Molecular Future Reflects on Its Journey in the Cryptocurrency Sphere

Molecular Future (MOF), a leading digital asset investment service, is inviting the world to take a look back at its dynamic journey in the cryptocurrency industry. Recent events, such as its delisting from the OKEX exchange, have prompted the organization to offer a comprehensive analysis of its path, including the capital operations that have shaped its trajectory.

Molecular Future Emerges as a Dark Horse in 2017

In 2017, MOF was launched by the Molecular Group through an Initial Coin Offering (ICO), garnering attention with its innovative vision and potential. It secured funding from respected institutions and publicly traded companies, establishing itself as an intriguing project.

The MOF Framework Bridges Digital Assets and Traditional Finance

Molecular Future aimed to provide a comprehensive digital asset investment service that seamlessly integrated blockchain technology with traditional financial systems. It introduced the Mega Operation System (MOS) and the user-friendly Molecular App, offering various investment services and real-time market analysis.

Exponential Rise and Exchange Success

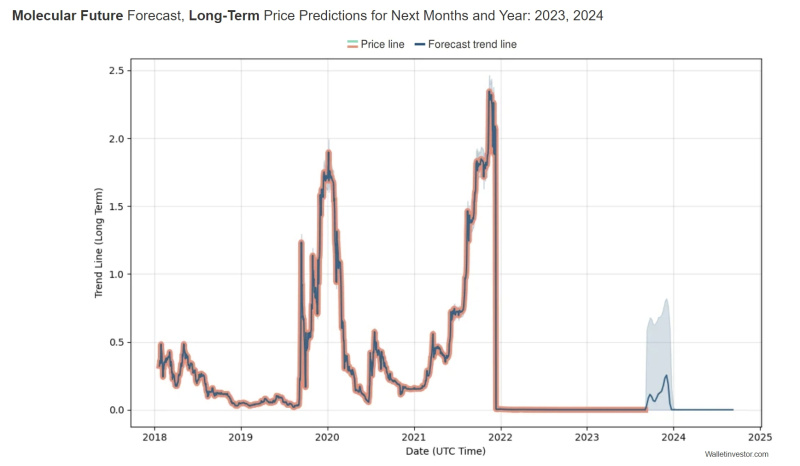

After its ICO, MOF quickly earned listings on renowned exchanges like OKEX, BitFarm, and Bittrex. Despite a challenging bear market, it defied the odds and became one of the top 30 cryptocurrencies globally, with significant trading volumes on OKEX.

Strategic Capital Operations Lead to Success

A pivotal moment for MOF was its strategic sale to Australia’s HCASH Foundation at its peak, showcasing the Molecular Group’s adept capital operations. This transition brought in new leadership and demonstrated the group’s expertise in navigating the volatile cryptocurrency landscape.

A Fall from Grace: Post-Acquisition Challenges

Despite efforts to revitalize the project after its acquisition by the HCASH Foundation, MOF faced persistent challenges. It was unable to regain its previous momentum, leading to its delisting from OKEX.

Lessons in Capital Operations and Blockchain Investments

The MOF journey emphasizes the crucial role of capital operations in blockchain projects. It highlights the importance of strategic financial maneuvering, even for projects with market recognition and potential. Long-term planning is essential for success in the rapidly evolving blockchain industry, for both investors and entrepreneurs.

The MOF journey provides valuable insights into the significance of capital operations in the blockchain industry. Long-term sustainability should be a central focus alongside short-term achievements. As the blockchain sector continues to evolve, a shrewd approach to capital operations remains indispensable.

About Molecular Future (MOF)

Molecular Future (MOF) is a forward-thinking digital asset investment service provider that merges blockchain technology with traditional financial systems. Its mission is to create a decentralized exchange offering real-time on-chain trading, liquidity management, and innovative investment services through the Molecular App.

Contact

Jackson Huang

Hot Take: The Importance of Strategic Capital Operations in Blockchain Projects

Reflecting on Molecular Future’s journey highlights the critical role played by strategic capital operations in the success of blockchain projects. This case study emphasizes that careful financial planning and maneuvering are essential, even for projects with initial market recognition and potential. Long-term sustainability should be prioritized alongside short-term achievements in the ever-evolving blockchain industry. Investors and entrepreneurs alike must navigate this dynamic landscape with meticulous planning and a shrewd approach to capital operations.

By

By

By

By

By

By

By

By

By

By