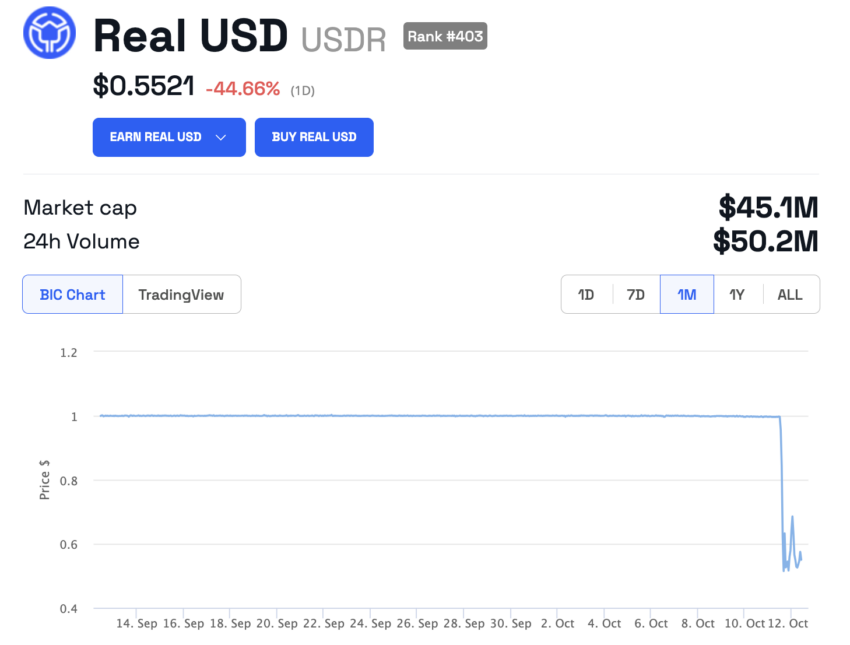

In the last 24 hours, there have been mass redemptions of the Polygon-based stablecoin USDR, leading to a depletion of the liquid DAI collateral held by its issuer TangibleDAO (Tangible). This caused panic selling and caused the asset to deviate from its $1 peg.

One user, concerned that Tangible would not be able to sell off the real estate that backs its coin, decided to swap $130,000 for $0.0001 USDC on Binance Smart Chain. As a result, a Maximum Extractable Value (MEV) bot made a profit of $107,000 from this transaction.

Tangible’s Plan to Compensate USDR Users After Depeg

Tangible has announced its plan to address the situation and compensate USDR users. The company intends to liquidate its insurance fund and mark its TNGBL token to zero in order to improve liquidity. TNGBL is a token that can be locked up by anyone to receive a multiplier based on the lock-up period, as well as a non-fungible token (NFT) representing their position.

In addition, the decentralized autonomous organization (DAO) plans to contribute $2.4 million from its own holdings of DAI, USDC, and USDT.

Furthermore, Tangible has outlined its longer-term plan to mint real-world tokenized assets into a yield-generating Basket token. Users will have the option to earn yields from Basket tokens, sell them on Pearl (a decentralized exchange on Polygon), or farm them on the platform.

Tangible has also confirmed its willingness to liquidate real-world property if there is no demand for Basket tokens.

Challenges Faced by RWA-Backed Stablecoins

Stablecoins backed by real-world assets are a relatively new concept. They harken back to the days when the US government backed dollars with physical gold bars, a practice that was discontinued in 1971.

The idea of backing stablecoins with blockchain representations of real-world assets is still being explored. Companies are working to find ways to quickly convert these tokenized assets into cash when users need it.

There are several hurdles to overcome, such as facilitating fast and legal transfers of ownership for real-world assets conducted on the blockchain. Additionally, there is the challenge of transferring ownership of an asset from one blockchain to another.

Lawmakers also need to establish rules regarding the protection of tokenized RWAs from theft and loss by digital asset custodians.

Hot Take: Tangible’s Response and the Future of RWA-Backed Stablecoins

The recent events surrounding TangibleDAO and its USDR stablecoin highlight some of the challenges and risks associated with RWA-backed stablecoins. It serves as a reminder that liquidity and proper collateralization are essential for maintaining stability in these types of assets.

Tangible’s plan to compensate USDR users by liquidating its insurance fund and contributing its own holdings demonstrates a commitment to resolving the situation. However, it also raises questions about the long-term viability and scalability of RWA-backed stablecoins.

As the industry continues to explore and innovate in the realm of tokenized assets, it will be crucial to address the challenges of liquidity, legal transfers, and asset protection. Only by doing so can RWA-backed stablecoins gain wider adoption and establish themselves as a reliable and trustworthy form of digital currency.

By

By

By

By

By

By

By

By

By

By