Ethereum Staking Interest Hits Zero: What’s Behind the Trend?

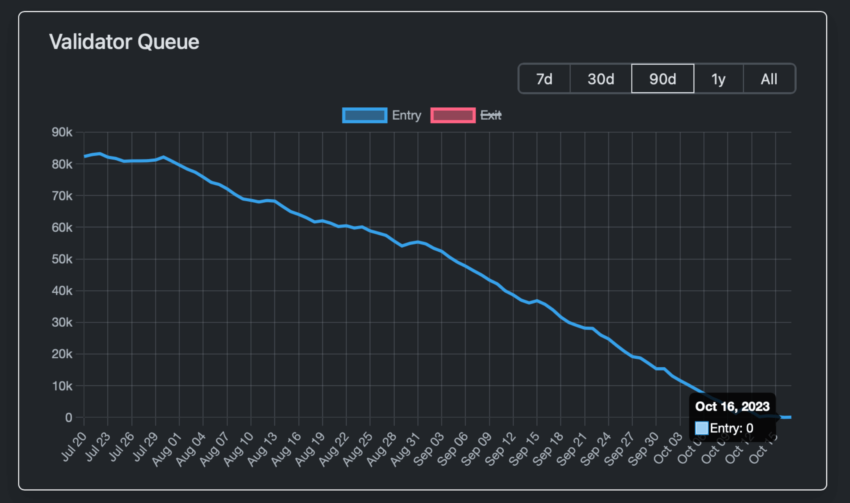

This week, the number of people wanting to become Ethereum validators has dropped to zero, a significant deviation from the peak in June 2023. So, what is causing this decline in interest?

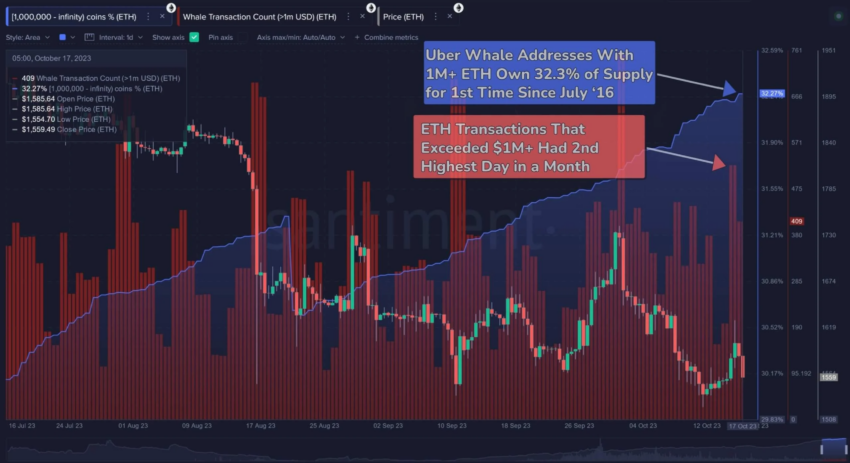

Ethereum Whales Continue to Accumulate

Holders of addresses with at least one million ETH now own 32.3% of the total supply, the highest level since 2016. This indicates that interest in Ethereum remains strong.

However, JPMorgan analysts have criticized the growing centralization of the network due to the popularity of staking platforms. They argue that dependence on a few large players poses a risk to the blockchain’s security.

What’s Going on With Ethereum Staking?

Ethereum validators store transaction history, validate transfers, and add new blocks. Currently, it requires 32 ETH to stake, making it inaccessible for many investors.

The “entry” queue for validators has decreased to zero for the first time, indicating a lack of interest in staking. The queue exists because only 3,600 validators can perform simultaneous operations per day to maintain network security.

As the queue size decreased, the average waiting time for staking also decreased. However, the profitability of staking has dropped from 5.2% to 3.5%.

Cause of Declining Interest in Ethereum Staking

The decline in overall market activity and the long-term decrease in ETH’s value have resulted in a lack of interest in staking. Even small investors are hesitant to send their coins for staking.

The decline in activity is also attributed to the April 2023 Shapella update, which made it easier to withdraw funds from staking. This initially attracted many investors, but the hype faded over time.

Back to Neutral Times?

StakeWise co-founder Kirill Kutakov believes that the decline in staking demand is a return to its “neutral” value before the Shapella update. As long as more people want to become validators than leave the role, there is no cause for concern in the blockchain industry.

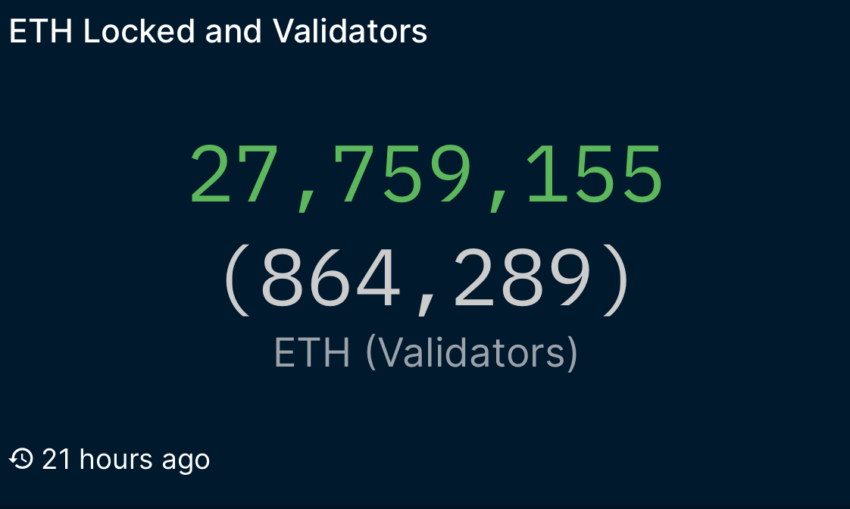

Currently, over 27.7 million ETH are in the Ethereum smart custodial contract, with 864,289 active validators in the network.

Hot Take: The Future of Ethereum Staking

The decline in interest in Ethereum staking may be temporary, with the buzz expected to return when professional institutional investors enter the space. However, the growth trend in staking will take time to develop. In the meantime, short-term US Treasuries offer a more attractive investment option.

By

By

By

By

By

By

By

By

By

By