A Dip in Institutional Crypto Activity

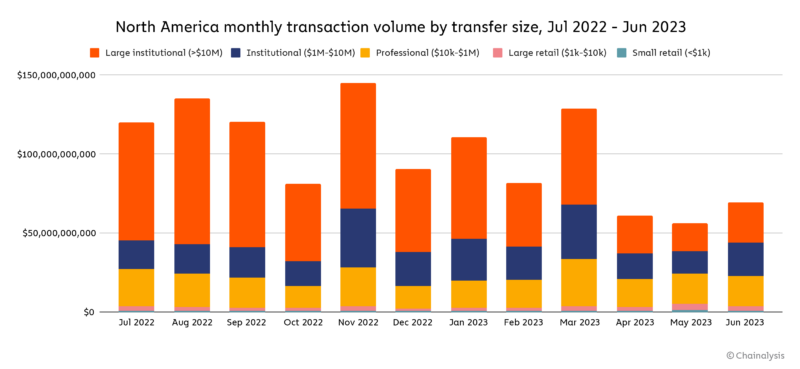

In March, a series of bank failures occurred, impacting institutional crypto trading and causing a decline in large-scale crypto transactions. According to Chainalysis, the volume of institutional cryptocurrency transactions valued at over $10 million experienced a sharp drop starting in April 2023, particularly in North America. However, professional and retail trading volumes remained constant during this period.

The banking crisis in March, which resulted in major US bank shutdowns such as Silicon Valley Bank, Signature, and Silvergate, is cited as a significant factor contributing to this decline. Additionally, the failure of digital currency exchanges and lending desks like FTX and Alameda Research in November further exacerbated the decline.

The Exodus of Stablecoins from North America

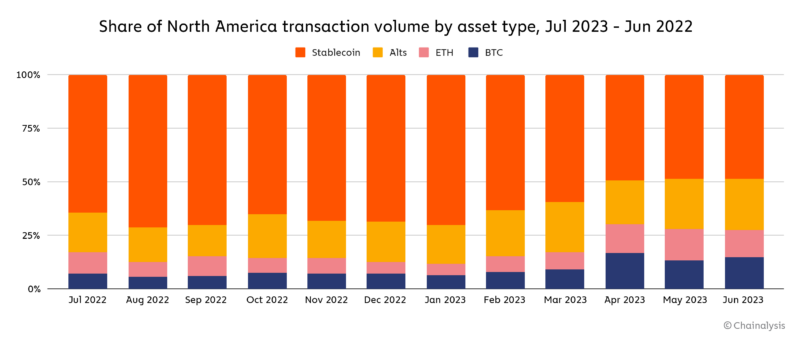

Another consequence of the banking crisis highlighted by Chainalysis is the diminishing dominance of stablecoins in North America. From February 2023 onwards, stablecoins began losing ground in the region. The percentage of digital currency volume attributed to stablecoins decreased from 70.3% to 48.8% between February and June.

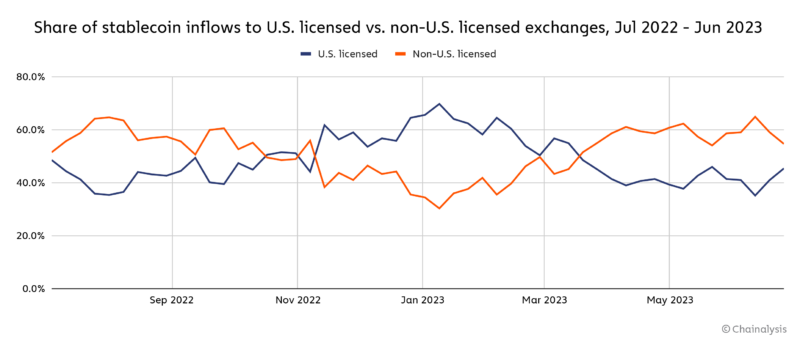

Chainalysis’s research reveals that since spring 2023, there has been a noticeable shift of stablecoin inflows from US-licensed crypto services to non-US counterparts. This migration pattern suggests businesses and traders seeking financial shores beyond US jurisdictions.

The Rise of Non-U.S. Licensed Services

According to Chainalysis, non-US licensed platforms received 54.6% of stablecoin inflows among the top 50 services as of June. This shift marks a reversal of the previous trend where stablecoin inflows were moving towards US-licensed services in late 2022 and early 2023.

Overall, the bank failures in March had far-reaching consequences for institutional crypto trading, resulting in a decline in large-scale transactions and a shift towards non-US jurisdictions for stablecoin inflows.

Hot Take: The Impact of Bank Failures on Institutional Crypto Trading

Bank failures in March have significantly affected institutional crypto trading, leading to a decrease in large-scale transactions and a shift away from North America. The volume of institutional cryptocurrency transactions valued at over $10 million experienced a sharp decline, while stablecoins lost dominance in the region. These developments are attributed to the banking crisis, major US bank shutdowns, and the failure of digital currency exchanges and lending desks. As a result, businesses and traders are now seeking financial opportunities outside of US jurisdictions.

By

By

By

By

By

By

By

By