Bitcoin Options Expiry: What to Expect

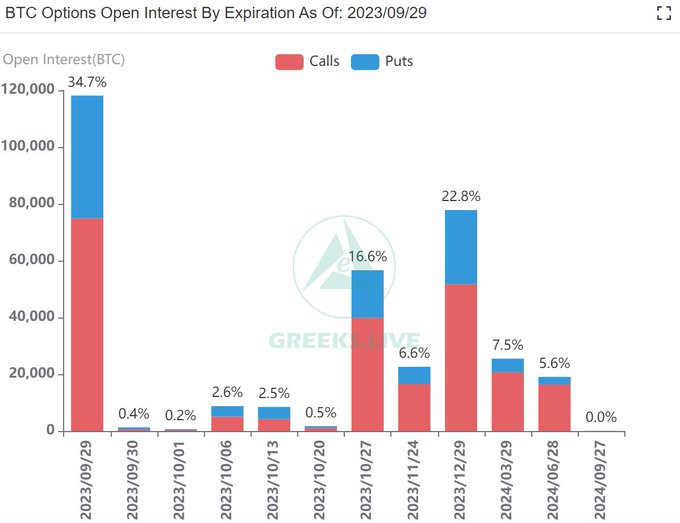

Today is a significant day for Bitcoin options as around 118,000 contracts with a notional value of $3.2 billion are set to expire. This end-of-the-month expiry is much larger than previous weeks’ events, and it could have an impact on the crypto markets.

Max Pain Point for Bitcoin Options

The max pain point for today’s expiring contracts is $26,500, which is currently lower than the spot BTC price. The max pain level represents the price where most losses occur when contracts expire. The put/call ratio for these contracts is 0.58, indicating that almost two-thirds of them are calls (longs).

Greeks Live, a market analysis platform, noted that this quarterly delivery follows the trend of previous years’ Q3 events. The third quarter is typically less active, and the share of put positions in today’s contracts is significantly lower compared to weekly deliveries.

Implied Volatility and Market Consolidation

The downtrend in implied volatility (IV) suggests that market consolidation and low volumes will likely continue after the expiry. IV measures expected future volatility derived from expiring derivatives contracts.

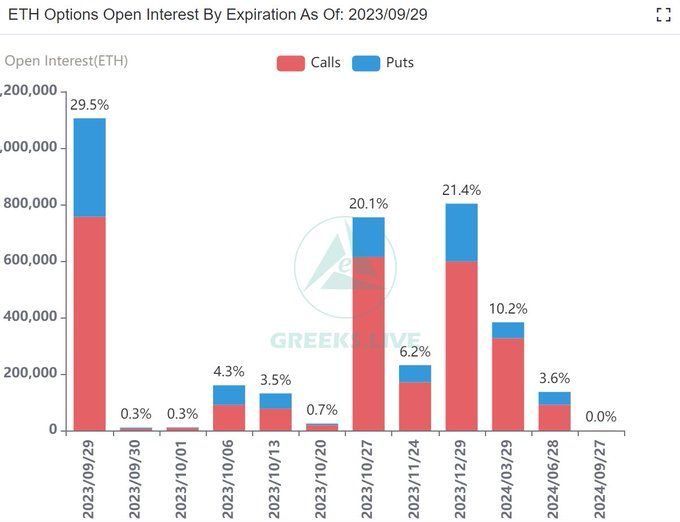

Ethereum Contracts Expiry

In addition to Bitcoin options, today also marks the expiration of 1.1 million Ethereum contracts with a notional value of $1.8 billion. The max pain point for these contracts is $1,650, which is currently the trading price of ETH.

Green Day for Crypto Markets

Today, crypto markets are experiencing a rare positive day, with the total market cap climbing 2% to reach $1.11 trillion. Bitcoin briefly surpassed $27,000 yesterday but has since dropped back to $26,958. Ethereum, on the other hand, gained 2.8% and reached $1,651. The momentum in ETH may be driven by the anticipation of the first futures ETFs launching in the US next week.

Hot Take: Implications of Options Expiry

With the significant Bitcoin and Ethereum options expiries today, there is potential for increased volatility and market movements. Traders and investors will closely watch how these expirations impact prices and whether there will be any significant shifts in market sentiment. Additionally, the downtrend in implied volatility suggests that the current consolidation phase may continue for some time. Overall, today’s expiries have the potential to shape short-term market dynamics and provide insight into investor expectations for Bitcoin and Ethereum.

By

By

By

By

By

By

By

By

By

By