The SEC Fines BlackRock Advisors for Inaccurate Investment Disclosures

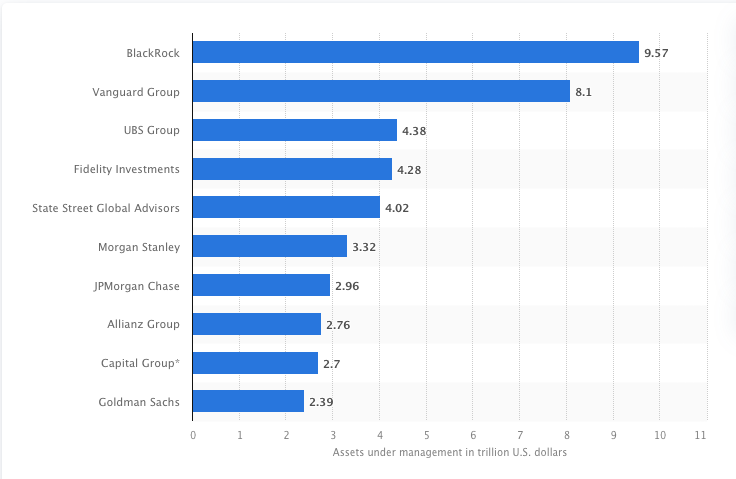

The U.S. Securities and Exchange Commission (SEC) has imposed a $2.5 million penalty on BlackRock Advisors LLC, the world’s largest asset manager, for providing inaccurate investment disclosures. The charges are related to BlackRock’s investments in Aviron Group, an entertainment firm, between 2015 and 2019.

BlackRock Neither Admits Nor Denies SEC Findings

BlackRock, which manages over $9.43 trillion in assets, inaccurately described Aviron to investors and regulators, according to the SEC. The asset manager classified Aviron, an ad planner for films, as a “Diversified Financial Services” company, misrepresenting its interest rate.

In response to the SEC’s findings, Andrew Dean from the Enforcement Division’s Asset Management Unit stated that accurate disclosures are crucial for investors to evaluate closed-end or mutual funds. BlackRock had identified the inaccuracies in 2019 and subsequently reported the Aviron investment correctly in all subsequent reports.

SEC Plays Hardball

This case is a significant development in the SEC’s efforts to enforce accurate investment disclosures. BlackRock’s penalty emphasizes the importance of transparency in investment management and the consequences of providing false information.

Hot Take: BlackRock Faces SEC Penalty for Inaccurate Investment Disclosures

The SEC has fined BlackRock Advisors LLC, the world’s largest asset manager, with a $2.5 million penalty for providing inaccurate investment disclosures. BlackRock inaccurately described its investments in Aviron Group, an entertainment firm, between 2015 and 2019. This case highlights the importance of transparency and accurate reporting in investment management. The SEC’s actions demonstrate their commitment to enforcing accurate investment disclosures and holding asset managers accountable.

By

By

By

By

By

By

By

By

By

By