The Crypto Winter Takes a Toll on Binance Founder’s Wealth

The founder of Binance, Changpeng Zhao, also known as CZ, has suffered a significant loss in his net worth due to the crypto winter. His fortune has plummeted to $17.2 billion from its peak of $96 billion in January 2022.

Reasons Behind the Wealth Decline

The decline in CZ’s wealth can be attributed to a slump in crypto trading volumes at Binance. The Bloomberg Billionaires Index has revised down its revenue estimates for Binance by 38% after data revealed a substantial decrease in the firm’s trading volumes this year.

Zhao’s actions have also influenced the troubles faced by Sam Bankman-Fried, another prominent figure in the crypto industry. When Zhao sold his holdings of FTT tokens, it caused a collapse in Bankman-Fried’s FTX exchange and subsequent bankruptcy within a week.

Lawsuits and Regulatory Challenges

Binance is not only facing declines in trading volumes but also a series of lawsuits from US regulators, including the SEC and CFTC. The regulatory bodies accuse Binance of various violations, which the exchange denies and is currently battling in court.

In addition, Binance’s standing in the traditional financial system has diminished after it announced it would no longer transact in dollars. This move resulted in a dramatic shrinkage in volumes and led Bloomberg’s wealth index to value Binance’s US exchange at zero.

Binance Remains a Major Player

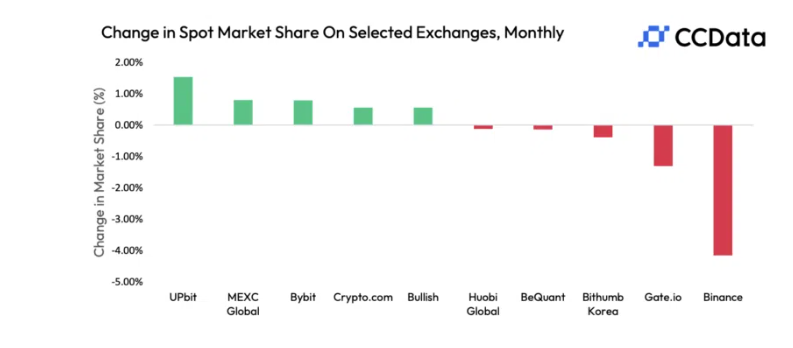

Despite these setbacks, Binance still holds a significant market share in the crypto industry. Research shows that Binance captured 62% of total on-exchange crypto trades in Q1 2023, although this figure has since slipped to 51%. However, Binance experienced the largest drop in spot market share among its competitors in September.

Hot Take: Recovery Signs for Binance and the Crypto Market

Despite the challenges faced by Binance and the broader cryptocurrency sector, there are signs of recovery as the third quarter of 2023 concludes. Market volatility is starting to return, and CZ himself acknowledges the self-correcting nature of the market. He believes that with an open democratic market, prices will go too high and eventually self-correct.

By

By

By

By

By

By

By

By