A New Report Raises Concerns About HTX’s Tether (USDT) and USDC Transactions

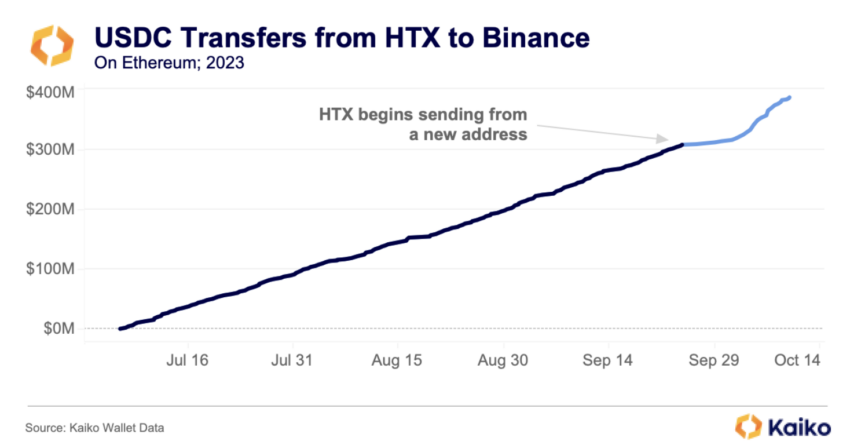

A recent research report by Kaiko Research (Kaiko) has revealed that HTX has been selling large amounts of Tether (USDT) for USDC over the past three months. What’s more concerning is that each sale was followed by significant USDC transfers to Binance, suggesting potential links between the two exchanges.

HTX’s JustLend Product Under Scrutiny

The transactions involving HTX raise concerns about its JustLend product. HTX offers customers one staked USDT (stUSDT) for every deposited USDT, claiming to earn interest by investing in low-risk treasury instruments. However, it has been found that the amount of stUSDT deposits reported by HTX matches the exact amount transferred to Binance.

While there is currently no evidence of any wrongdoing, this raises concerns due to HTX’s history of abnormal trading activity that does not always align with major market events.

HTX’s Reliance on stUSDT Raises Investor Concerns

Investors are worried about HTX’s concentration of reserves in stUSDT, which now accounts for about 14% of its total reserves. This has led institutional investors to reportedly withdraw a significant portion of their holdings on HTX.

The decline in Tether is also concerning, considering that HTX holds only about 5% of its reserves in USDT, compared to Binance’s 30%. Most of HTX’s reserves consist of TRX (19%) and HT (17%), its native token.

Hot Take: Questions Surrounding HTX and Its Connections

The recent report by Kaiko Research raises questions about the links between HTX and Binance, as well as the reliance on stUSDT reserves. It remains to be seen whether these concerns will have any long-term impact on HTX and its reputation in the crypto industry.

By

By

By

By

By

By

By

By