Coinbase Stock Hits Highest Level in 2023

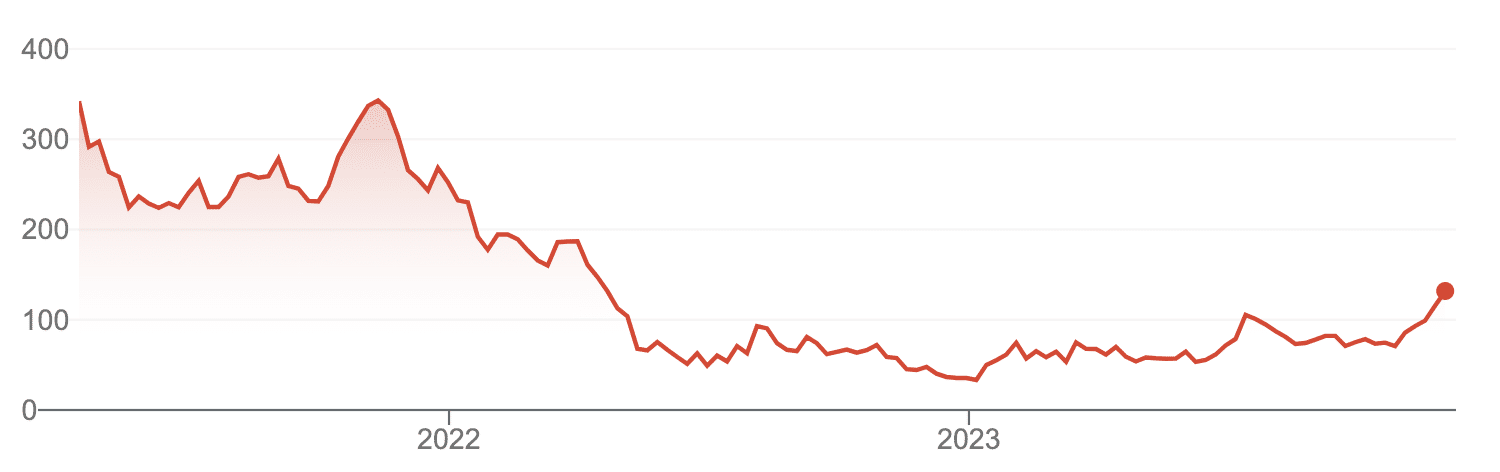

Shares of the cryptocurrency exchange Coinbase, with the ticker COIN, are currently trading at $128.27, reaching their highest level in 2023. This surpasses the previous peak from July and aligns with price levels seen in May 2022 when Bitcoin traded above $30,000.

Although below its all-time high in November 2021, Coinbase’s recent performance is notable.

Coinbase CEO’s Comments

Coinbase’s surge in stock price follows comments by CEO Brian Armstrong, who stated that the US Department of Justice’s settlement with Binance marks a turning point for the crypto industry.

“The enforcement action against Binance, that’s allowing us to kind of turn the page on that and hopefully close that chapter of history,” Armstrong said.

Broader Bullish Trend for Crypto

Meanwhile, Coinbase’s stock rise coincides with a broader bullish trend in the crypto market. In the past month, COIN has outperformed major assets like Bitcoin and Ethereum, gaining over 70%.

This outperformance has led Cathie Wood’s Ark Invest to rebalance its ETF holdings, selling $5.3 million worth of Coinbase shares and acquiring about $1.2 million in Robinhood shares. Coinbase now constitutes 13% of the ARK Fintech Innovation ETF portfolio.

Overall, Coinbase’s stock performance tends to mirror the volatility of the crypto market. As crypto prices rise, COIN benefits, and when prices decline, its shares follow suit.

Hot Take: Coinbase Stock Surges Amid Crypto Market Momentum

Coinbase’s stock surge to its highest level in 2023 reflects the overall bullish momentum in the crypto market. The comments by CEO Brian Armstrong regarding the settlement with Binance have contributed to investor optimism.

In addition, Coinbase has outperformed major cryptocurrencies like Bitcoin and Ethereum in recent months, attracting attention from investors and leading to rebalancing of ETF holdings.

As Coinbase’s stock price closely correlates with the volatility of the crypto market, its performance serves as an indicator of market sentiment. With COIN currently outperforming major crypto assets, it suggests a positive outlook for the industry as a whole.

By

By

By

By

By

By

By

By

By

By