Analyst Predicts 20% Decline in Bitcoin Price

If historical patterns are anything to go by, Bitcoin could see a decline of at least 20% in the near future. This prediction is based on the aggregated open interest of all cryptocurrencies except Bitcoin forming a bearish pattern.

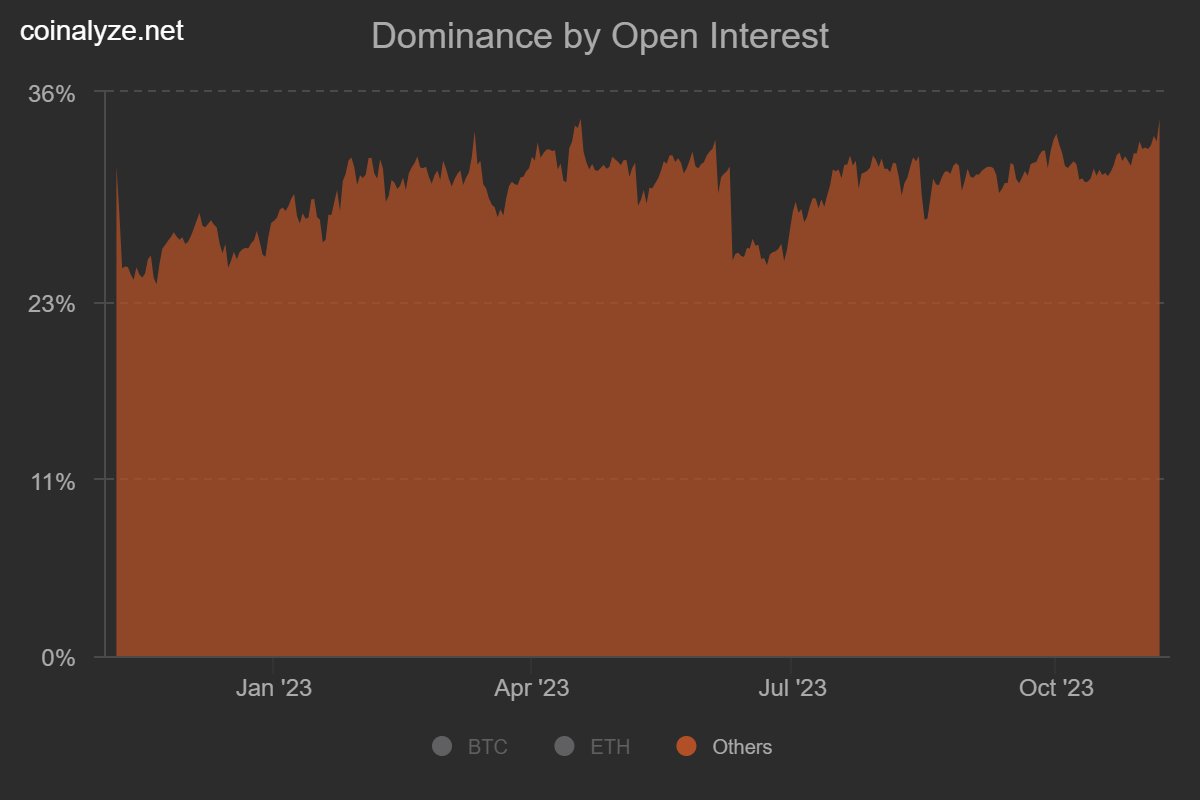

Aggregated Open Interest of Assets Excluding Bitcoin

CryptoQuant Netherlands community manager Maartunn points out that the aggregated open interest of all cryptocurrencies except Bitcoin is showing a bearish pattern. The “open interest” indicator measures the total amount of derivative positions (in USD) open on all exchanges globally. High values indicate more volatile price movements, while low values imply relative calmness for the price. The current trend has surpassed the $12.2 billion level and is now at $13.8 billion, signaling an overheated derivative market.

Potential Impact on Bitcoin

Given the historical significance of this metric, if past patterns hold true, then Bitcoin may be approaching its peak. Another analyst also points out that the dominance of futures open interest in assets other than Bitcoin and Ethereum has reached 2023 highs, further indicating an overheated market that could spell danger for Bitcoin and the rest of the cryptocurrency sector.

BTC Price

In recent days, Bitcoin made another attempt at $35,000 but has since fallen below that level to trade around $34,700.

Hot Take: Market Overheating Signals Potential Trouble for Bitcoin

The overheated status of the cryptocurrency market, as indicated by the aggregated open interest and dominance of futures open interest in assets other than Bitcoin and Ethereum, suggests potential trouble ahead for Bitcoin and the broader cryptocurrency sector.

By

By

By

By

By

By

By

By

By

By