New Degree Program Launched to Meet Rising Demand for FinTech Specialists

New Zealand’s University of Waikato is addressing the growing demand for fintech professionals by introducing a new three-year Bachelor of Banking, Finance, and Technology (BBFinTech) degree program. The program aims to fill the gap in undergraduate education in New Zealand by focusing on open banking, digital currencies, and related technologies.

Recognizing the Importance of Digital Technology in Finance

The pro vice-chancellor of Waikato Management School, Matt Bolger, emphasized the significance of digital technology in the world of finance. He stated that nothing in finance happens without digital technology, highlighting the need for a program that can provide knowledge and expertise in the fintech sector.

Bolger also pointed out the lack of undergraduate degrees in New Zealand that combine finance and technology competencies. The BBFinTech program was developed to address this gap and prepare students to understand both open banking and digital currencies.

Opportunities in the Growing Fintech Industry

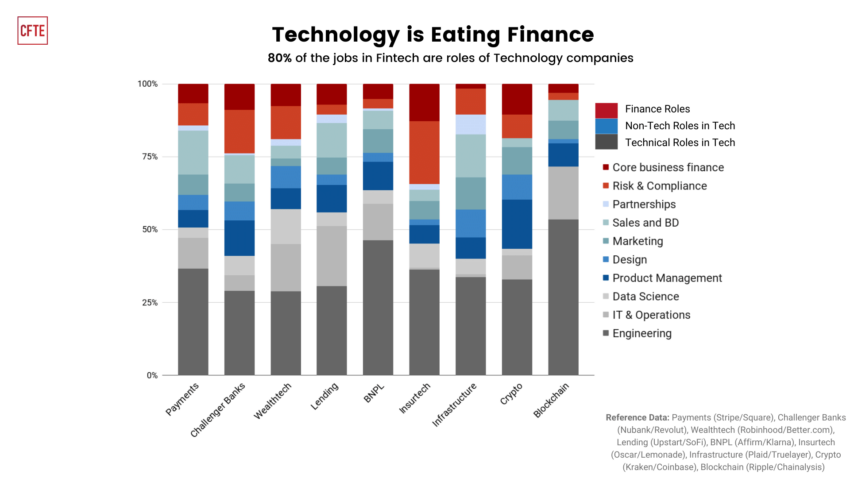

Bolger recognized the immense growth potential in the fintech sector. With the BBFinTech program, students have the opportunity to gain skills and knowledge that can lead to lucrative job opportunities in the industry.

Singapore’s Investment in Fintech Innovation

In Singapore, the Monetary Authority of Singapore (MAS) is investing around $112 million over three years in the Financial Sector Technology and Innovation Scheme (FSTI). This funding will support cutting-edge finance projects, including web3 solutions, strengthening Singapore’s position as a global tech hub.

Ravi Menon, Managing Director of MAS, highlighted Singapore’s commitment to fostering innovation in the financial sector. The FSTI program, which has already awarded $340 million since 2015, will continue to drive technology and innovation adoption. The latest iteration, FSTI 3.0, will focus on AI and Data Analytics (AIDA), Regulation Technology (RegTech), and Environmental, Social, and Governance (ESG) Fintech solutions.

The Growing Importance of Digital Currencies and Fintech

The introduction of the BBFinTech program at the University of Waikato and MAS’s investment in fintech innovation demonstrate the increasing significance of digital currencies and fintech in the global economy. Both initiatives highlight the growing recognition of the need for expertise in these fields.

Hot Take: Meeting the Demand for FinTech Specialists

As the world becomes increasingly reliant on digital technology, the demand for fintech specialists continues to rise. Recognizing this trend, New Zealand’s University of Waikato has launched a new degree program that aims to bridge the gap in undergraduate education by providing knowledge and expertise in open banking, digital currencies, and related technologies. This program positions students to take advantage of the immense growth potential in the fintech sector and opens doors to lucrative job opportunities. Additionally, Singapore’s investment in fintech innovation further emphasizes the importance of digital currencies and fintech in today’s global economy. These initiatives reflect the growing recognition of the need for expertise in the ever-evolving world of finance and technology.

By

By

By

By

By

By

By

By