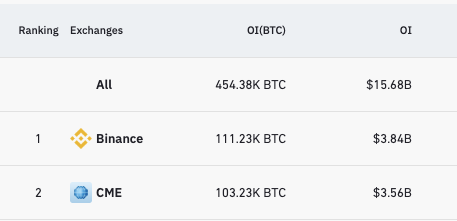

Chicago Mercantile Exchange (CME) Poised to Surpass Binance in Bitcoin Futures Open Interest

According to Gabor Gurbac, a strategy advisor at VanEck, the Chicago Mercantile Exchange (CME) is on track to surpass Binance as the largest exchange in terms of Bitcoin futures open interest. Gurbac highlighted the increasing open interest in Bitcoin futures on CME compared to Binance.

Currently, CME has 103.23K Bitcoin in open interest, while Binance has 111.23K BTC in open interest. The small gap between the two suggests that other markets may also catch up soon, indicating institutional involvement and a growing market.

Gurbac believes that this is just the beginning for institutions entering the crypto market and expects physical markets to catch up as well.

The current price of Bitcoin is $34,502.

Gurbac also recalls the challenges faced while filing for VanEck’s first-ever Bitcoin futures ETF and the difficulties in explaining it to US regulators.

However, another user points out that while CME’s rise in Bitcoin futures is significant, it is important to consider the overall health of secondary markets and their impact on price discovery mechanisms.

Recent Speculation Over Spot Bitcoin ETFs

There has been considerable speculation surrounding the approval of a spot Bitcoin ETF in the US. A recent survey revealed that 64% of respondents plan to adopt a long-term holding strategy for Bitcoin in anticipation of a spot Bitcoin ETF.

Analysts predict that the approval of a spot Bitcoin ETF will have positive outcomes for investors. Vetle Lunde, a senior analyst at K33 Research, suggests that investors should take advantage of the current uncertainty surrounding approval decisions and accumulate Bitcoin at its current price.

Learn More: How To Open a Bitcoin Account in 3 Easy Steps

Hot Take: The Growing Influence of Institutional Investors in Crypto

The increasing open interest in Bitcoin futures on CME compared to Binance signifies the growing presence of institutional investors in the crypto market. This trend suggests that institutions are recognizing the potential of cryptocurrencies as an asset class.

As more institutions enter the market, it is likely that other markets will follow suit. The approval of a spot Bitcoin ETF in the US could further accelerate this trend and attract more investors.

Overall, the rise of institutional involvement in crypto indicates that the market is still in its early stages, and there is significant room for growth and development.

By

By

By

By

By

By

By

By

By

By