Permanently High Interest Rates in the US?

Economists believe that permanently high interest rates may be the new normal in the United States. The market is already pricing in higher rates and suggesting that they may not return to the target set by the US central bank.

Market Expectations

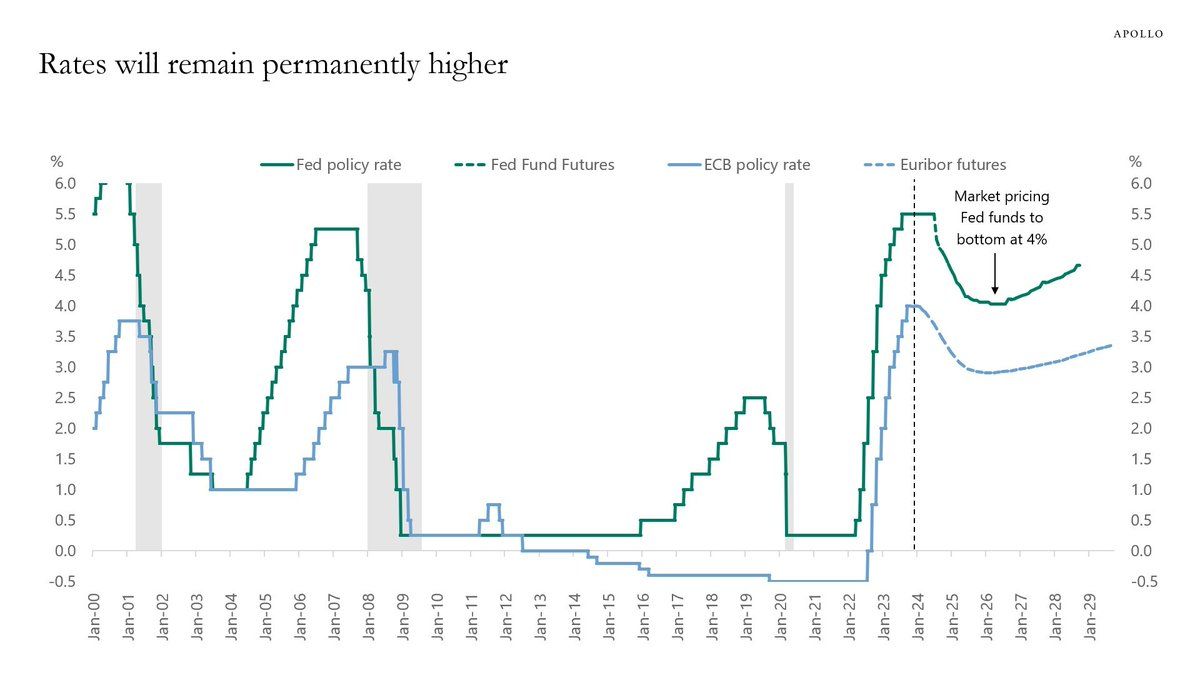

The markets are already factoring in higher interest rates going forward. According to The Kobeissi Letter, the Fed funds rate is expected to bottom at 4% in 2025 before rising again. The era of “free money” is over.

The Federal Reserve paused its rate hikes in July, but that doesn’t mean rates will automatically fall. Currently, US rates stand at 5.5%, having been increased 11 times since early 2020.

Impact on National Debt

The soaring national debts may force the Fed to lower rates faster due to increasing interest payments. The US national debt currently stands at a record high of $33.56 trillion, with additional billions added every day.

Last week, Goldman Sachs analysts commented that rising rates would lead to a drag on GDP growth for a longer period. They also highlighted risks such as elevated valuations of risky assets, survival of unprofitable firms, and wide federal deficits. BlackRock has also predicted that rates will remain high.

Moody’s Investors Service warned that US companies face growing refinancing and default risks as interest rates are expected to stay high and borrowing conditions tighten.

Consumer sentiment has also soured in October, with households anticipating higher inflation in the coming year. Additionally, monthly retail sales data is expected to decline.

Impact on Crypto

High interest rates negatively affect consumers burdened with debt, resulting in higher payments and rates for mortgages, auto loans, credit cards, and bank loans. This reduces available capital for higher-risk investments like cryptocurrencies and stocks.

Furthermore, high rates provide better returns on savings accounts, creating incentives to keep cash in interest-bearing accounts rather than investing in digital assets.

Long-Term Impact

Persistently high interest rates can slow down economic growth and increase the vulnerability of the economy to recession when combined with other negative shocks like geopolitical tensions.

Hot Take: Permanently High Interest Rates Challenge Economic Growth and Crypto Investments

Economists suggest that the United States may be facing permanently high interest rates. The market is already factoring in these higher rates, indicating that they may not return to the central bank’s target. This shift has significant implications for both the economy and cryptocurrency investments.

The Federal Reserve’s decision to pause rate hikes does not guarantee a decrease in rates. In fact, US rates currently stand at 5.5%, having been raised 11 times since early 2020. This trend may continue due to skyrocketing national debts and increasing interest payments.

Higher interest rates have a detrimental impact on consumers burdened with debt, reducing their available capital for riskier investments like crypto or stocks. Additionally, better returns on savings accounts incentivize individuals to keep their cash in interest-bearing accounts rather than exploring digital assets.

Long-term high rates can slow down economic growth and increase the economy’s vulnerability to recession, especially when combined with other negative shocks. As a result, it is essential for individuals and investors to carefully consider the implications of permanently high interest rates on their financial decisions.

By

By

By

By

By

By

By

By

By

By