Global Crypto Exchanges Drive Demand for Compliance Advisers

With the new advertising rules in the UK, global crypto exchanges are seeking compliance advisers, leading to high demand and limited supply. This has resulted in three companies profiting from the surge in demand.

Archax, backed by Abrdn and authorized by the UK Financial Conduct Authority (FCA) to review crypto advertisements, has expanded its compliance team to handle the increased workload. Notable exchanges Coinbase and OKX rely on Archax for compliance services.

Compliance Companies Profit from the Trend

Crypto consultancy Englebert has partnered with advisory firm Helford Capital to meet the UK’s digital asset regulations. Additionally, start-up Gateway21 has applied to specialize in this market niche.

The process of compliance for these companies is mostly manual, depending on the number of coins listed on an exchange, according to Simon Barnaby, Archax’s Chief Marketing Officer. The scarcity of compliance companies allows a select few to capitalize on the situation, as lawyer Charles Kerrigan argues.

“It’s a smart way of making money as there are very few service providers and many firms that need it.”

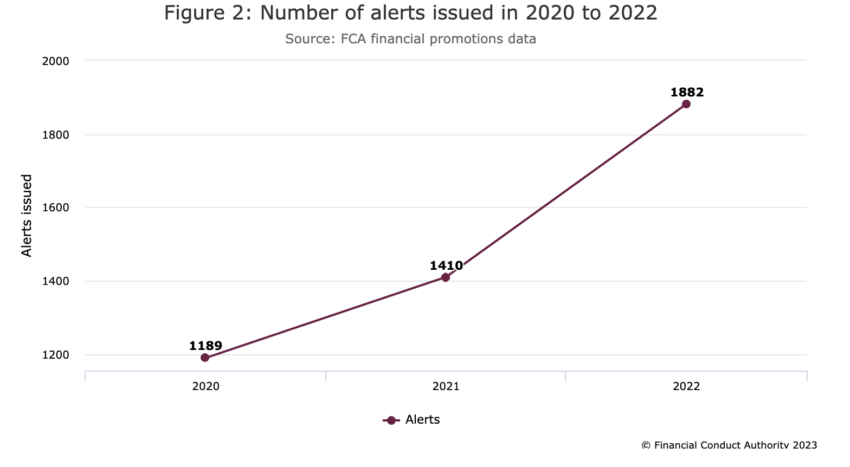

The FCA implemented new financial promotion rules on October 8, allowing only authorized firms to release crypto advertisements. This move is expected to be followed by more regulations after the approval of the Financial Services and Markets bill this year.

Following the implementation of the new rules, the FCA issued alerts for 150 unauthorized crypto promoters. Companies that obtained licenses before the new rules came into effect automatically qualified.

SEC Challenges Security Labeling

The FCA’s actions align with the US Securities and Exchange Commission’s (SEC) proposal to revise the names of new financial products. SEC Chairman Gary Gensler believes that using outdated names for new products could harm investors.

The SEC has chosen not to appeal a ruling that deemed its rejection of Grayscale’s Bitcoin Trust exchange-traded fund conversion as “arbitrary” and “capricious.” This decision could accelerate the next crypto bull market if experts’ predictions about the approval of multiple Bitcoin ETFs this year come true.

In the meantime, exchanges must maintain sufficient capitalization. Coinbase has introduced leverage futures trading for non-US customers, while Binance has integrated Polygon-based USDC, which is expected to attract corporate trading revenues.

Hot Take: Crypto Compliance and SEC Labeling Proposals

The demand for compliance advisers in the crypto industry is surging due to new advertising regulations in the UK. This presents an opportunity for compliance companies to profit from the limited supply. Meanwhile, the SEC’s proposal to update security labeling reflects its commitment to protecting investors in the evolving financial landscape. The decision not to appeal a recent ruling on Grayscale’s Bitcoin Trust ETF may lead to increased market optimism and potential approval of more Bitcoin ETFs. As exchanges adapt to regulatory changes, they continue to innovate and expand their offerings, ensuring they remain well-capitalized.

By

By

By

By

By

By

By

By