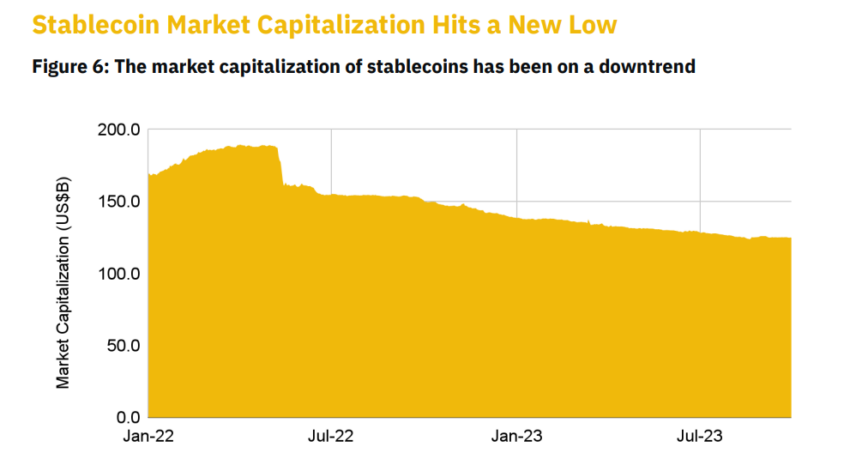

The Decline of Stablecoins

Stablecoins have experienced a significant decline over the past 18 months, with their market cap decreasing by 35% since May 2022. This decline can be attributed to various factors, including increased regulatory uncertainty and scrutiny from global regulators.

A report from CCData revealed that stablecoin trading volume on centralized exchanges decreased by 28.4% in September, reaching the lowest monthly total since July 2020, amounting to $331 billion.

The Decline’s Underlying Factors

One of the key contributors to the decline in stablecoin market cap is the collapse of TerraUSD. The market cap, which reached $189 billion in May 2022, has now fallen to approximately $124 billion.

Experts believe that regulatory uncertainties have also played a significant role in hindering the growth of stablecoins. Binance has raised concerns about potential delistings of multiple stablecoins in Europe due to upcoming regulations like Markets in Crypto Assets (MiCA) next year. The exchange states that none of the stablecoins currently meet the required licenses for operating in the region.

Regulatory efforts in jurisdictions such as the U.S. and Hong Kong are expected to further suppress the stablecoin market and contribute to its downward trend.

Despite these challenges, Binance Research emphasizes that stablecoins still play a crucial role in the crypto ecosystem.

USDT Remains Dominant

Despite the overall decline in the stablecoin market, USDT remains the dominant player with a market cap of $83.54 billion, three times higher than its closest competitor, USDC, which stands at $25.017 billion. USDT holds a market share of about 67.3%, according to DeFiLlama data.

USDT’s Ninth Anniversary

Tether’s USDT recently celebrated its ninth anniversary, with CTO Paolo Ardoino describing it as a technology revolutionizing finance. Ardoino also highlighted the importance of stablecoins, stating that central banks view them as the future of their digital money (CBDCs).

Hot Take: The Challenges Faced by Stablecoins

The decline in stablecoins’ market cap can be attributed to several factors, including regulatory uncertainties and increased scrutiny from global regulators. These challenges have hindered the growth of stablecoins and led to a decrease in trading volume on centralized exchanges. However, despite these obstacles, stablecoins still hold a fundamental role in the crypto ecosystem. USDT remains the dominant player in the sector, maintaining its market share and highlighting the significance of stablecoins in shaping the future of digital finance.

By

By

By

By

By

By

By

By

By

By