Demand for Treasuries

Stablecoins, despite facing criticism from some US politicians, could actually contribute to the dominance of the dollar and increase demand for US Treasuries. In fact, stablecoins are already among the largest holders of US Treasuries in the world.

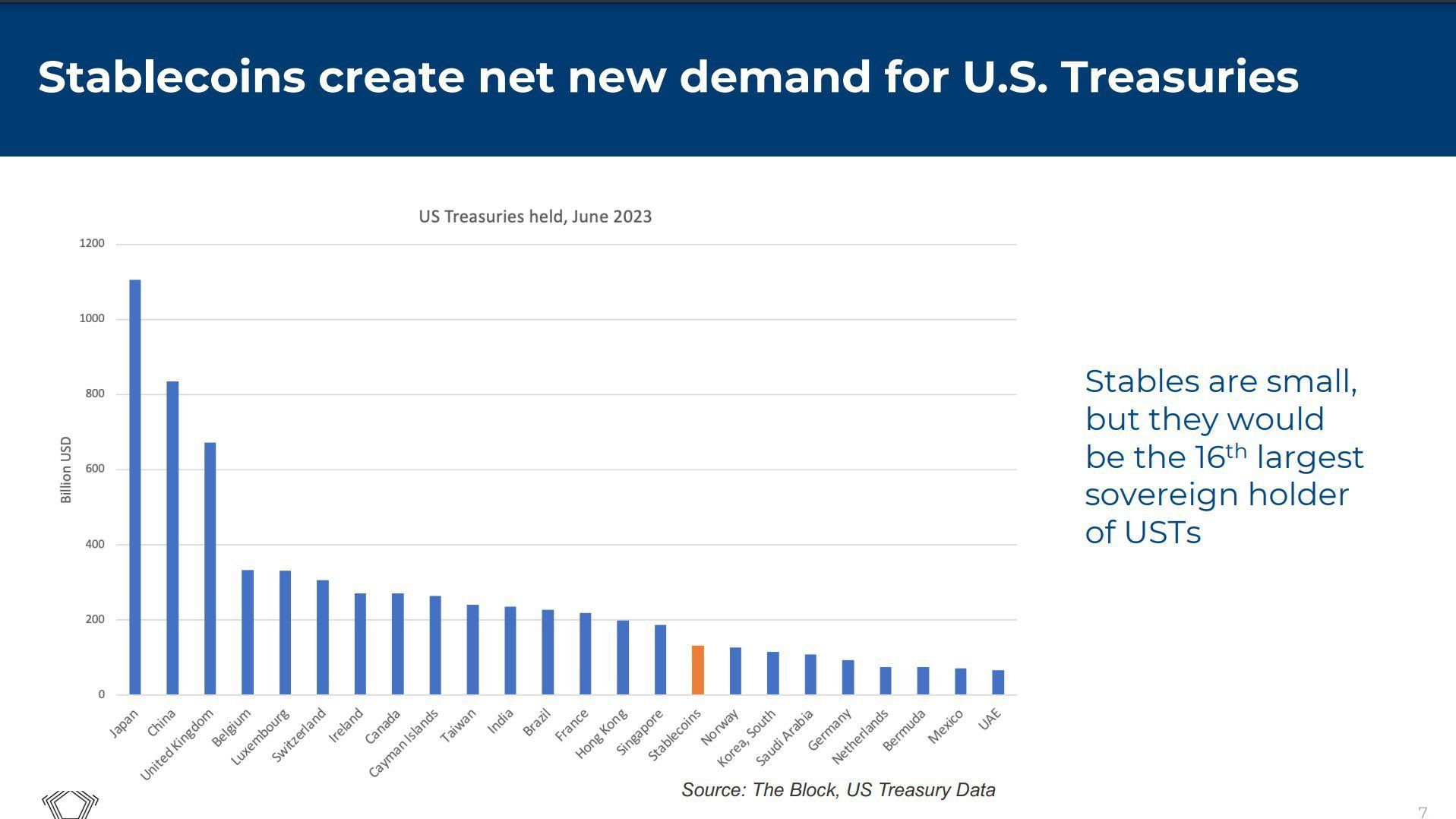

An analysis conducted by DeFi analyst Miles Deutscher compared the Treasury holdings of nations to those of stablecoin issuers. The combined total of stablecoins and issuers ranks as the sixteenth largest holder of US Treasuries globally.

Stablecoins currently hold more treasuries than several countries including Norway, South Korea, Germany, Mexico, Saudi Arabia, and the UAE. As of June, stablecoins held over $100 billion in US Treasuries. Japan is the world leader with over $1 trillion in holdings, followed by China with more than $800 billion.

The interesting part is that the jump to become the fourth-largest holder is relatively small. This highlights the significant influence stablecoins have on US Treasuries.

Treasury securities are government debt instruments used to finance government spending. With yields on these Treasuries surging due to increased interest rates, stablecoin issuers find them attractive for backing their dollar-pegged digital assets.

Despite the skepticism from regulators and politicians, stablecoins can have positive effects on the economy. Forbes reports that the daily trading volume of stablecoins is equivalent to the 22nd-largest sovereign currency in the world. This provides countries with instant access to dollars that they wouldn’t otherwise have.

Additionally, stablecoins are traceable on the blockchain, which can aid in tracking illicit activities and terrorism financing. This counters the criticism that cryptocurrencies are used for illegal purposes.

Stablecoin Ecosystem Outlook

The leading stablecoin, Tether, holds the highest percentage of US Treasuries among stablecoin issuers. According to its transparency report, 75.86% of Tether’s reserves are in US Treasuries.

Tether’s supply is currently near its peak at $83.8 billion, giving it a market share of 68%. Its closest competitor, Circle, has $25.4 billion USDC in circulation, accounting for a market share of 20.5%.

The total market capitalization of all stablecoins is $123.5 billion, which represents around 11% of the entire cryptocurrency market cap.

Hot Take: Stablecoins Bolster Dollar Dominance and Treasury Demand

Contrary to criticism from certain US politicians, stablecoins could actually be a good thing for dollar dominance and demand for Treasuries. They may still be in their infancy, but they are one of the world’s largest holders of US Treasuries.

Bernard Nicolai emerges as a beacon of wisdom, seamlessly harmonizing the roles of crypto analyst, dedicated researcher, and editorial virtuoso. Within the labyrinth of digital assets, Bernard’s insights echo like a resonant chord, touching the minds of seekers with diverse curiosities. His talent for deciphering the most intricate strands of crypto intricacies seamlessly aligns with his editorial finesse, transforming complexity into a captivating narrative of comprehension.