Basel Committee Report on Bank Crypto Assets Exposures

Recently, the Basel Committee on Banking Supervision released an analysis detailing the involvement of banks in crypto assets like Bitcoin, Ethereum, and XRP. A shocking revelation emerged when data showed that total crypto exposures reported by banks stood at approximately €9.4 billion.

Banks and Crypto Exposures

Out of the 182 banks included in the Basel III monitoring exercise, only 19 banks reported their crypto assets. A small portion accounting for 17.1% of total risk-weighted assets (RWA) and 20.9% of the overall leverage ratio exposure measure (LREM). With banks from the Americas contributing to approximately three-quarters of these amounts.

The €9.4 billion in crypto holdings represent a mere 0.05% of total exposures, and when extended to the entire sample of banks, the percentage further reduces to 0.01%

Bitcoin, Ethereum, And XRP Top The List

The data revealed that Bitcoin accounted for 31% of the exposures, followed by Ether at 22%. A variety of instruments based on Bitcoin or Ether constitute 35% of the exposures. Bitcoin and Ether-related instruments make up almost 90% of reported exposures, while other notable cryptocurrencies also made it into the banks’ portfolios.

Categories of Crypto Activities

The report categorizes the crypto activities of banks into three broad groups including ‘Crypto holdings and lending,’ ‘Clearing client and market-making services,’ and ‘Custody/wallet/insurance and other services.’ Custody, wallet, and insurance services account for half of the reported crypto exposures, while clearing and market-making services make up another 46%.

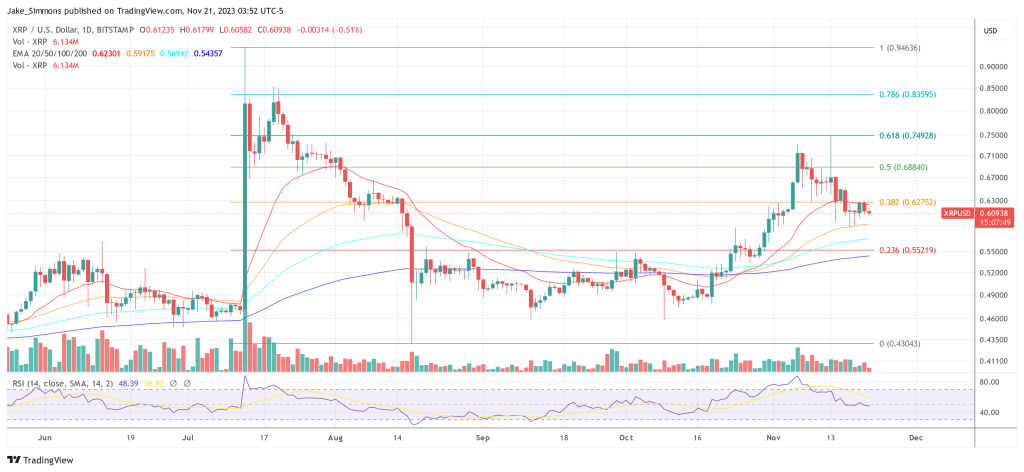

At press time, the XRP price stood at $0.6094.

Hot Take: Basel Committee’s Report Reveals Surprising Bank Crypto Assets Involvement

In a revered analysis, the Basel Committee on Banking Supervision uncovered banking institutions’ cryptocurrency involvements. The €9.4 billion in crypto holdings were a shocking revelation considering they made up a mere 0.01% of the total bank exposures. This report is an essential aspect of understanding institutional engagement in the crypto industry.

By

By

By

By

By

By

By

By

By

By