The UK’s Financial Conduct Authority (FCA) Takes Strong Stance on Crypto Promotions

The FCA has issued 146 alerts identifying malpractice on the first day of new promotion regulations. This proactive approach is a significant step in curbing the excesses of crypto investment promotions. The FCA’s recently published handbook provides a comprehensive framework for crypto firms’ promotion of digital assets, ensuring promotions are “fair, clear and not misleading” while acknowledging the evolving nature of the crypto market.

Protecting Investors

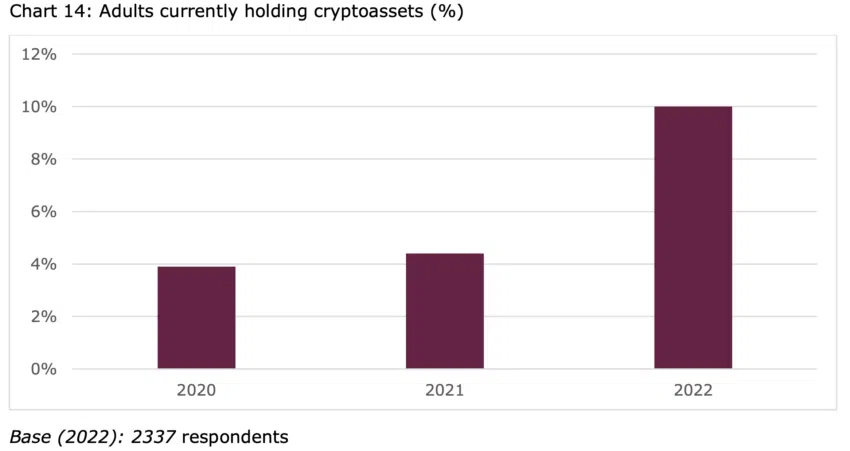

The regulator estimates that nearly 5 million British adults owned crypto assets as of August 2022. The introduction of the new rules aims to protect these investors, who may regret making hasty decisions to invest in crypto. James Daley, managing director of Fairer Finance, hailed the FCA’s move as a “good moment” to instate “proper regulation.”

Positive Reception and Critics Speak Out

Laith Khalaf, head of investment analysis at AJ Bell, echoed Daley’s sentiments, stating that the FCA was definitely “making progress” on regulating cryptocurrency. However, the decision to regulate the marketing of cryptocurrency investments has sparked controversy. Critics argue that treating cryptocurrencies as regulated investments could create a “halo effect,” making investors take them more seriously due to apparent regulatory approval.

Hot Take: Stricter Regulations for Crypto Investments

The FCA’s proactive approach to regulating crypto investment promotions is a significant step towards protecting investors from misinformation and malpractice. While some critics argue that this could create a halo effect, leading to increased seriousness from investors, others see it as a positive move for the industry. With nearly 5 million British adults owning crypto assets, these regulations aim to ensure fair and clear promotions while adapting to the dynamic nature of the sector.

By

By

By

By

By

By

By

By

By

By