Decline in Trading Volumes for Solana, Bitcoin, and Ethereum

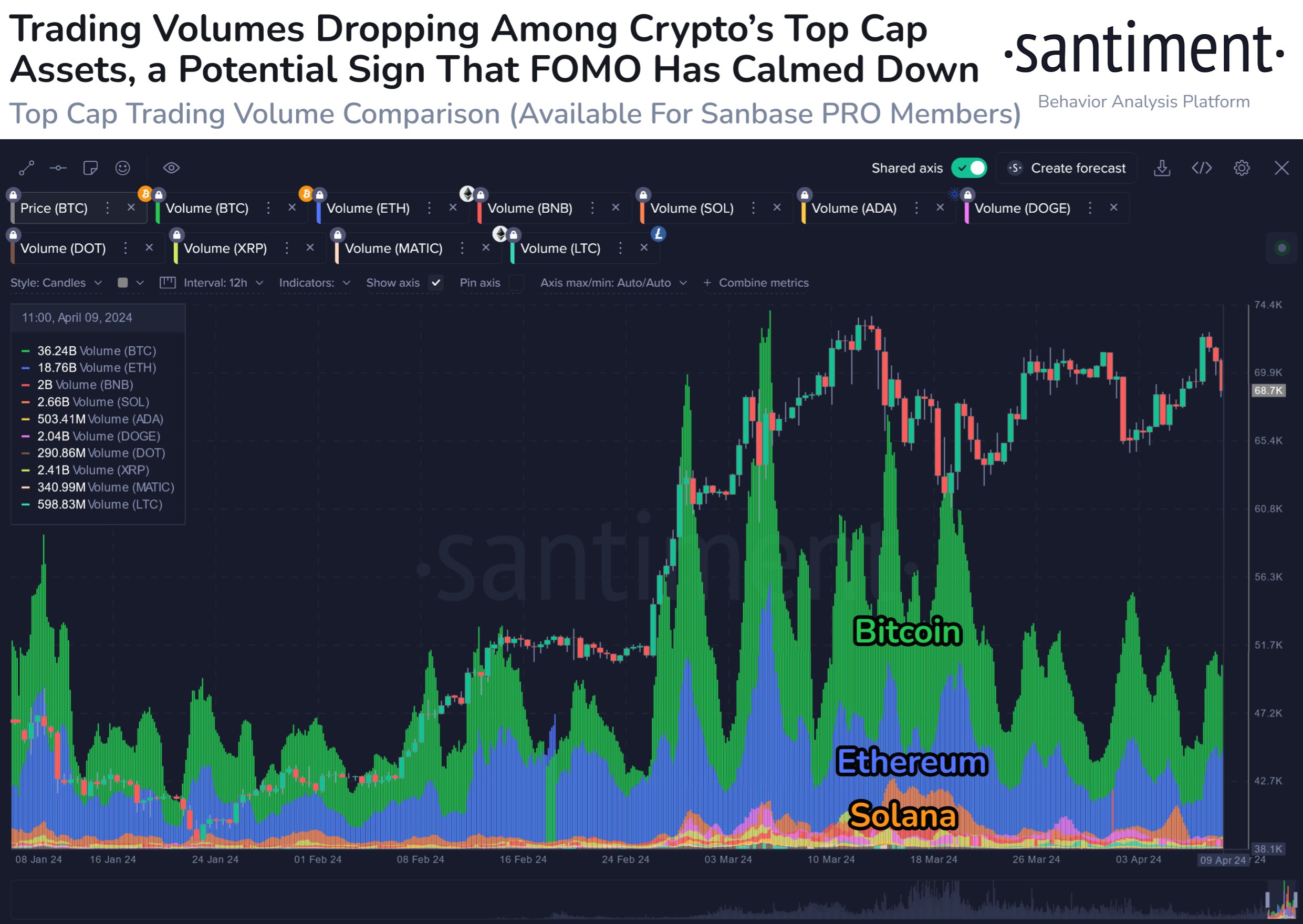

Recent data from Santiment reveals that trading volumes in the cryptocurrency market have been decreasing since early March. This decline affects popular assets like Solana, Bitcoin, and Ethereum, indicating a shift in market activity.

- Definition of Trading Volume:

- The term “trading volume” refers to the total amount of a cryptocurrency traded on various spot exchanges.

- High vs. Low Trading Volume:

- High trading volume suggests active trading and strong interest in a specific asset.

- Low trading volume can indicate an inactive market with decreased interest in a coin.

Trend Analysis of Top Cryptocurrencies

Visual representations of trading volume trends provide valuable insights into market dynamics. The chart below illustrates the fluctuation in trading volumes for Bitcoin, Ethereum, and Solana:

- Peak in Late February:

- Trading volumes for top cryptocurrencies surged at the end of February and early March, reaching a peak.

- Gradual Decline Post-Peak:

- Following the peak, trading volumes began to gradually decline, signaling a shift in market sentiment.

- Impact on Solana:

- Despite BNB’s larger market cap, Solana consistently led in trading volume among altcoins before also experiencing a decrease.

Market Outlook and Predictions

The diminishing trading volumes for Solana, Bitcoin, and Ethereum hint at a broader market trend. Analysts suggest that a turnaround in the direction of these top assets could lead to an uptick in trading activity:

- Future Expectations:

- As leading cryptocurrencies establish clear trends, trading volumes are likely to rise again, reflecting renewed market interest.

Solana Price Performance

While trading volumes have been tapering off, Solana’s price has also seen a decline, dropping over 12% in the past week alone. This downward price movement has impacted investor sentiment and market dynamics.

Hot Take: Implications of Declining Trading Volumes

On-chain data shows Solana and other top cryptocurrencies have seen a decline in trading volume recently. Here’s what this trend indicates about the current market scenario:

By

By

By

By

By

By

By

By

By

By