The Rise of AI and Real-World Assets in Crypto

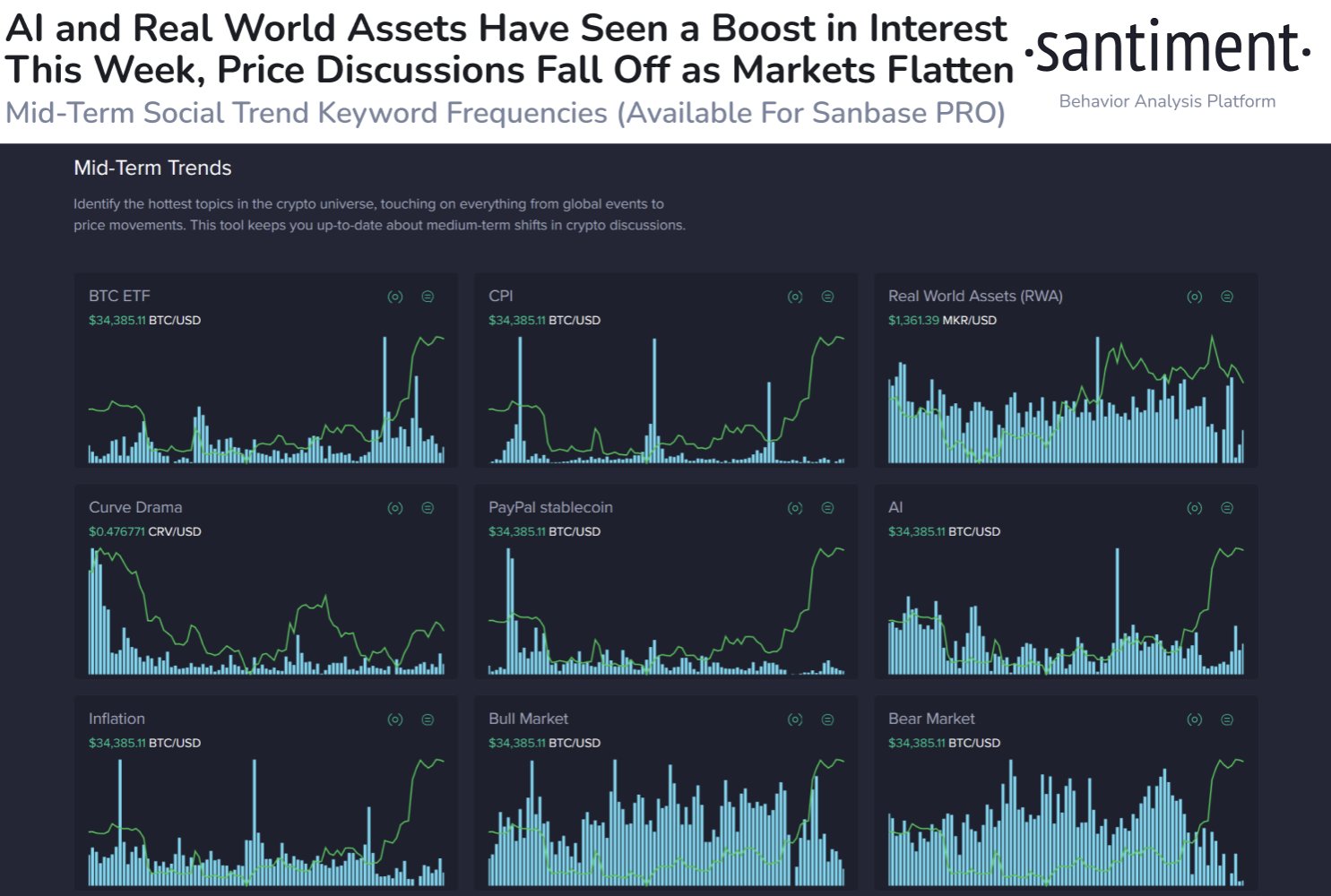

Recent data from Santiment shows a surge in global discussions about artificial intelligence (AI) and real-world assets in the crypto space. Traders and investors are shifting their focus away from bullish or bearish market sentiments and are instead exploring the potential of AI and its applications in real-world assets. Despite the volatility of the crypto market, sentiment surrounding BTC reaching $40K remains positive.

AI and Real-World Assets Gain Prominence

Countries around the world are actively promoting the growth of AI, leading to increased investor interest in real-world assets and AI-related discussions. On the other hand, topics like cryptocurrency prices, consumer price index (CPI), PayPal stablecoin, Curve drama, bull market, and bear market have seen lower engagement levels. This highlights the growing importance of AI and real-world assets as emerging hot spots in the global financial landscape.

Interestingly, despite BTC’s price appreciation, search volumes for Bitcoin exchange-traded funds (ETFs) remain relatively subdued. In contrast, discussions around AI and real-world assets continue to gain traction.

Investors Attracted to AI-Based Tokens

In addition to the growing interest in AI and real-world assets, prices of AI-based tokens such as OCEAN, INJ, and FET have skyrocketed during a breather in the Bitcoin price rally. This surge in prices is attributed to leading tech giants like Google, Microsoft, and Anthropic investing in AI and fostering its development. As companies worldwide shift their focus to AI and real-world assets, discussions related to AI have overshadowed the cryptocurrency price landscape.

Hot Take: AI and Real-World Assets Take Center Stage in Crypto

The recent surge in global discussions about artificial intelligence and real-world assets in the crypto space reflects a shift in investor sentiment. Traders and investors are increasingly exploring the potential of AI and its applications in real-world assets, moving away from traditional bullish or bearish market sentiments. With leading tech giants investing in AI and companies worldwide adopting AI and real-world assets, it’s clear that these areas are emerging as hot spots in the global financial landscape.

By

By

By

By

By

By

By

By

By

By