Bitcoin Long-Term Holders Finish 2023 with Strong Accumulation

According to on-chain data, Bitcoin’s long-term holders have ended 2023 with a strong belief in the cryptocurrency. These holders have consistently set new all-time highs for their supply, indicating their confidence in Bitcoin’s long-term prospects.

Grouping Investors by Holding Time

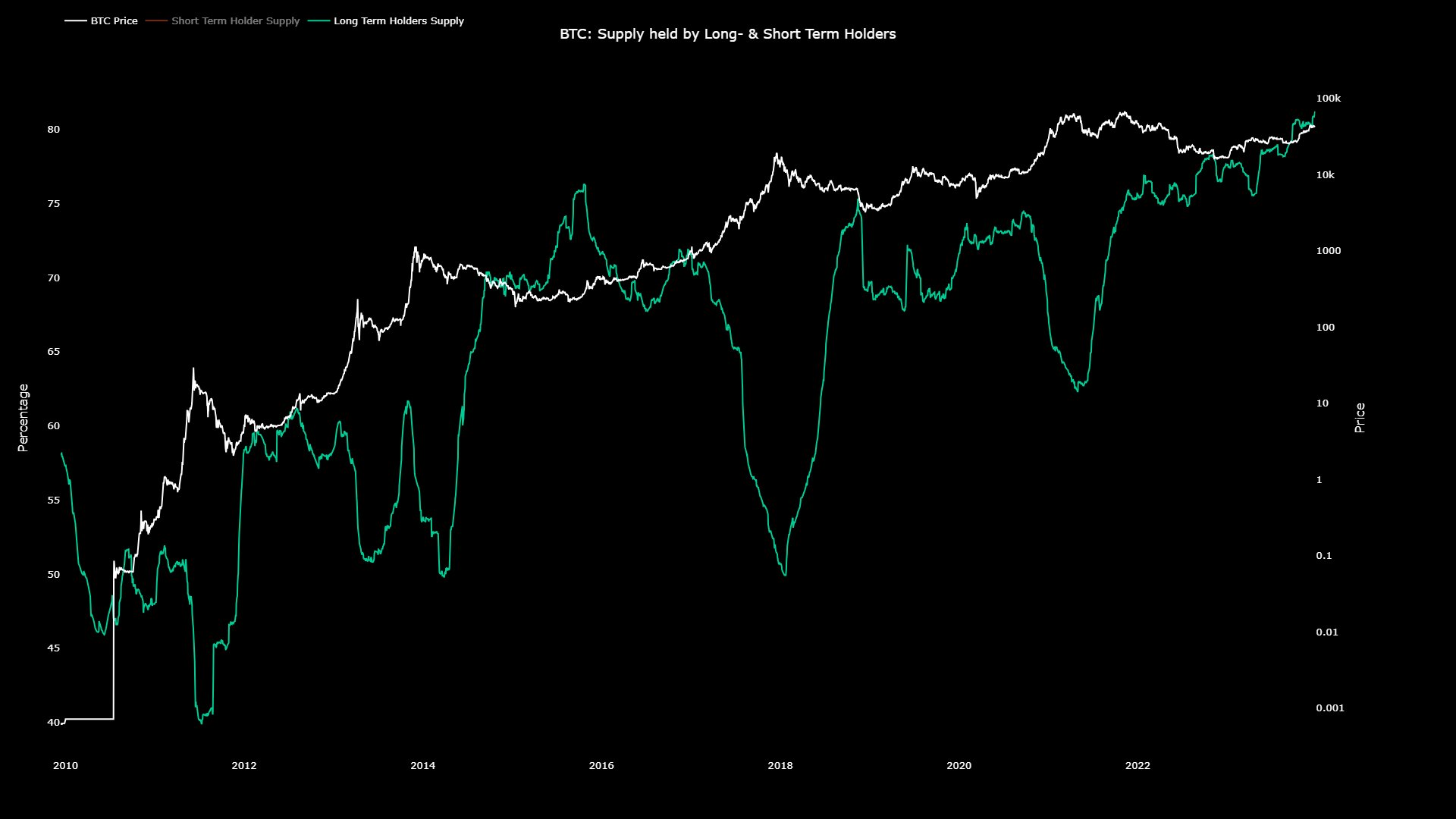

On-chain data allows investors to be grouped in various ways, one of which is holding time. The Bitcoin market can be broadly divided into two cohorts: short-term holders and long-term holders. Short-term holders are those who hold their coins for less than 155 days, while long-term holders are those who hold their coins for longer periods.

The Stubbornness of Long-Term Holders

Statistically, the longer an investor holds their coins, the less likely they are to sell or move them. Long-term holders tend to stay silent during market crashes and rallies, displaying their stubbornness and conviction in Bitcoin’s potential.

Tracking Long-Term Holders’ Movements

A way to monitor the movements of long-term holders is through the combined supply they hold in their wallets. This indicator shows an overall uptrend throughout 2023, with consecutive new all-time highs at the end of the year.

Diamond Hands and Positive Outlook

The rise in the percentage of the total circulating supply held by long-term holders is a positive sign for Bitcoin’s long-term outlook. Currently, these diamond hands are approaching control of 80% of the supply, indicating their strong belief in the cryptocurrency.

However, it’s important to note that this indicator has a 155-day delay. Any increases in the indicator reflect buying that happened 155 days ago. Additionally, long-term holders historically participate in significant selling during bull rallies to harvest profits from their bear-market accumulations.

Bitcoin Price

Currently, Bitcoin’s price is stagnant around $42,700.

Hot Take: Long-Term Holders Remain Bullish on Bitcoin

Despite Bitcoin’s recent price stagnation, long-term holders continue to accumulate and display confidence in the cryptocurrency. Their strong belief is evident through consecutive all-time highs in their supply. As long-term holders approach control of 80% of the supply, it indicates a positive outlook for Bitcoin’s future. While this indicator has a delay of 155 days and doesn’t reflect current buying activity, significant declines in the metric may signal the beginning of bullish momentum for Bitcoin. Overall, long-term holders’ accumulation and conviction contribute to the resilience and potential growth of Bitcoin.

By

By

By

By

By

By

By

By

By

By

By

By