an area of exploration, with female adoption outpacing that of males over the past year.

By

By

By

By

By

By

By

By