VanEck Analyzes Solana’s Potential for Blockchain Leadership

A recent blog post by global asset manager VanEck suggests that the price of Solana’s native token, $SOL, could reach as high as $3,211 or drop as low as $9.81 by 2030. VanEck emphasizes the importance of Smart Contract Platforms (SCPs) in enabling decentralized applications and believes that for blockchain to achieve widespread adoption, it must offer more than just financial transactions.

Solana’s Distinctive Features and Strengths

VanEck highlights Solana’s commitment to scalability and efficiency. The asset manager recognizes Solana’s focus on high-speed data processing and transaction capabilities, making it one of the most efficient blockchains available. This technological advancement sets Solana apart from other platforms.

Usability: A Crucial Element for Adoption

VanEck stresses the importance of speed, ease of use, and accessibility for a blockchain platform to become the foundation for groundbreaking applications. According to VanEck, Solana excels in these areas, making it a strong contender for hosting future innovative applications.

Financial Sustainability: A Challenge for Solana

Solana currently faces challenges in terms of its financial model. The costs of maintaining its blockchain infrastructure exceed its revenue. VanEck advises that Solana needs to find a sustainable way to balance its security expenses with its income to ensure long-term viability.

Solana vs. Ethereum: A Philosophical Divide

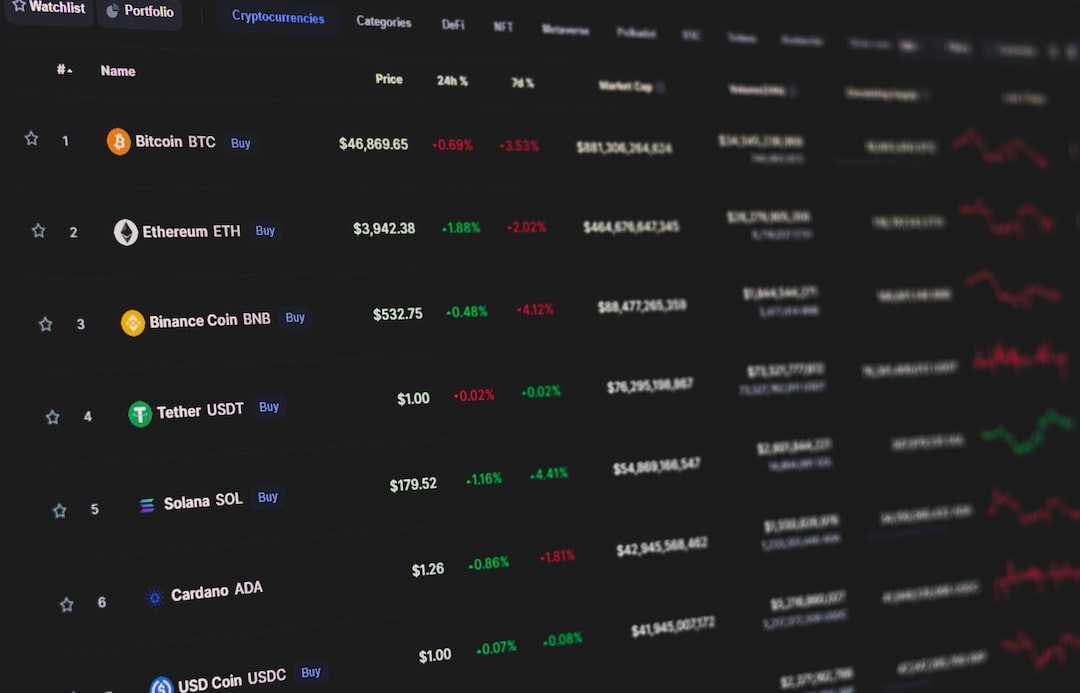

VanEck highlights the differing philosophies between Solana and Ethereum in blockchain development. While Ethereum aims for modular solutions, Solana focuses on an integrated, high-throughput system. This philosophical divide could impact their respective market shares.

Developer Engagement and Ecosystem Expansion

Solana’s complex architecture and the requirement for expertise in the Rust programming language pose challenges for developers. However, VanEck notes that Solana has managed to maintain a steady number of active developers, which is vital for its long-term success.

Revenue Models and Value Capture in the Long Run

VanEck explores potential revenue sources for Solana, such as transaction fees and Miner Extractable Value (MEV). The firm suggests that Solana could adjust its pricing strategies to capture more value in the future.

Risks and Prospects: A Balanced View

While acknowledging the risks associated with Solana’s experimental technology and stability, VanEck sees significant upside potential for the platform. VanEck believes that Solana is worth considering for investment portfolios due to its promising prospects.

Hot Take: Solana’s Potential as a Leading Blockchain Platform

In conclusion, VanEck’s analysis indicates that Solana has the potential to become a leading blockchain platform. With its focus on scalability, efficiency, usability, and developer engagement, Solana stands out in the crowded blockchain space. While financial sustainability remains a challenge, Solana’s unique features and strengths position it well for future growth. As blockchain technology continues to evolve, Solana could play a crucial role in driving widespread adoption and hosting groundbreaking applications.

By

By

By

By

By

By

By

By

By

By