The UK Emerges as a Dominant Player in the Crypto Market

Recently, the United Kingdom has made significant progress in the crypto market, according to a study conducted by Chainalysis. The study reveals that the increase in crypto activity in the UK is a result of stricter regulations targeting digital currencies and stablecoins.

The study highlights the UK’s remarkable growth in the global digital currency space. With its financial hubs and bustling urban centers, the country has surpassed many of its peers and is now a dominant player in Central, Northern, and Western Europe (CNWE).

UK: Leading Crypto Economy in CNWE

The latest report from Chainalysis sheds light on the UK’s impressive performance in the digital currency arena. CNWE is the second-largest global crypto economy, responsible for 17.6% of global crypto transaction volume from July 2022 to June 2023, with an estimated transaction value of $1 trillion.

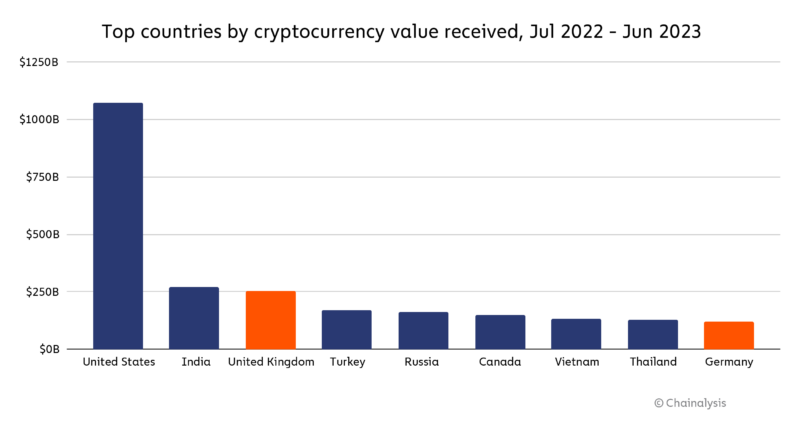

Within CNWE, the UK stands out as the top digital currency economy and ranks third globally in transaction volumes, closely following the US and India.

Last year, the UK recorded approximately $252.1 billion in digital currency transactions, solidifying its dominant position in shaping the European crypto narrative.

Other Key Players in CNWE

While the UK leads in CNWE, other countries like Germany and Spain are not far behind. Germany recorded around $120 billion in crypto transactions, followed by Spain with approximately $110 billion over the past year.

France, the Netherlands, Italy, Switzerland, and Sweden also play significant roles in the CNWE region, highlighting its importance in the broader digital currency sphere.

Emerging Crypto Scene in Eastern Europe

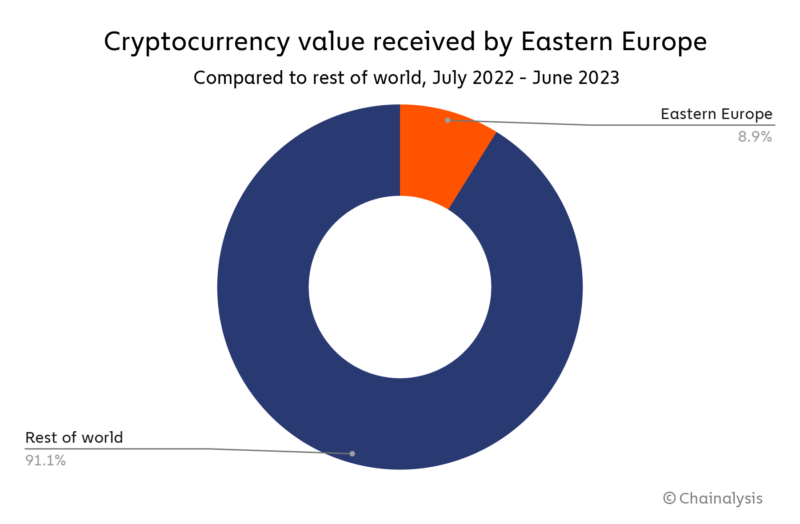

Chainalysis’s exploration of Eastern Europe’s crypto scene reveals interesting insights. The region has become the fourth-largest digital currency market, with $445 billion in crypto transactions from July 2022 to June 2023, accounting for 8.9% of the global transaction volume.

In addition to Europe, Nigeria has also experienced a surge in crypto usage. According to Chainalysis, Nigeria’s digital currency transactions increased by 9% year-over-year, reaching $56.7 billion between July 2022 and June 2023.

Featured image from Unsplash, Chart from TradingView

Hot Take: The UK Takes Center Stage in the European Crypto Market

The United Kingdom has emerged as a dominant player in the evolving crypto market, particularly in Central, Northern, and Western Europe (CNWE). With its strict regulations and financial expertise, the UK has surpassed many countries in terms of transaction volumes and digital currency activities. This growth highlights the country’s significant role in shaping the European crypto narrative and showcases its potential for further expansion in the future. As the global crypto market continues to evolve, it will be interesting to see how the UK maintains its position and navigates the ever-changing landscape.

By

By

By

By

By

By

By

By

By

By