South Korea: A Growing Crypto Market

A recent report by Web3 market strategy consulting firm DeSpread reveals that South Korea is home to approximately 6 million crypto investors, accounting for over 10% of the country’s population. This surge in interest and trust in cryptocurrency highlights South Korea’s significance in the global digital finance landscape.

Dominance of Korean Crypto-Centralized Exchanges

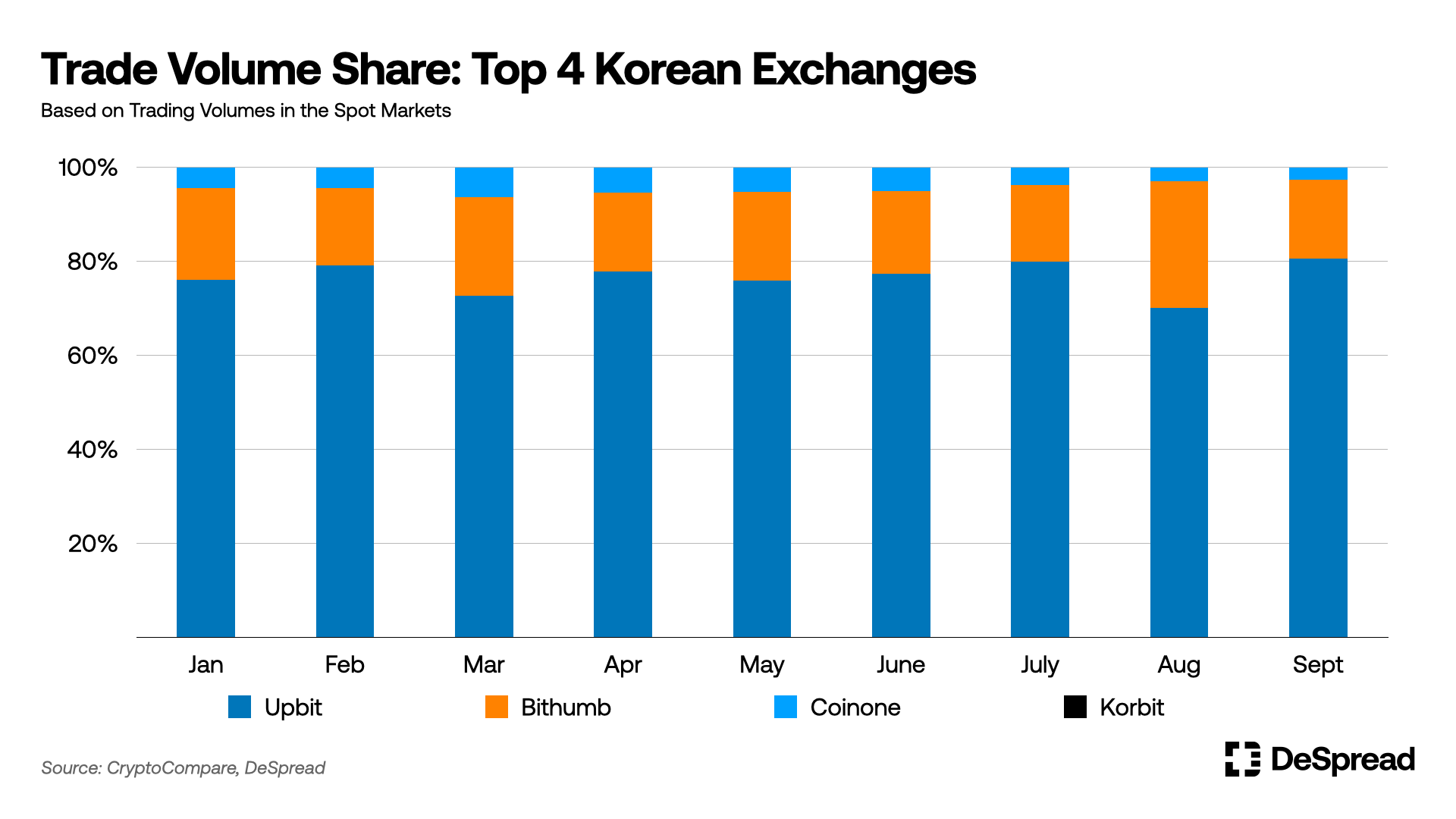

In contrast to the declining crypto trading volumes worldwide, Korean Centralized Exchanges (CEXs) are experiencing a different trend. Upbit, Bithumb, Coinone, and Korbit, the four major players in the Korean market, collectively contribute to 10% of the global trading volume. In fact, Upbit leads the pack with an impressive $36 billion trading volume in February alone, capturing 80% of the Korean market.

Bithumb follows closely with a market share of 15-20%, while Coinone and Korbit trail behind with shares of 3-5% and less than 1% respectively.

Investor Preference for Altcoins

When it comes to investment preferences, Korean CEXs reveal a distinct inclination towards altcoins. Unlike platforms like Coinbase, where institutional investors have a dominant influence, individual investors take center stage on Upbit. The report also highlights Coinbase’s Q2 shareholder letter which states that institutional investors contribute to around 85% of Coinbase’s total trading volume.

According to DeSpread’s report:

“Institutional investors account for approximately 85% of Coinbase’s total trading volume. They tend to pursue portfolio stability, which is why trading in BTC and ETH, which boast the highest market capitalization among cryptocurrencies, occupies a relatively high proportion.”

Data extracted from market reports further supports this trend, with Loom Network ($LOOM) leading the pack with a trading dominance of 62%. Other notable altcoins include eCash ($XEC) at 55%, Flow ($FLOW) at 43%, Stacks ($STX) at 37%, and Bitcoin SV ($BSV) at 34%.

Bitcoin’s Position in the Korean Market

Interestingly, South Korean investors show less interest in Bitcoin despite its status as the top cryptocurrency by market capitalization. However, Bitcoin continues to perform well globally, with a nearly 20% increase over the past week.

Although Bitcoin experienced a retracement from its previous highs of $35,000, it currently trades at $35,027 with no significant movement in the past 24 hours.

Overall, South Korea’s growing crypto market and dominance of centralized exchanges demonstrate the country’s importance in the global digital finance industry. While altcoins are favored by individual investors, Bitcoin continues to thrive despite its lower popularity among South Korean investors.

Hot Take: South Korea Emerges as an Influential Crypto Player

With over 6 million crypto investors comprising more than 10% of its population, South Korea has established itself as a significant player in the global digital finance landscape. The dominance of Korean Centralized Exchanges (CEXs) and the growing interest in altcoins among individual investors highlight the country’s unique position. Although Bitcoin may not be the preferred choice for South Korean investors, its global performance remains strong. As South Korea’s crypto market continues to evolve, it will undoubtedly shape the future of digital finance.

By

By

By

By

By

By

By

By

By

By

By

By