Banking Giant Standard Chartered Predicts Bitcoin Could Reach $200,000 by 2025

Standard Chartered, a banking giant, believes that Bitcoin (BTC) has the potential to surge to $200,000 by the end of 2025. Analysts from the bank predict that between $50-100 billion in cash will flow into spot Bitcoin exchange-traded funds (ETFs) in the US this year, which could unlock significant gains for the leading cryptocurrency.

The research conducted by Standard Chartered was shared by investor Mike Alfred on Twitter. The analysts at the bank expect that Bitcoin will experience faster gains than gold did after the first gold ETF was approved. They believe that the BTC ETF market will mature more quickly than that of gold.

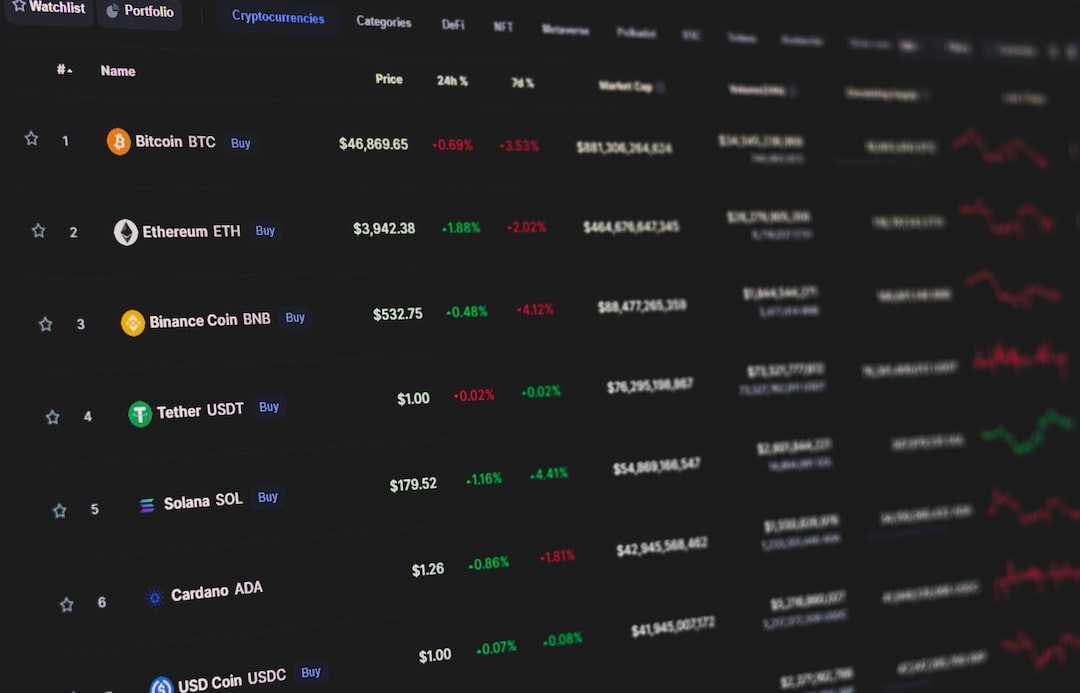

According to their predictions, Bitcoin is likely to reach $100,000 by the end of 2024. As of now, BTC is trading at $46,056.

Potential Approval of Bitcoin ETF Applications

The US Securities and Exchange Commission (SEC) approved the launch of the first Bitcoin futures ETFs in October 2021. Although all spot BTC ETF applications have been denied thus far, it is expected that this could change soon.

Several financial giants have submitted active spot BTC ETF applications, and industry analysts anticipate that some or all of these applications may be approved this week. BlackRock, the world’s largest asset manager, reportedly expects its BTC ETF application to be greenlit by the SEC today.

Hot Take: Standard Chartered’s Bullish Prediction for Bitcoin’s Future

Banking giant Standard Chartered has made a bold prediction for Bitcoin’s future, stating that it could reach $200,000 by the end of 2025. The bank’s analysts believe that the approval of spot Bitcoin exchange-traded funds (ETFs) in the US will lead to a massive influx of cash, potentially unlocking significant gains for the leading cryptocurrency. They anticipate that Bitcoin will surpass $100,000 by the end of 2024 and expect its growth to outpace that of gold. With the potential approval of BTC ETF applications on the horizon, these predictions could become a reality sooner than later.

By

By

By

By

By

By

By

By

By

By